Question

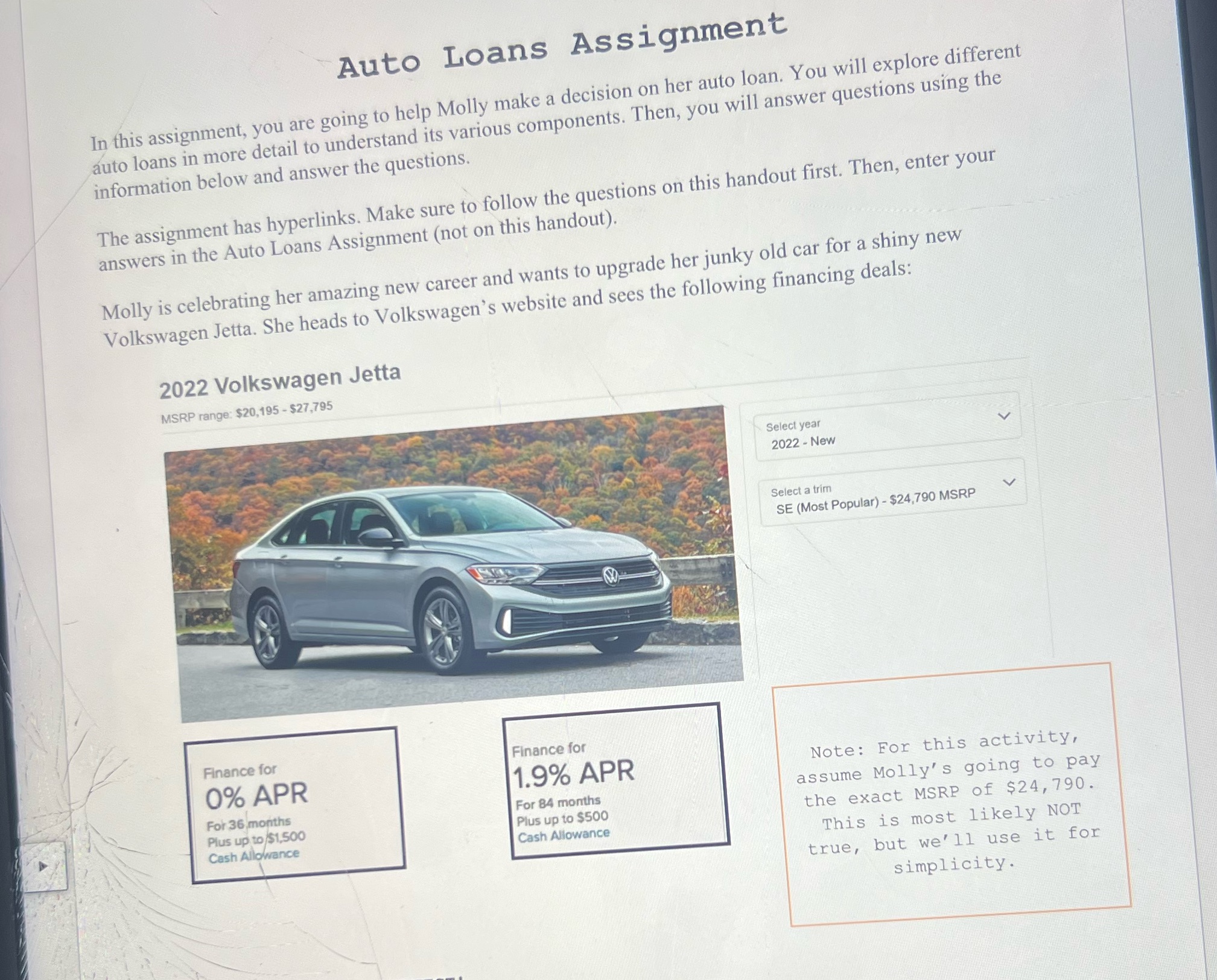

Using the following information below, answer the questions Using the Loan Calculator and the 1.9% APR offer, how much will Molly's monthly payment be?Group of

Using the following information below, answer the questions Using the Loan Calculator and the 1.9% APR offer, how much will Molly's monthly payment be?Group of answer choicesA. $377B. $277C. $200D. $177How much total interest will Molly pay using this plan?Group of answer choicesA. $1,500B. $2300C. $1,498D. $1,598When Molly adds all her payments, how much will the car cost her using this plan?Group of answer choicesA. $24,790B. $21,790C. $25,190D. $25,788Molly still has a $2500 down payment. How much loan does Molly need?Group of answer choicesA. $21,890B. $24,790C. $25,190D. $22,290How much will Molly's monthly payment be using the Bankrate calculator?Group of answer choicesA. $429B. $400C. $529D. $250How much total interest will Molly pay using this plan?Group of answer choicesA. $4,000B. $3,000C. $2,870D. $3,870When Molly adds all her payments, how much will the car cost her?Group of answer choicesA. $25,760B. $28,260C. $24,390D. $21,890What valuable lessons did Molly learn about auto financing?Group of answer choicesA. High interest rate = larger total interest and higher overall costB. A short loan term will decrease the total amount you pay, but will increase your monthly payment, which you might not be able to afford with your budgetC. Companies advertise only the lowest rates available to lure you in, even though your own rates might be much higherD. All of the aboveMolly desperately wants a Volkswagen Jetta, and this new monthly payment is pretty high again. What suggestion would you not give her for making her dream become reality?Group of answer choicesA. She should still make her dream become reality and purchase the car.B. Save up a larger down payment so a shorter loan term becomes more possible in her budgetC. Work on building up her credit history, and wait until she can qualify for better terms, before buying the carD. Try financing through her bank or credit union; maybe they'll offer better rates than the Volkswagen dealership

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started