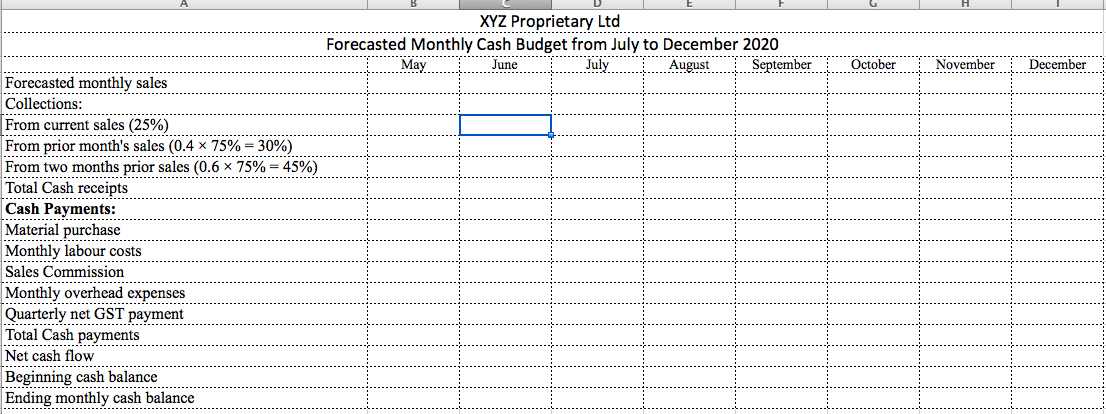

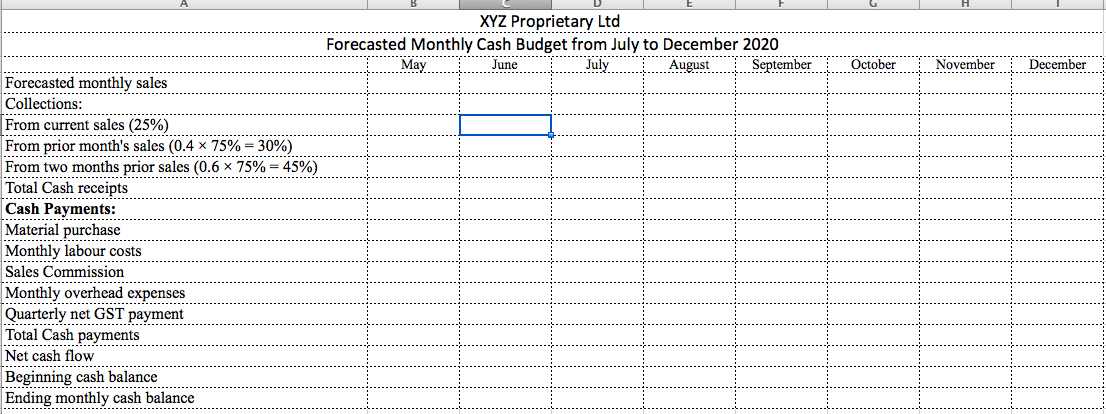

Using the following information, prepare the monthly projected cash budget from July to December for your own business Give the name of your business followed by Pty Ltd." Use the following figures as an example, however, you need to change name and figures to prepare the projected cash budget for your business. Your business has projected sales of $20,000 in May, $22,500 in June, $25,000 in July, $27,500 in August, $30,000 in September, $35,000 in October, $40,000 in November, and $45,000 in December. Of the projected sales, 25% will be received in cash on delivery and 75% will be on credit. Of the credit sales, 40% will be received one month after the sale and the remaining outstanding balances will be received in the second month after the sale. Materials cost 25% of the current month's projected sales. The material cost is paid in the month after the purchase. Labour expense is 30% of projected sales and is paid in the month of sales. Sales agent receives commission at 10% of the monthly sales and is paid in the month after the sale. Company's cash payments for overhead in July, August, September, October, November and December are $2,000, $3,000, $4,000, $5,000, $6,000, and $7,000, respectively. The company needs to lodge BAS statement quarterly and hence estimated GST payment of $4,500 and $6,000 in September and December, respectively. The cash balance at the beginning of July is $2,500. Based on the above information, construct the monthly projected cash budget from July to December for your business. You are required to estimate the projected monthly cash inflows, cash outflows, net cash flows, beginning cash balance and ending cash balance. You can use the following excel template XYZ Proprietary Ltd Forecasted Monthly Cash Budget from July to December 2020 May July August September June October November December Forecasted monthly sales Collections: -------- .......................... ........ From prior month's sales (0.4 x 75% - 30%) ................................................................... From two months prior sales (0.6 x 75% = 45%) Total Cash receipts .................. Cash Payments: ............. Material purchase P............. Monthly thly labour costs Sales Commission Monthly overhead expenses Quarterly net GST payment Total Cash payments Net cash flow Beginning cash balance Ending monthly cash balance