Answered step by step

Verified Expert Solution

Question

1 Approved Answer

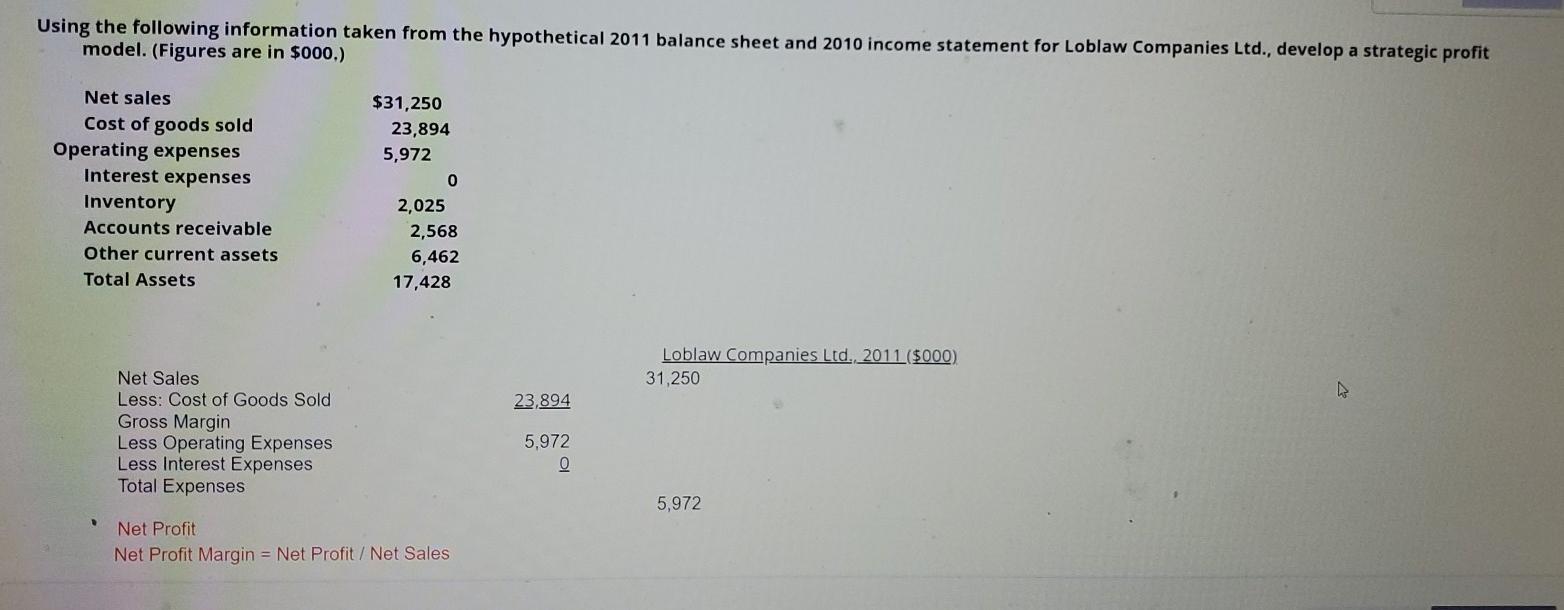

Using the following information taken from the hypothetical 2011 balance sheet and 2010 income statement for Loblaw Companies Ltd., develop a strategic profit model. (Figures

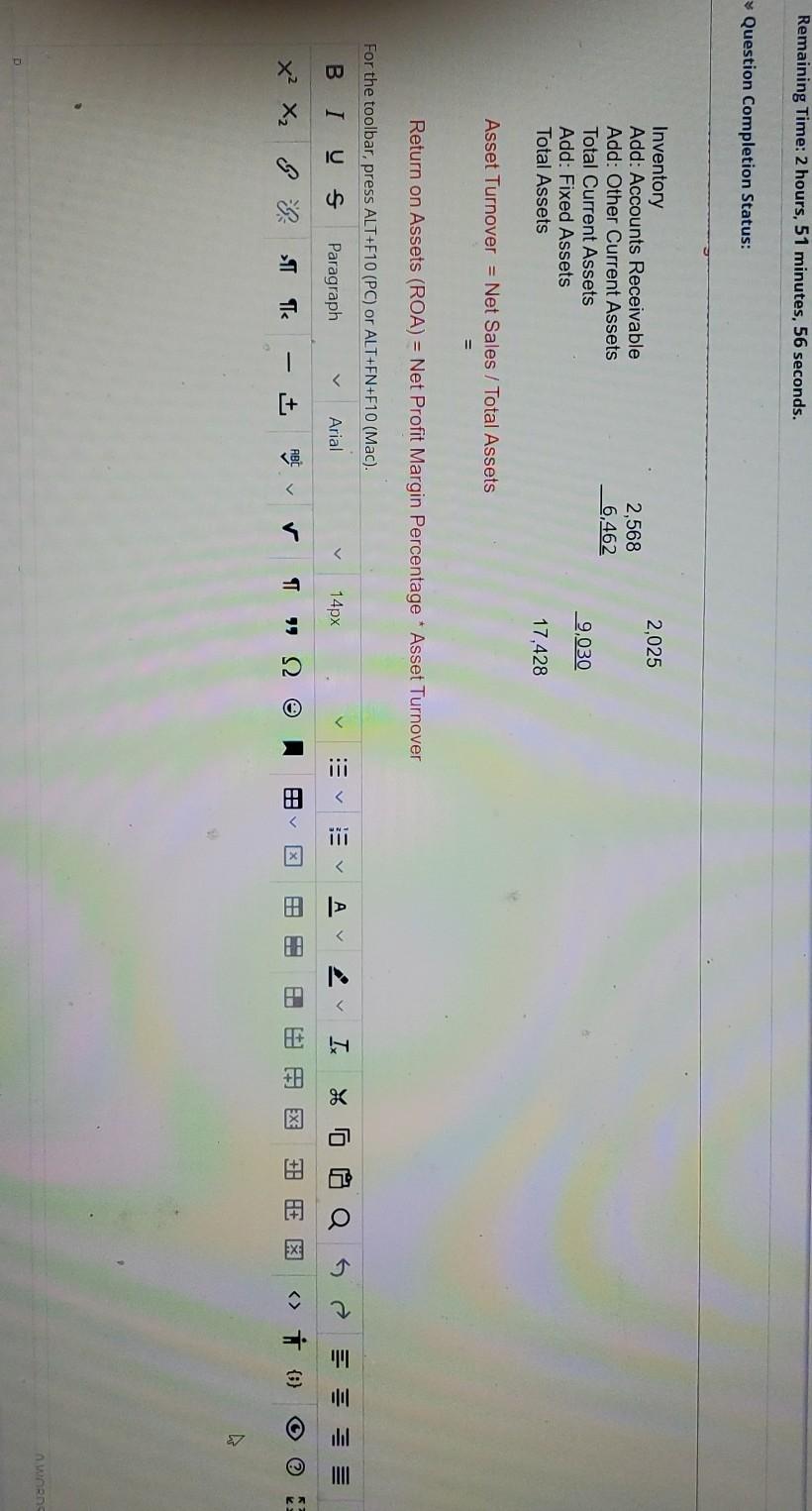

Using the following information taken from the hypothetical 2011 balance sheet and 2010 income statement for Loblaw Companies Ltd., develop a strategic profit model. (Figures are in $000.) $31,250 23,894 5,972 0 Net sales Cost of goods sold Operating expenses Interest expenses Inventory Accounts receivable Other current assets Total Assets 2,025 2,568 6,462 17,428 Loblaw Companies Ltd., 2011 ($000) 31,250 23,894 Net Sales Less: Cost of Goods Sold Gross Margin Less Operating Expenses Less Interest Expenses Total Expenses 5,972 0 5,972 Net Profit Net Profit Margin = Net Profit/Net Sales Remaining Time: 2 hours, 51 minutes, 56 seconds. Question Completion Status: 2,025 Inventory Add: Accounts Receivable Add: Other Current Assets Total Current Assets Add: Fixed Assets Total Assets 2,568 6,462 9,030 17,428 Asset Turnover = Net Sales / Total Assets Return on Assets (ROA) = Net Profit Margin Percentage * Asset Turnover For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI U S Paragraph Arial 14px !!! ini IC * O 5 MI ? x & G > TIC + ABC > 19 Hi HE # WORDS D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started