Question

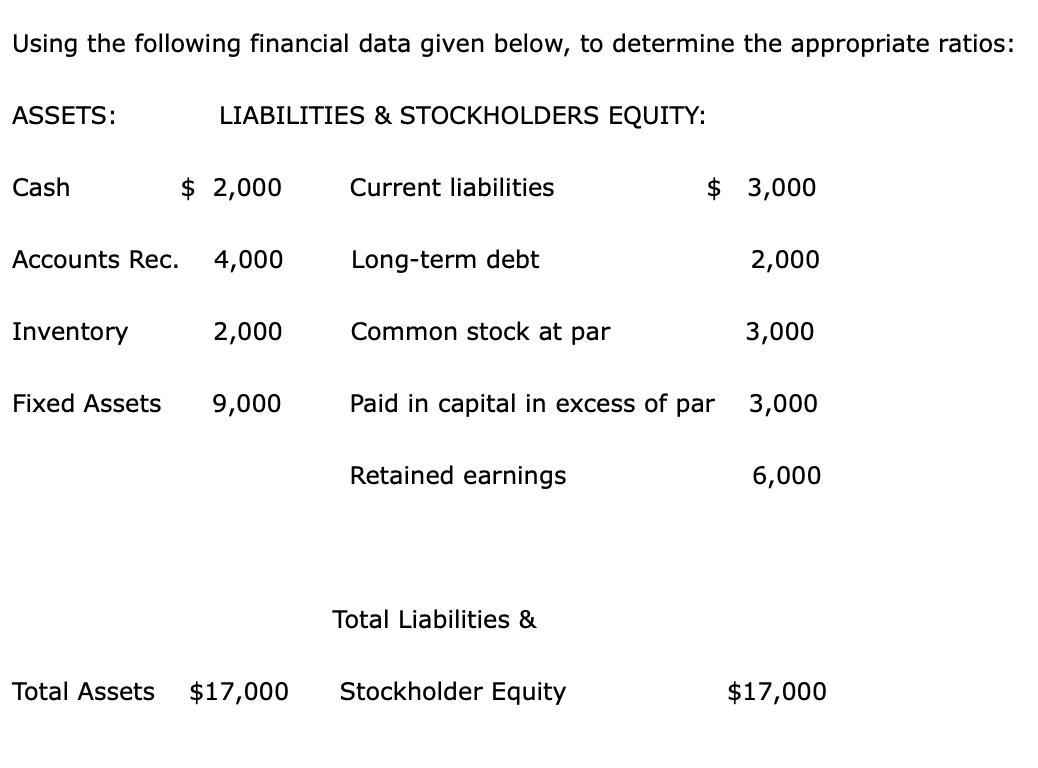

Using the following financial data given below, to determine the appropriate ratios: ASSETS: Cash Inventory LIABILITIES & STOCKHOLDERS EQUITY: Accounts Rec. 4,000 Fixed Assets

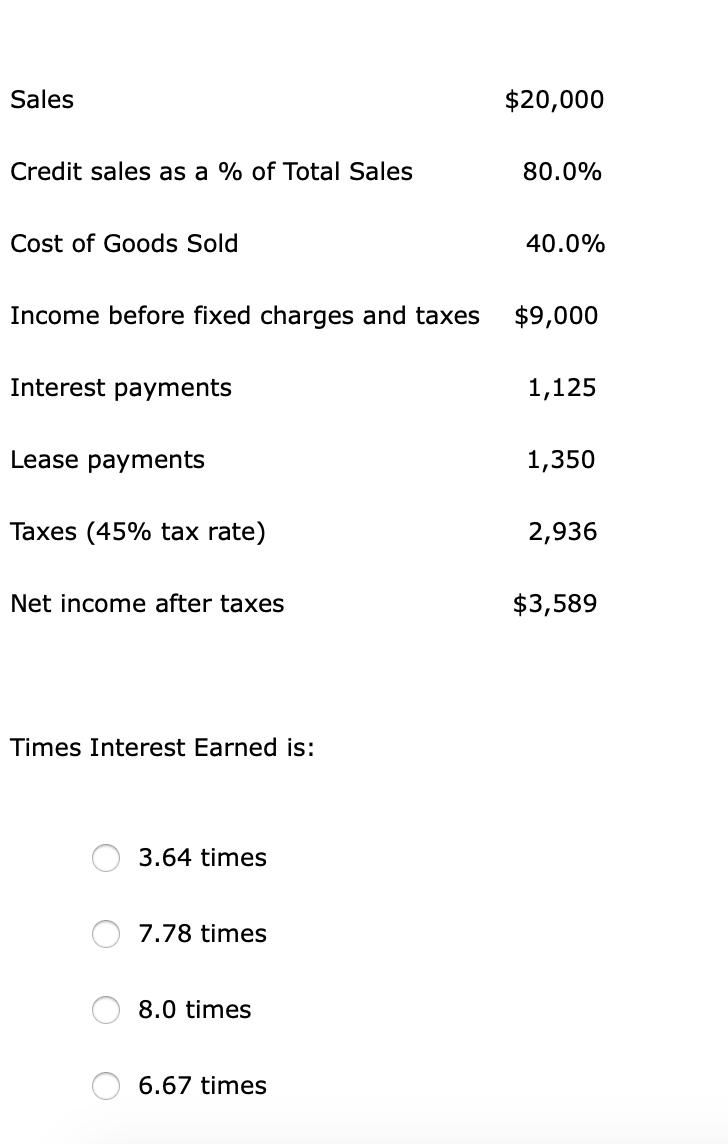

Using the following financial data given below, to determine the appropriate ratios: ASSETS: Cash Inventory LIABILITIES & STOCKHOLDERS EQUITY: Accounts Rec. 4,000 Fixed Assets $ 2,000 2,000 9,000 Total Assets $17,000 Current liabilities Long-term debt Common stock at par Paid in capital in excess of par Retained earnings Total Liabilities & $ 3,000 Stockholder Equity 2,000 3,000 3,000 6,000 $17,000 Sales Credit sales as a % of Total Sales Cost of Goods Sold Income before fixed charges and taxes Interest payments Lease payments Taxes (45% tax rate) Net income after taxes Times Interest Earned is: 3.64 times 7.78 times 8.0 times 6.67 times $20,000 80.0% 40.0% $9,000 1,125 1,350 2,936 $3,589

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Times interest earne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: LibbyShort

7th Edition

78111021, 978-0078111020

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App