Using the following information, what is the:

- total debit balance amount on the adjusted trial balance sheet

- total stockholders' equity balance on the balance sheet

- total liabilities and stockholders' equity balance on the balance sheet

- cash flow from operating activities

- cash flow from investing activities

- cash flow from financing activities

$

$

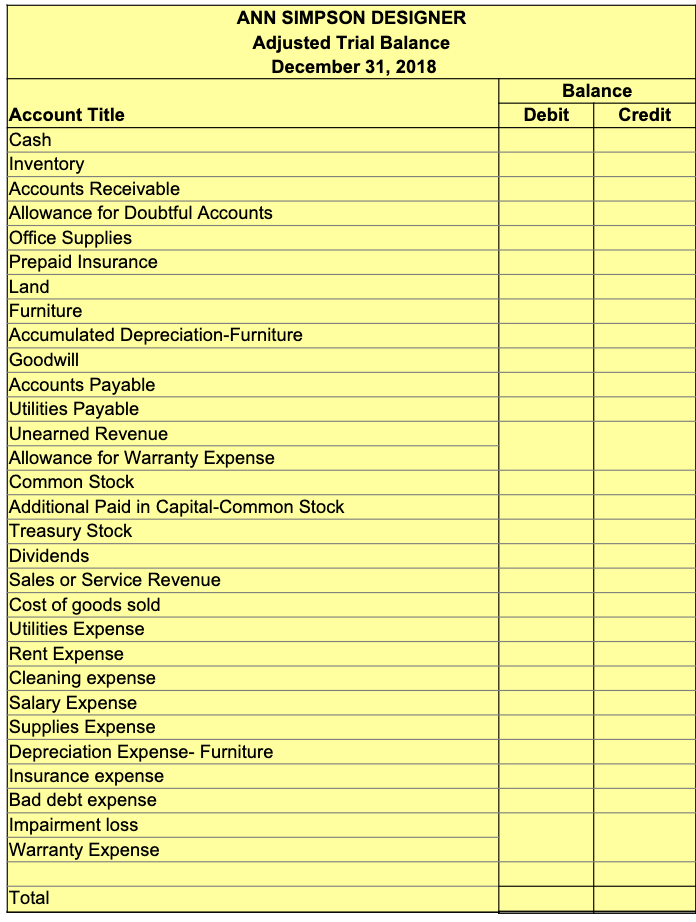

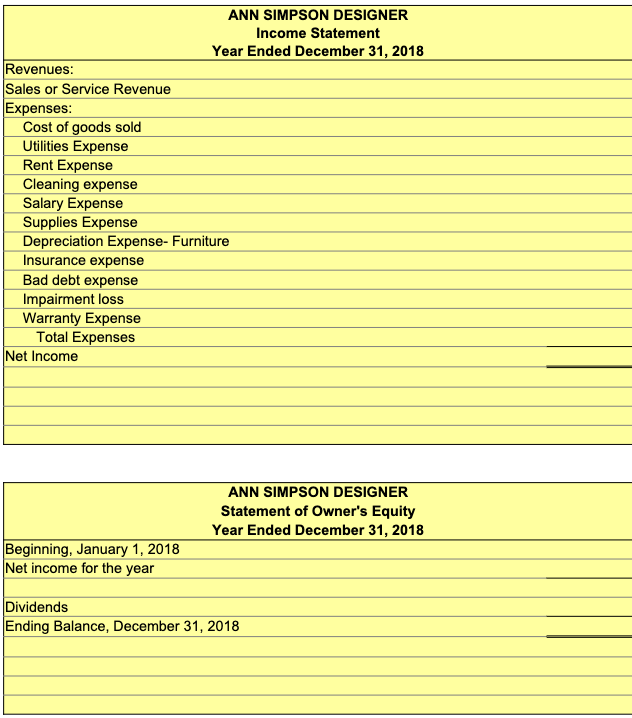

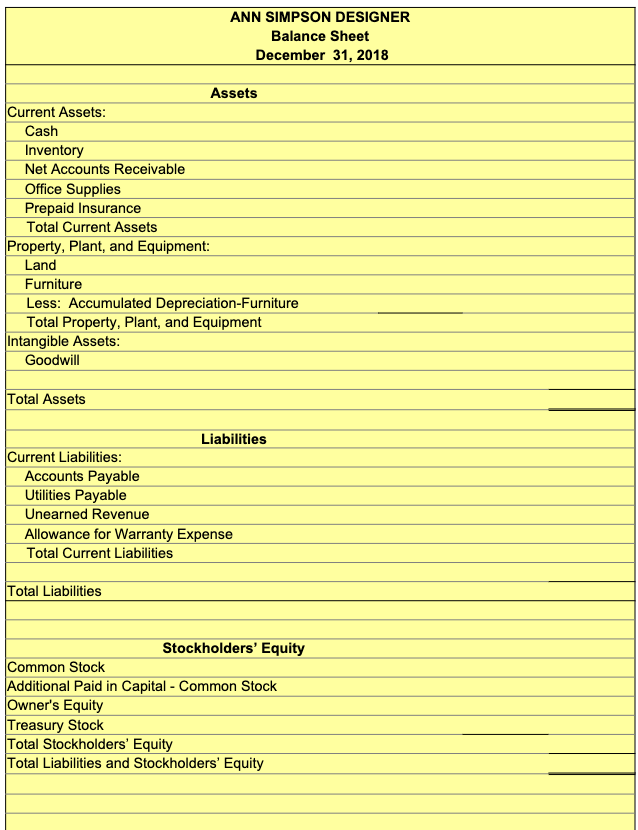

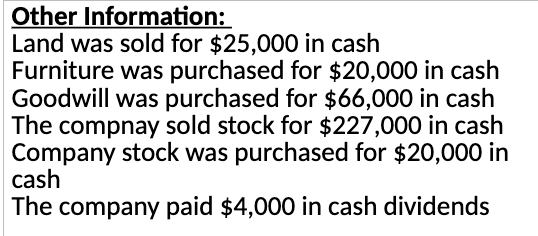

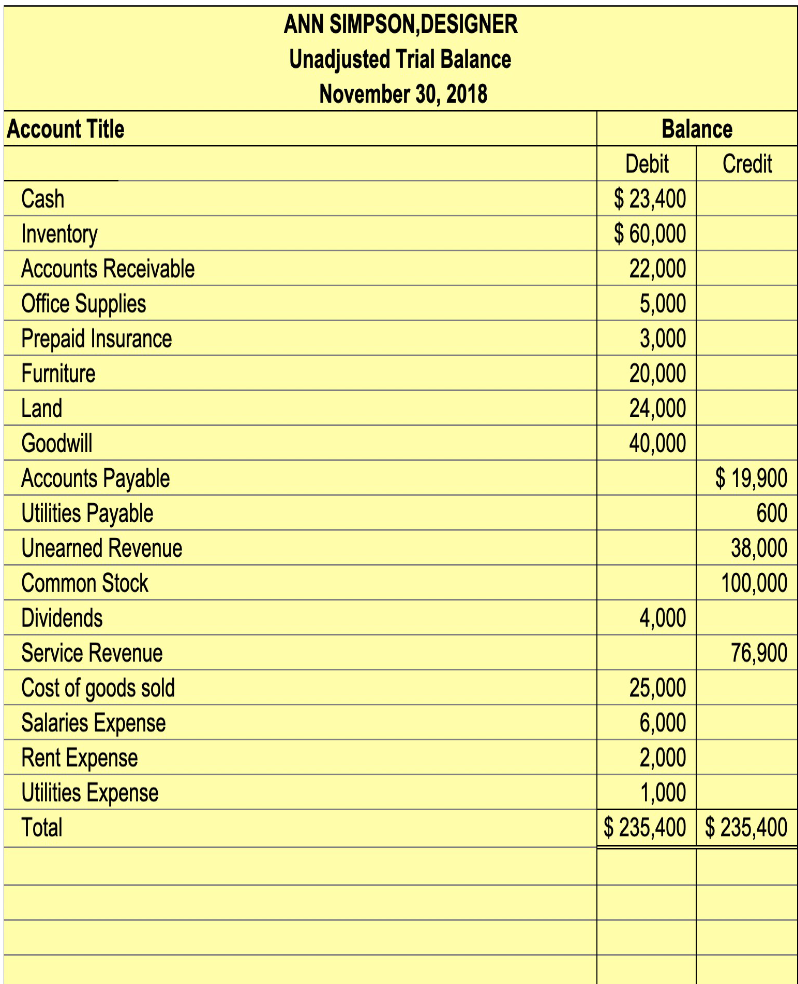

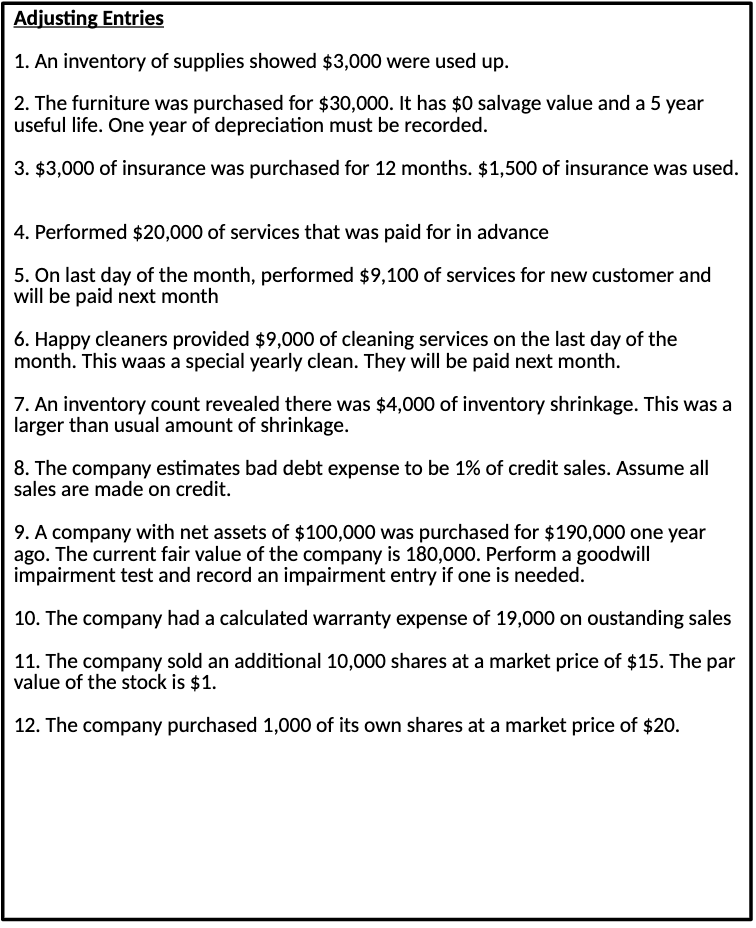

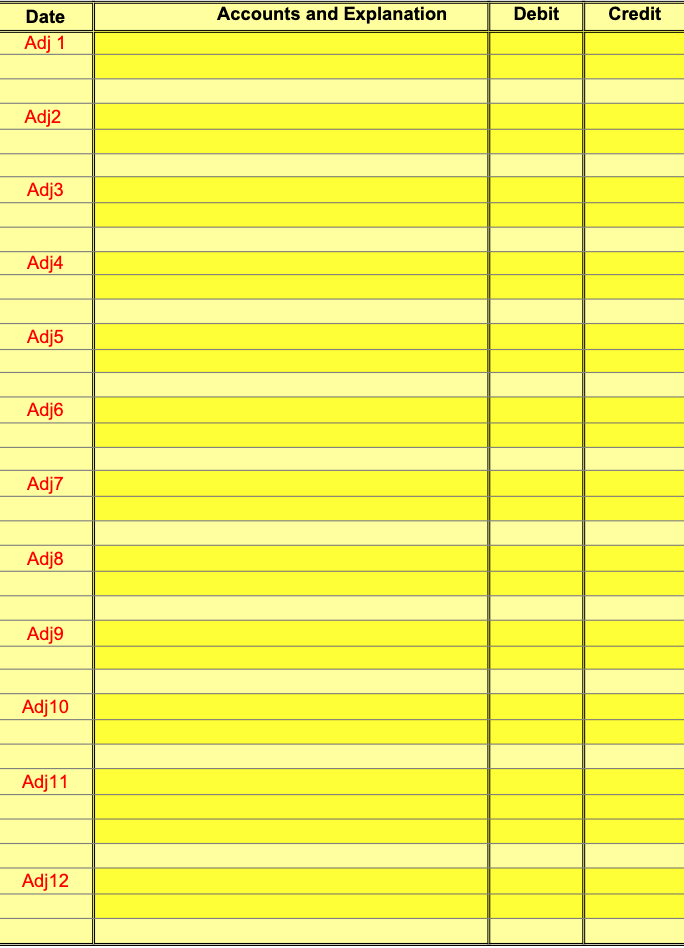

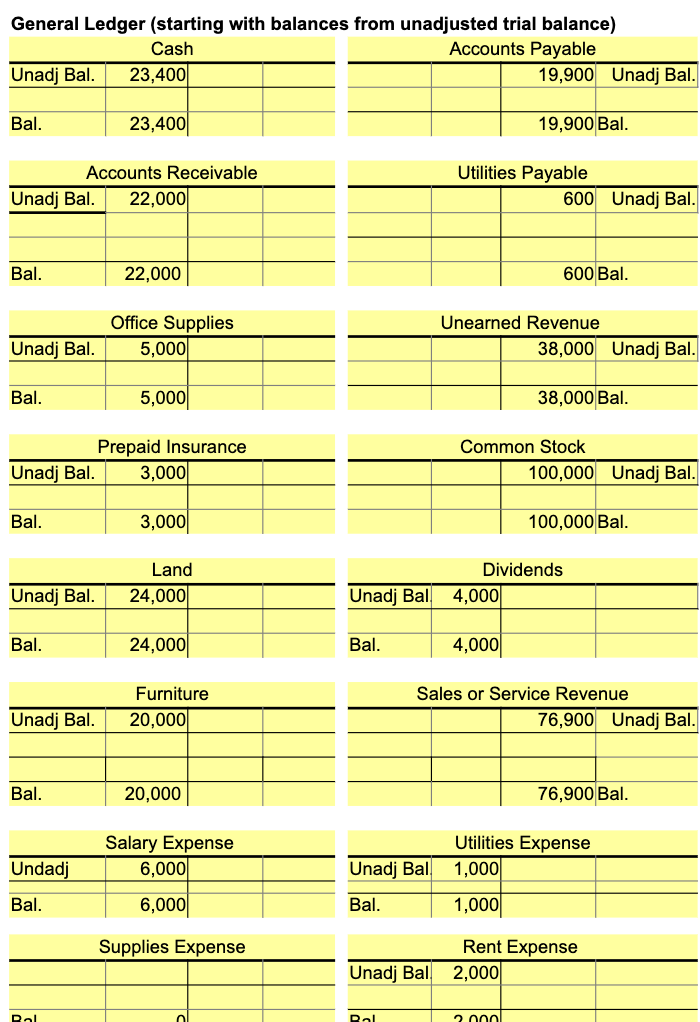

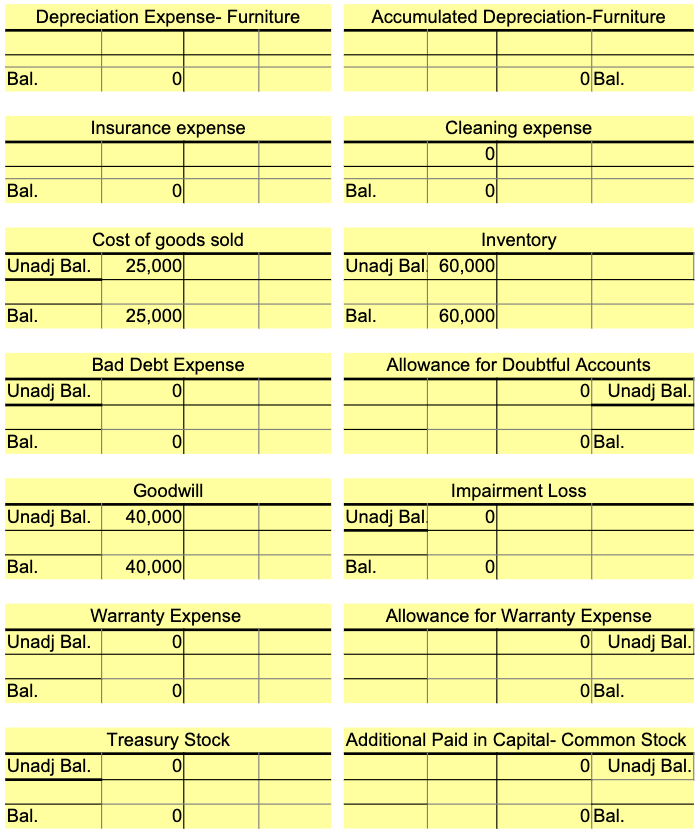

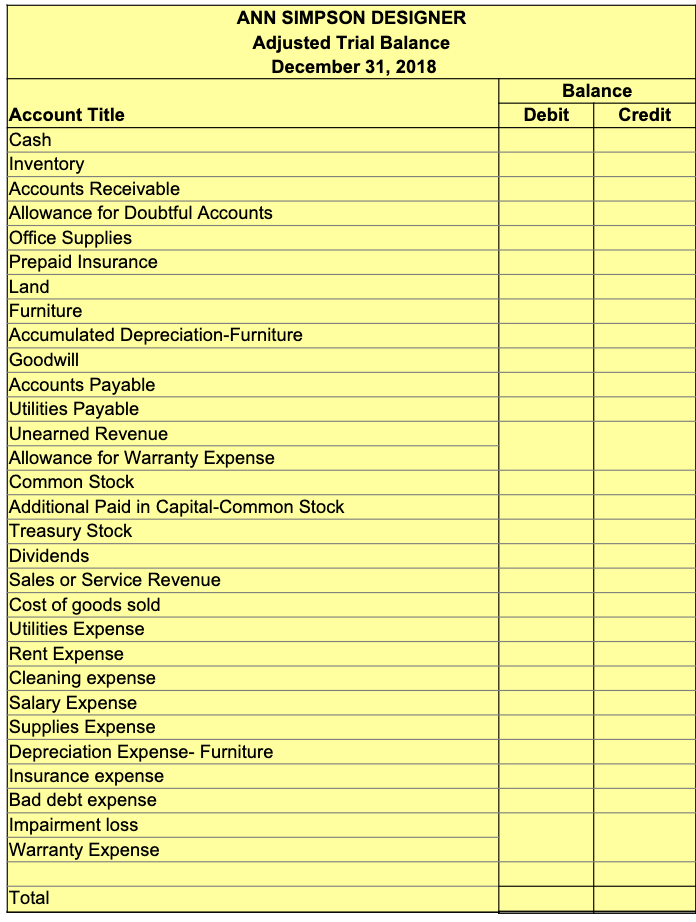

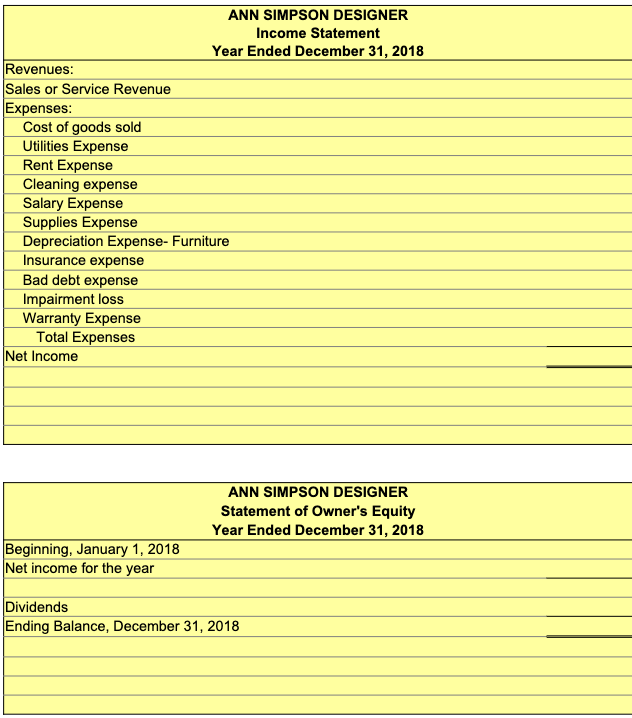

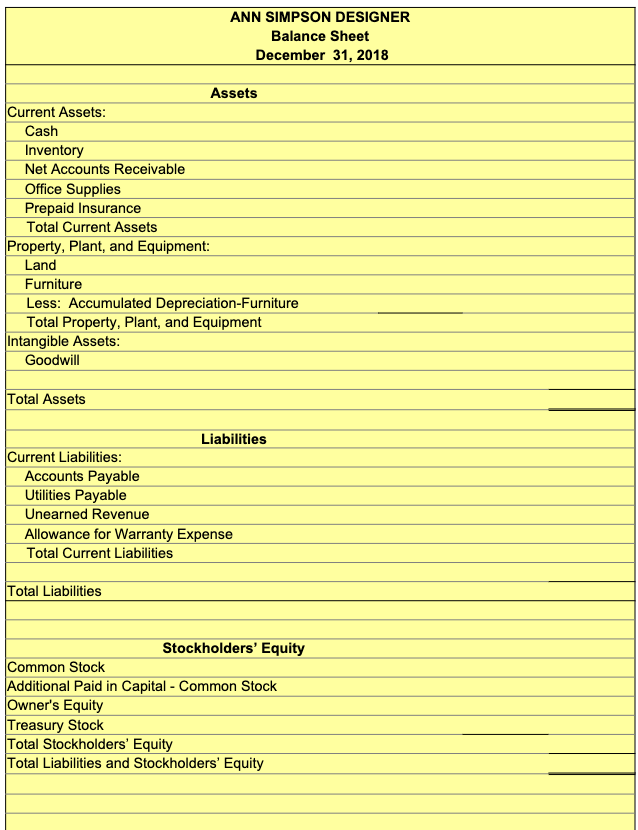

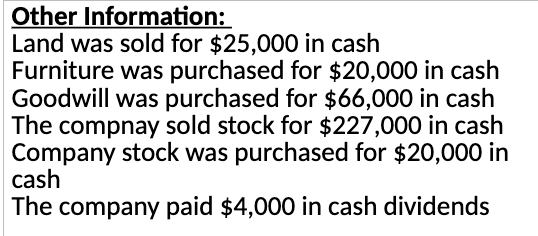

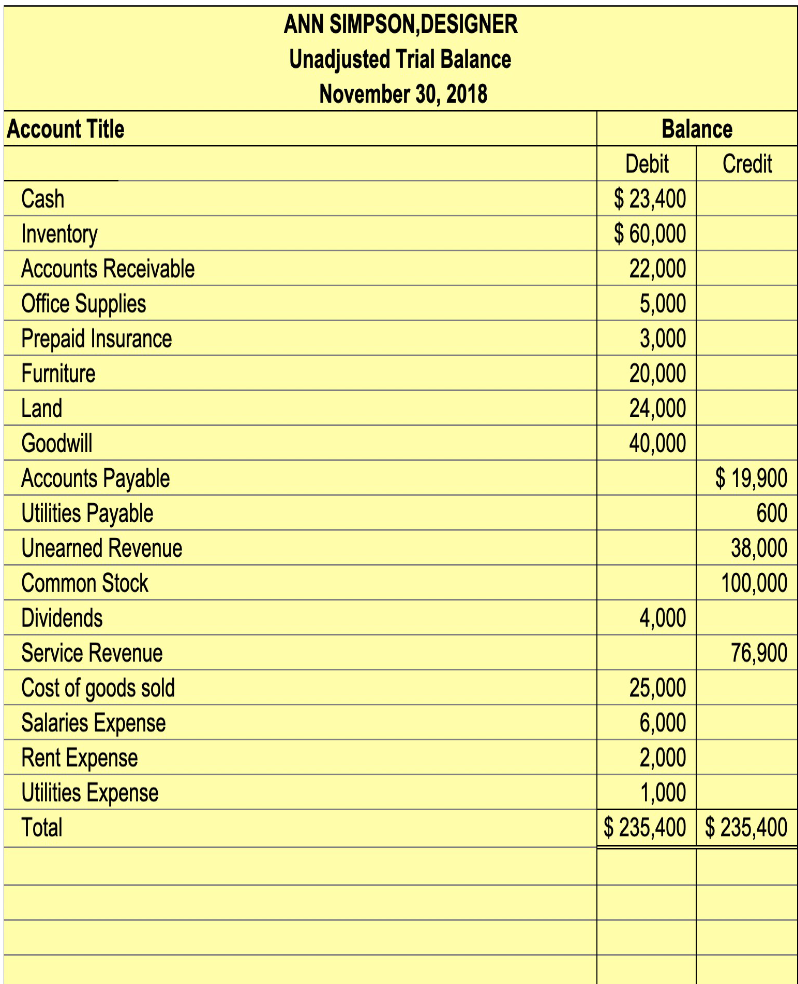

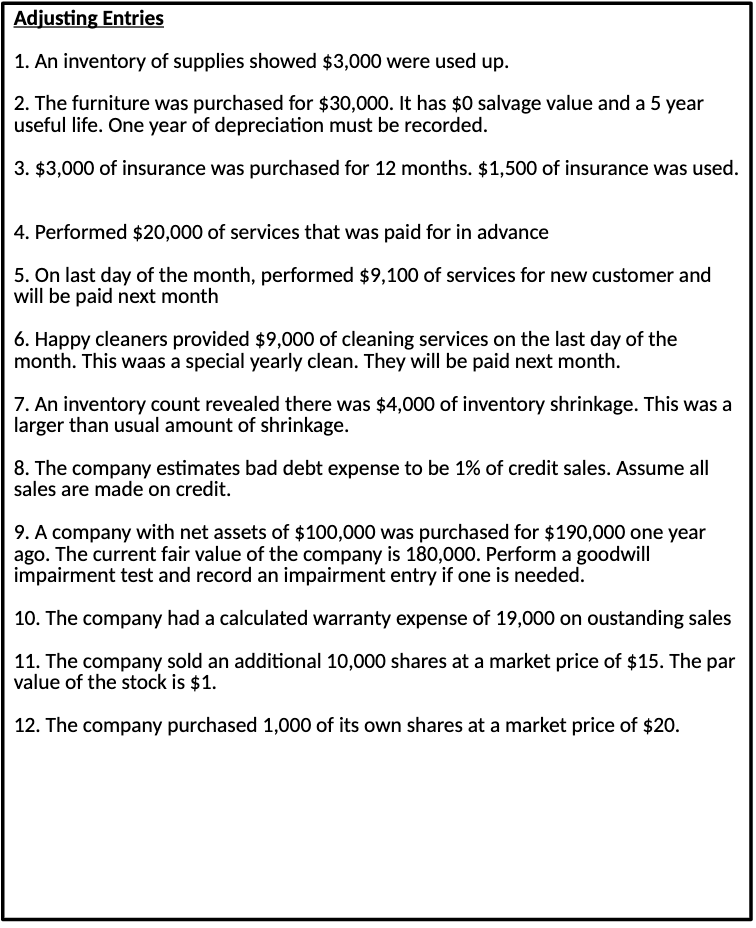

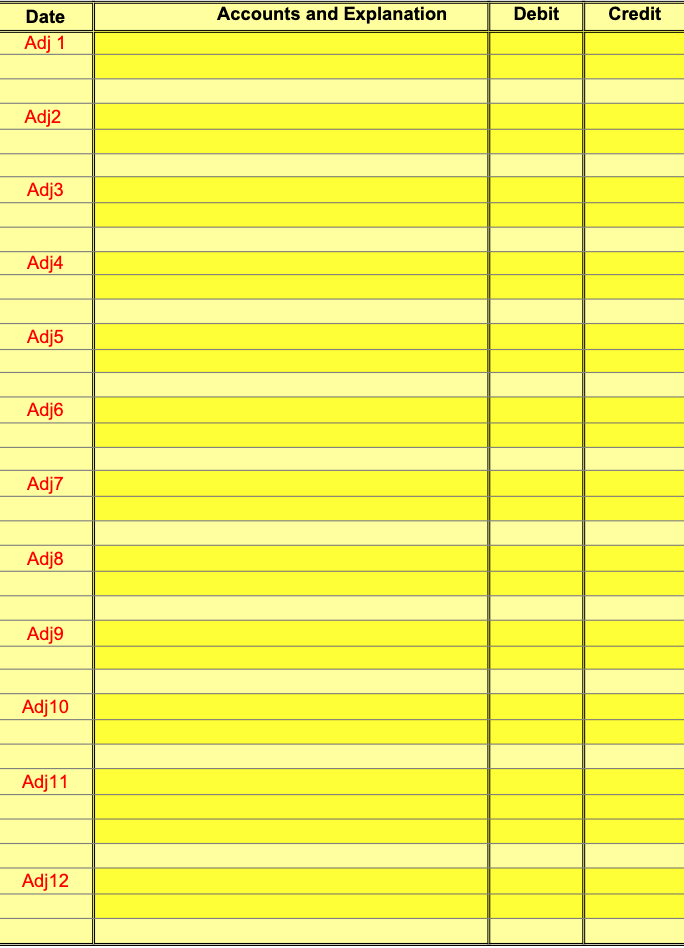

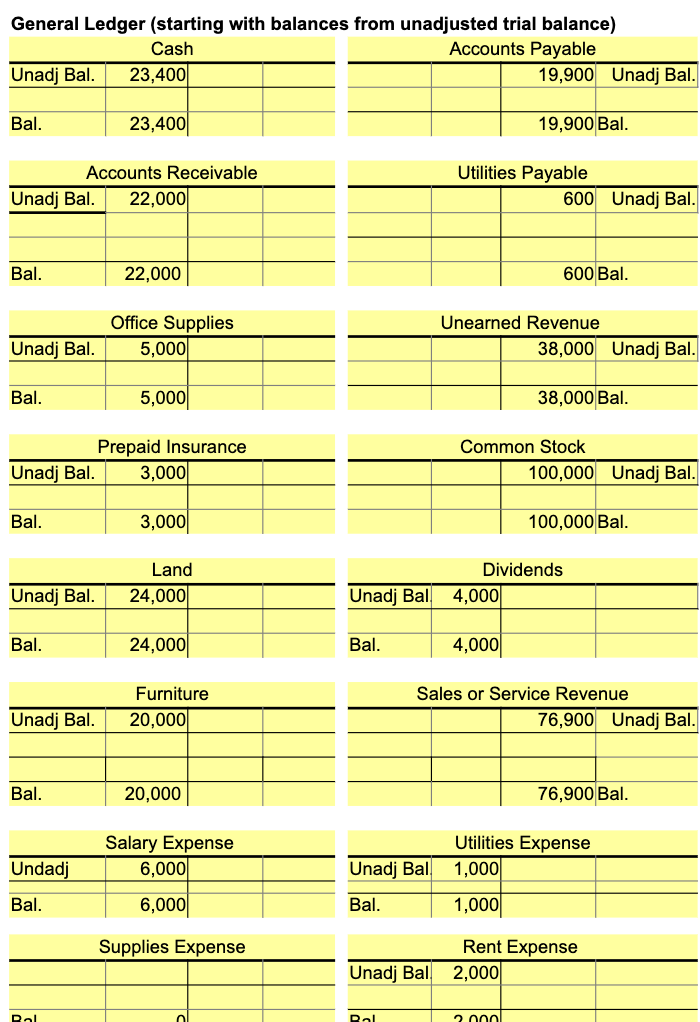

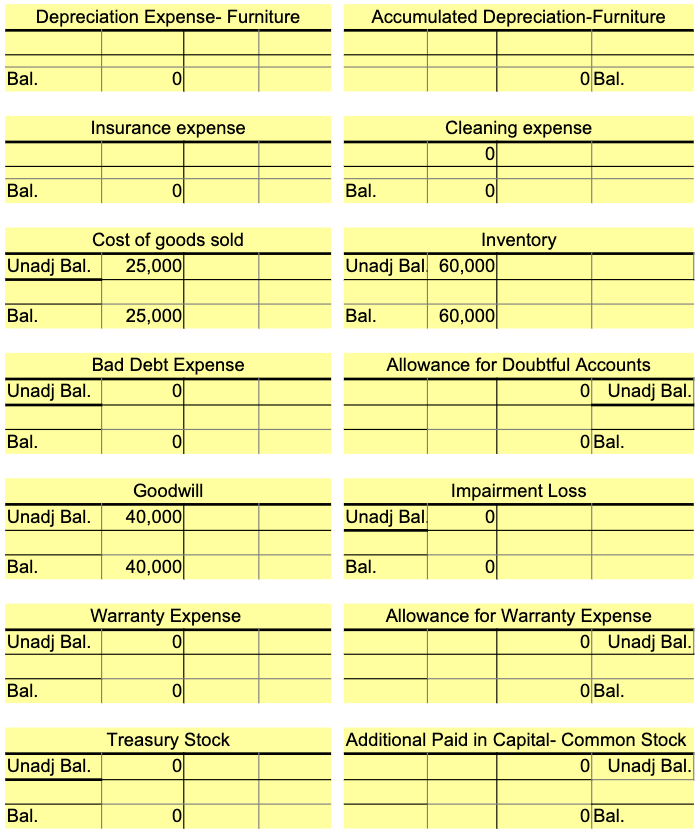

ANN SIMPSON,DESIGNER Unadjusted Trial Balance November 30, 2018 Account Title Cash Inventory Accounts Receivable Office Supplies Prepaid Insurance Furniture Land Goodwill Accounts Payable Utilities Payable Unearned Revenue Common Stock Dividends Service Revenue Cost of goods sold Salaries Expense Rent Expense Utilities Expense Total Balance Debit Credit $ 23,400 $ 60,000 22,000 5,000 3,000 20,000 24,000 40,000 $ 19,900 600 38,000 100,000 4,000 76,900 25,000 6,000 2,000 1,000 $ 235,400 $ 235,400 Adjusting Entries 1. An inventory of supplies showed $3,000 were used up. 2. The furniture was purchased for $30,000. It has $0 salvage value and a 5 year useful life. One year of depreciation must be recorded. 3. $3,000 of insurance was purchased for 12 months. $1,500 of insurance was used. 4. Performed $20,000 of services that was paid for in advance 5. On last day of the month, performed $9,100 of services for new customer and will be paid next month 6. Happy cleaners provided $9,000 of cleaning services on the last day of the month. This waas a special yearly clean. They will be paid next month. 7. An inventory count revealed there was $4,000 of inventory shrinkage. This was a larger than usual amount of shrinkage. 8. The company estimates bad debt expense to be 1% of credit sales. Assume all sales are made on credit. 9. A company with net assets of $100,000 was purchased for $190,000 one year ago. The current fair value of the company is 180,000. Perform a goodwill impairment test and record an impairment entry if one is needed. 10. The company had a calculated warranty expense of 19,000 on oustanding sales 11. The company sold an additional 10,000 shares at a market price of $15. The par value of the stock is $1. 12. The company purchased 1,000 of its own shares at a market price of $20. Accounts and Explanation Debit Credit Date Adj 1 Adj2 Adj3 Adj4 Adj5 Adj6 Adj7 Adj8 Adj9 Adj 10 Adj11 Adj12 General Ledger (starting with balances from unadjusted trial balance) Cash Accounts Payable Unadj Bal. 23,400 19,900 Unadj Bal. Bal. 23,400 19,900 Bal. Accounts Receivable Unadj Bal. 22,000 Utilities Payable 600 Unadj Bal. Bal. 22,000 600 Bal. Office Supplies 5,000 Unearned Revenue 38,000 Unadj Bal. Unadj Bal. Bal. 5,000 38,000 Bal. Prepaid Insurance Unadj Bal. 3,000 Common Stock 100,000 Unadj Bal. Bal. 3,000 100,000 Bal. Land 24,000 Dividends Unadj Bal 4,000 Unadj Bal. Bal. 24,000 Bal. 4,000 Furniture 20,000 Sales or Service Revenue 76,900 Unadj Bal. Unadj Bal. Bal. 20,000 76,900 Bal. Salary Expense 6,000 Utilities Expense 1,000 Undadj Unadj Bal Bal. 6,000 Bal. 1,000 Supplies Expense Rent Expense 2,000 Unadj Bal Ral Rol 2000 Depreciation Expense- Furniture Accumulated Depreciation-Furniture Bal. o Bal. Insurance expense Cleaning expense 0 Bal. Bal. Cost of goods sold Unadj Bal. 25,000 Inventory Unadj Bal 60,000 Bal. 25,000 Bal. 60,000 Bad Debt Expense Unadj Bal. Allowance for Doubtful Accounts o Unadj Bal. Bal. O Bal. Goodwill 40,000 Impairment Loss Unadj Bal. Unadj Bal Bal. 40,000 Bal. Warranty Expense Unadj Bal. 0 Allowance for Warranty Expense 0 Unadj Bal. Bal. O Bal. Treasury Stock Unadj Bal. 0 Additional Paid in Capital- Common Stock o Unadj Bal. Bal. O Bal. ANN SIMPSON DESIGNER Adjusted Trial Balance December 31, 2018 Balance Debit Credit Account Title Cash Inventory Accounts Receivable Allowance for Doubtful Accounts Office Supplies Prepaid Insurance Land Furniture Accumulated Depreciation-Furniture Goodwill Accounts Payable Utilities Payable Unearned Revenue Allowance for Warranty Expense Common Stock Additional Paid in Capital-Common Stock Treasury Stock Dividends Sales or Service Revenue Cost of goods sold Utilities Expense Rent Expense Cleaning expense Salary Expense Supplies Expense Depreciation Expense- Furniture Insurance expense Bad debt expense Impairment loss Warranty Expense Total ANN SIMPSON DESIGNER Income Statement Year Ended December 31, 2018 Revenues: Sales or Service Revenue Expenses: Cost of goods sold Utilities Expense Rent Expense Cleaning expense Salary Expense Supplies Expense Depreciation Expense- Furniture Insurance expense Bad debt expense Impairment loss Warranty Expense Total Expenses Net Income ANN SIMPSON DESIGNER Statement of Owner's Equity Year Ended December 31, 2018 Beginning, January 1, 2018 Net income for the year Dividends Ending Balance, December 31, 2018 ANN SIMPSON DESIGNER Balance Sheet December 31, 2018 Assets Current Assets: Cash Inventory Net Accounts Receivable Office Supplies Prepaid Insurance Total Current Assets Property, Plant, and Equipment: Land Furniture Less: Accumulated Depreciation-Furniture Total Property, Plant, and Equipment Intangible Assets: Goodwill Total Assets Liabilities Current Liabilities: Accounts Payable Utilities Payable Unearned Revenue Allowance for Warranty Expense Total Current Liabilities Total Liabilities Stockholders' Equity Common Stock Additional Paid in Capital - Common Stock Owner's Equity Treasury Stock Total Stockholders' Equity Total Liabilities and Stockholders' Equity Statement of Cash Flows Cash Flow from Operating Activities: Net Income (Loss) Adjustments to reconcile net income to cash: Provided by Operating Activities Depreciation expense Impariment loss Loss on disposal of long term assets Gain on disposal of long term assets Increase in accounts receivable Increase in inventory Increase in supplies Increase in prepaid insurance Increase in accounts payable Increase in utilities payable Increase in unearned revenue Increase in Allowance for warranty expense -------------- ------------- ------- ---- -=-=-= -.-.-.-.--.-.-.-.-. Net Cash Provided by Opearting Activites Cash Flow from Investing Activities: Cash receipt for sale of land Cash payment for acquisition furniture Cash payment for acquisiton Goodwill Net Cash Provided (Used) by Investing Activites Cash Flow from Financing Activities: Cash payment from purchase of common stock Cash receipt for sale of common stock cash payment of dividends ---- -------------- Net Cash Provided (Used) by Financing Activites Net Increase (Decrease) in Cash ------------------- Beginning Cash Balance --------- Ending Cash Balance Es..... **----------- Other Information: Land was sold for $25,000 in cash Furniture was purchased for $20,000 in cash Goodwill was purchased for $66,000 in cash The compnay sold stock for $227,000 in cash Company stock was purchased for $20,000 in cash The company paid $4,000 in cash dividends

$

$