Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the following financial statements for 2022, calculate the external financing needs for this firm using the following assumptions for 2023: sales will grow at

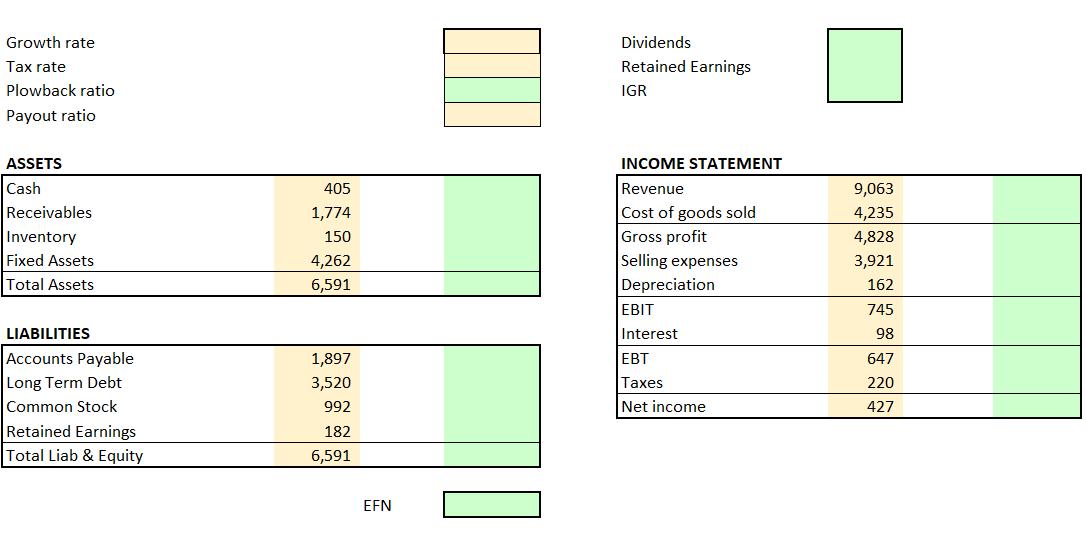

Using the following financial statements for 2022, calculate the external financing needs for this firm using the following assumptions for 2023: sales will grow at a rate of 12%, tax rate is 34%, and the firm will distribute 40% of net income as dividends.

Complete chart below with work:

Growth rate Tax rate Plowback ratio Payout ratio ASSETS Cash Receivables Inventory Fixed Assets Total Assets LIABILITIES Accounts Payable Long Term Debt Common Stock Retained Earnings Total Liab & Equity 405 1,774 150 4,262 6,591 1,897 3,520 992 182 6,591 EFN Dividends Retained Earnings IGR INCOME STATEMENT Revenue Cost of goods sold Gross profit Selling expenses Depreciation EBIT Interest EBT Taxes Net income 9,063 4,235 4,828 3,921 162 745 98 647 220 427

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of External Financing Needed EFN using the information provided in the image Assumptions Sales will grow at a rate of 12 in 2023 Tax rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started