Answered step by step

Verified Expert Solution

Question

1 Approved Answer

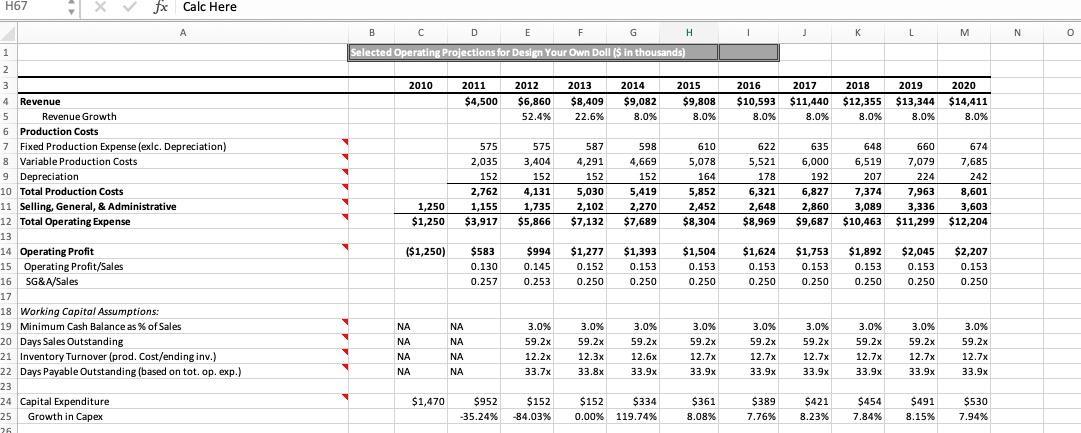

Need assistance (New Heritage Doll Company) determining Net Working Capital, NPV, and IRR for year 2010-2020. The tax Rate is 40%.Include formulas and solutions. Began

Need assistance (New Heritage Doll Company) determining Net Working Capital, NPV, and IRR for year 2010-2020. The tax Rate is 40%.Include formulas and solutions. Began NWC in 2011, but am stuck.

H67 1 2 3 4 Revenue 5 X fx Calc Here Revenue Growth A 6 Production Costs 7 Fixed Production Expense (exic. Depreciation) 8 Variable Production Costs 9 Depreciation 10 Total Production Costs 11 Selling, General, & Administrative 12 Total Operating Expense 13 14 Operating Profit 15 Operating Profit/Sales 16 SG&A/Sales 17 18 Working Capital Assumptions: 19 Minimum Cash Balance as % of Sales 20 Days Sales Outstanding 21 Inventory Turnover (prod. Cost/ending inv.) 22 Days Payable Outstanding (based on tot. op. exp.) 22 23 24 Capital Expenditure Growth in Capex 25 26 B D E F G Selected Operating Projections for Design Your Own Doll ($ in thousands) 2010 ($1,250) NA 575 2,035 152 2,762 1,250 1,155 $1,250 $3,917 2011 $4,500 $1,470 NA NA $583 0.130 0.257 2012 $6,860 52.4% 575 3,404 587 4,291 152 152 4,131 5,030 1,735 2,102 $5,866 $7,132 2013 $8,409 22.6% $994 $1,277 0.145 0.152 0.253 0.250 3.0% 59.2x 12.2x 33.7x $952 $152 -35.24% -84.03% 3.0% 59.2x 12.3x 33.8x 2014 $9,082 8.0% 598 4,669 152 5,419 2,270 $7,689 $1,393 0.153 0.250 3.0% 59.2x 12.6x 33.9x $152 $334 0.00% 119.74% H 2015 $9,808 8.0% 610 5,078 164 5,852 2,452 $8,304 $1,504 0.153 0.250 3.0% 59.2x 12.7x 33.9x $361 8.08% 1 2016 2017 $10,593 $11,440 8.0 % 8.0% 622 5,521 178 6,321 2,648 $8,969 J 3.0% 59.2x 12.7x 33.9x $389 7.76% K $1,624 $1,753 $1,892 0.153 0.153 0.153 0.250 0.250 0.250 3.0% 59.2x 12.7x 33.9x 2018 2019 2020 $12,355 $13,344 $14,411 8.0% 8.0% 8.0% 660 674 7,079 7,685 635 648 6,000 6,519 192 207 224 242 6,827 7,374 7,963 8,601 2,860 3,089 3,336 3,603 $9,687 $10,463 $11,299 $12,204 L 3.0% 59.2x 12.7x 33.9x $421 $454 8.23% 7.84% M $2,045 $2,207 0.153 0.250 3.0% 59.2x 12.7x 33.9x $491 8.15% 0.153 0.250 3.0% 59.2x 12.7x 33.9x $530 7.94% N 0

Step by Step Solution

★★★★★

3.57 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

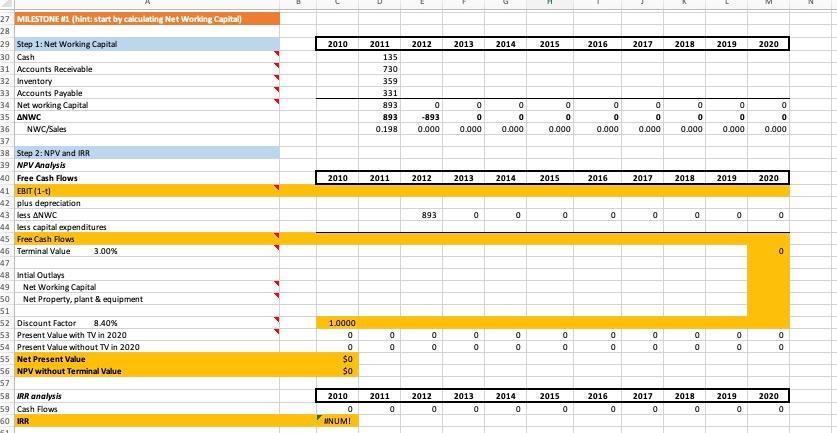

NWC Cash Accounts Receivable Inventory Accounts Payable NWC 135 730 359 331 NWC 1043 ANWC NWC Capita...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started