Using the Form 1120 Illustrated from Chapter 3 for inspiration, prepare and submit for grading a completed 2020 Form 1120 for Swift Corporation. Use the Corporate Tax Return_Student worksheet as your primary source of information. In case needed information is missing from the worksheet, you can rely on the Form 1120 Illustrated as a guide.

please fill out for 1120 pages 1-6.

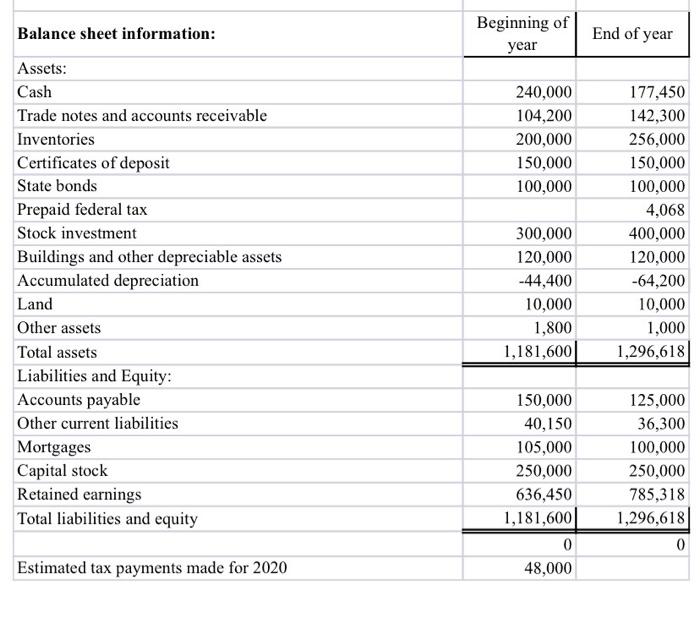

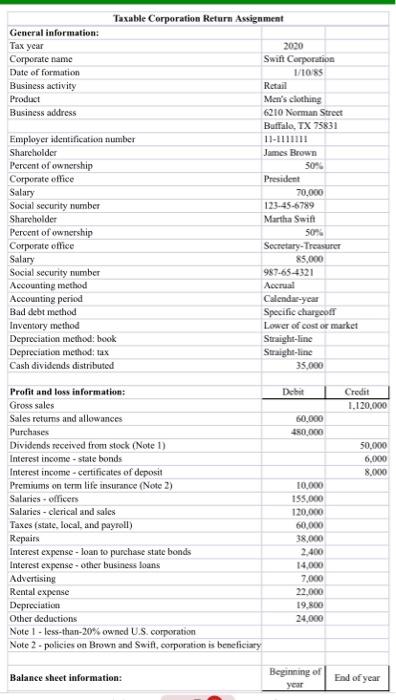

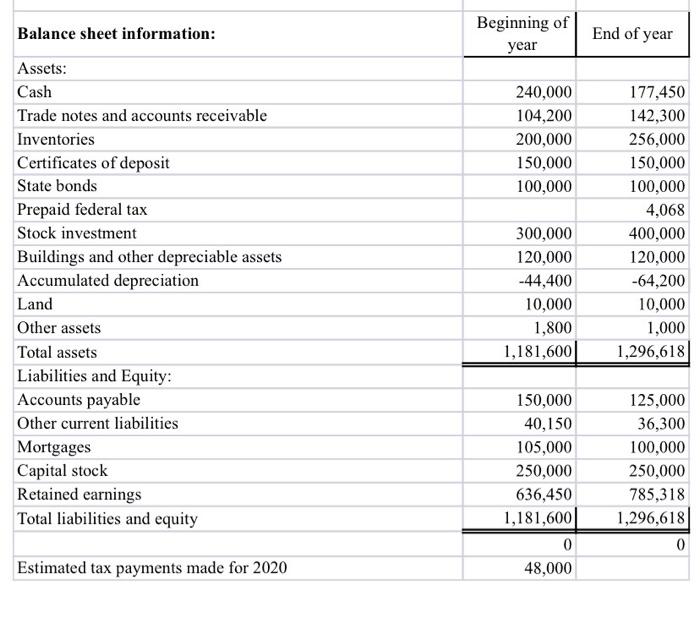

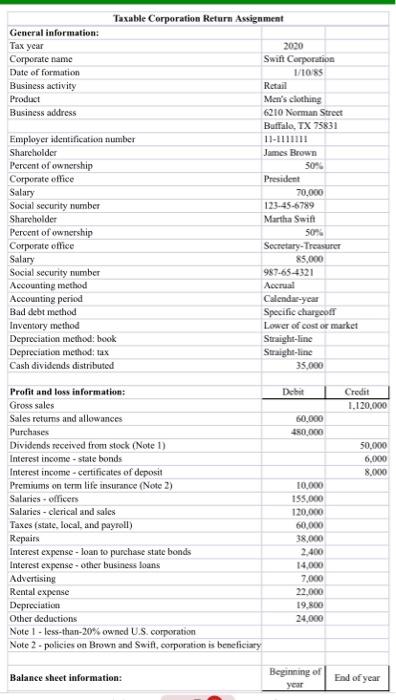

Balance sheet information: Beginning of year End of year 240,000 104,200 200,000 150,000 100,000 Assets: Cash Trade notes and accounts receivable Inventories Certificates of deposit State bonds Prepaid federal tax Stock investment Buildings and other depreciable assets Accumulated depreciation Land Other assets Total assets Liabilities and Equity: Accounts payable Other current liabilities Mortgages Capital stock Retained earnings Total liabilities and equity 177,450 142,300 256,000 150,000 100,000 4,068 400,000 120,000 -64,200 10,000 1,000 1,296,618 300,000 120,000 -44,400 10,000 1,800 1,181,600 150,000 40,150 105,000 250,000 636,450 1,181,600 0 48,000 125,000 36,300 100,000 250,000 785,318 1,296,618 0 Estimated tax payments made for 2020 Taxable Corporation Return Assignment General informations Tax year 2020 Corporate name Swift Corporation Date of formation 1/10/85 Business activity Retail Product Men's clothing Business address 6210 Norman Street Buffalo, TX 75831 Employer identification number 11-1111111 Sharcholder James Brown Percent of ownership 30 Corporate office President Salary 70.000 Social security number 123-45-6789 Shareholder Martha Swift Percent of ownership 50% Corporate office Secretary-Treasurer Salary 85.000 Social security number 987-65-4321 Accounting method Accrual Accounting period Calendar year Bad debt method Specifiechargeon Inventory method Lower of cost or market Depreciation method: book Straight-line Depreciation method: tax Straight line Cash dividends distributed 35.000 Profit and loss information: Debut Credit Gross sales 1.120.000 Sales retums and allowances 50.000 Purchases 450.000 Dividends received from stock (Note 1) 50.000 Interest income-stale bonds 6.000 Interest income - certificates of deposit 8.000 Premiums on term life insurance (Note 2) 10,000 Salaries - officers 155.000 Salaries - clerical and sales 120.000 Taxes (state, local and payroll) 60,000 Repairs 38,000 Interest expense - loan to purchase state bonds 2.400 Interest expense other business loans 14,000 Advertising 7.000 Rental expense 22.000 Depreciation 19.800 Other deductions 24,000 Note 1 - less-than-20% owned U.S. corporation Note 2 - policies on Brown and Swift, corporation is beneficiary Balance sheet information: Beginning of year End of year Balance sheet information: Beginning of year End of year 240,000 104,200 200,000 150,000 100,000 Assets: Cash Trade notes and accounts receivable Inventories Certificates of deposit State bonds Prepaid federal tax Stock investment Buildings and other depreciable assets Accumulated depreciation Land Other assets Total assets Liabilities and Equity: Accounts payable Other current liabilities Mortgages Capital stock Retained earnings Total liabilities and equity 177,450 142,300 256,000 150,000 100,000 4,068 400,000 120,000 -64,200 10,000 1,000 1,296,618 300,000 120,000 -44,400 10,000 1,800 1,181,600 150,000 40,150 105,000 250,000 636,450 1,181,600 0 48,000 125,000 36,300 100,000 250,000 785,318 1,296,618 0 Estimated tax payments made for 2020 Taxable Corporation Return Assignment General informations Tax year 2020 Corporate name Swift Corporation Date of formation 1/10/85 Business activity Retail Product Men's clothing Business address 6210 Norman Street Buffalo, TX 75831 Employer identification number 11-1111111 Sharcholder James Brown Percent of ownership 30 Corporate office President Salary 70.000 Social security number 123-45-6789 Shareholder Martha Swift Percent of ownership 50% Corporate office Secretary-Treasurer Salary 85.000 Social security number 987-65-4321 Accounting method Accrual Accounting period Calendar year Bad debt method Specifiechargeon Inventory method Lower of cost or market Depreciation method: book Straight-line Depreciation method: tax Straight line Cash dividends distributed 35.000 Profit and loss information: Debut Credit Gross sales 1.120.000 Sales retums and allowances 50.000 Purchases 450.000 Dividends received from stock (Note 1) 50.000 Interest income-stale bonds 6.000 Interest income - certificates of deposit 8.000 Premiums on term life insurance (Note 2) 10,000 Salaries - officers 155.000 Salaries - clerical and sales 120.000 Taxes (state, local and payroll) 60,000 Repairs 38,000 Interest expense - loan to purchase state bonds 2.400 Interest expense other business loans 14,000 Advertising 7.000 Rental expense 22.000 Depreciation 19.800 Other deductions 24,000 Note 1 - less-than-20% owned U.S. corporation Note 2 - policies on Brown and Swift, corporation is beneficiary Balance sheet information: Beginning of year End of year