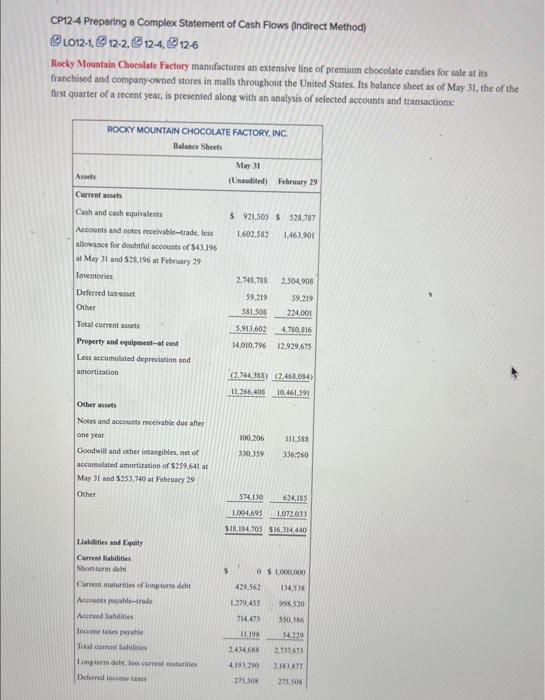

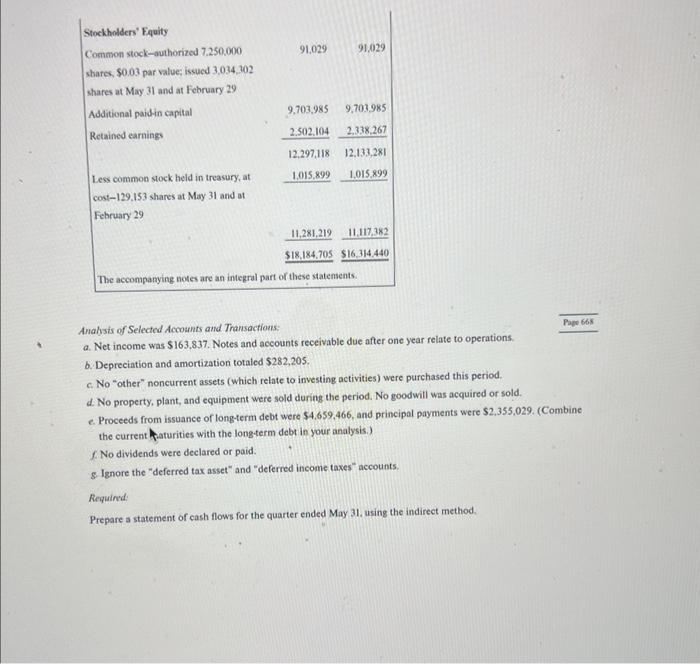

CP12-4 Preparing o Complex Statement of Cash Flows (Indirect Method) ()LO12-1,(9)12-2,12-4,126 Rocky Mountain Chocolate Factory manufactures an extensive line of premium chocolate candies for sale at its franchised and company-owned stores in malls throughout the United States. Its balance sheet as of May 31, the of the first quarter of a recent year, is presented along with an analyxis of selected accounts abd transactions: Analsis of Selected Accounts and Transactions: a. Net income was $163,837. Notes and accounts receivable due after one year relate to operations. b. Depreciation and amortization totaled $282,205. c. No "other" noncurrent assets (which relate to investing activities) were purchased this period. d. No property, plant, and equipment were sold during the period. No goodwill was acquired or sold. e. Proceeds from issuance of longterm debt were \$4,659,466, and principal payments were \$2,355,029. (Combine the current haturities with the longterm debt in your analysis.) f. No dividends were declared or paid. 5. Ignore the "deferred tax asset" and "deferred income taxes" accounts. Required: Prepare a statement of eash flows for the quarter ended May 31, using the indirect method. CP12-4 Preparing o Complex Statement of Cash Flows (Indirect Method) ()LO12-1,(9)12-2,12-4,126 Rocky Mountain Chocolate Factory manufactures an extensive line of premium chocolate candies for sale at its franchised and company-owned stores in malls throughout the United States. Its balance sheet as of May 31, the of the first quarter of a recent year, is presented along with an analyxis of selected accounts abd transactions: Analsis of Selected Accounts and Transactions: a. Net income was $163,837. Notes and accounts receivable due after one year relate to operations. b. Depreciation and amortization totaled $282,205. c. No "other" noncurrent assets (which relate to investing activities) were purchased this period. d. No property, plant, and equipment were sold during the period. No goodwill was acquired or sold. e. Proceeds from issuance of longterm debt were \$4,659,466, and principal payments were \$2,355,029. (Combine the current haturities with the longterm debt in your analysis.) f. No dividends were declared or paid. 5. Ignore the "deferred tax asset" and "deferred income taxes" accounts. Required: Prepare a statement of eash flows for the quarter ended May 31, using the indirect method