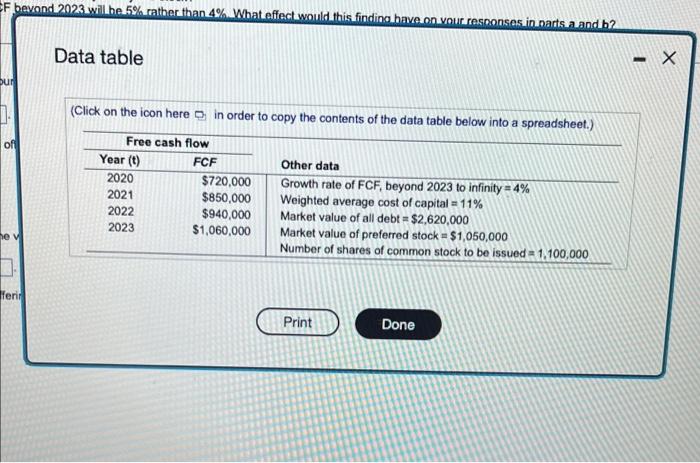

Using the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you have an oppor in owning the company, you are concerned about whether it is fairly priced. To determine the value of the shares, you have data sourons. The key values you have compiled are summarized in the following table, a. Use the free cash flow valuation model to estimate CoolTech's common stock value per share. b. Judging by your finding in part a and the stock's offering price, should you buy the stock? c. On further analysis, you find that the growth rate in FCF beyond 2023 will be 5% rather than 4%. What effect would this E 2. The value of CoolTech's entire company is $ (Round to the nearest dollar) The value per share of CoolTech's common stock is $(Round to the nearest cent.) b. On the basis of your finding in part a and the stock's offering price, should you buy the stock? (Select the best answer b Na Yes c. If the growth rate in FCF beyond 2023 will be 5%, the value of CoolTech's entire company will be (Round to the ne The value per share of CoolTech's common stock is (Round to the nearest cent) On the basis of your finding in parte and the stocks offering price, should you buy the stock? (Select the best answer belon A Yes B. No MacBod esc BO CO OOD 12 F 14 @ A A 1 w # # 3 2 $ 4 % 5 6 TAL hnce Problem Assume that you have an opportunity to buy tho stock of CoolTech, Inc, an IPO being offered for $9.52 per share. Although you are very much interested To determine the value of the shares, you have decided to apply the free cash flow valuation model to the fem's financial data that you've accumulated from a variety of lowing table, stock value per share. ou buy the stock? u be 5% rather than 4%. What effect would this finding have on your responses in parts a and b? It dollar) nearest cent.) ould you buy the stock? (Select the best answer below) ech's entire company will be $ (Round to the nearest dollar) e nearest cent) did you buy the stock? (Select the best answer below) Submit quiz EF bevond 2023 will be 5% rather than 4% What effect would this finding have on your responses in narts.a. and b2 Data table - X bur (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) of Free cash flow Year (t) FCF 2020 $720,000 2021 $850,000 2022 $940,000 $1,060,000 Other data Growth rate of FCF, beyond 2023 to infinity = 4% Weighted average cost of capital = 11% Market value of all debt = $2,620,000 Market value of preferred stock = $1,050,000 Number of shares of common stock to be issued = 1,100,000 2023 he fent Print Done