Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the given data pleas explain how to find (a-b) using the HP 12c financial calculator. In adition explain using the TVM (Time Value Money)

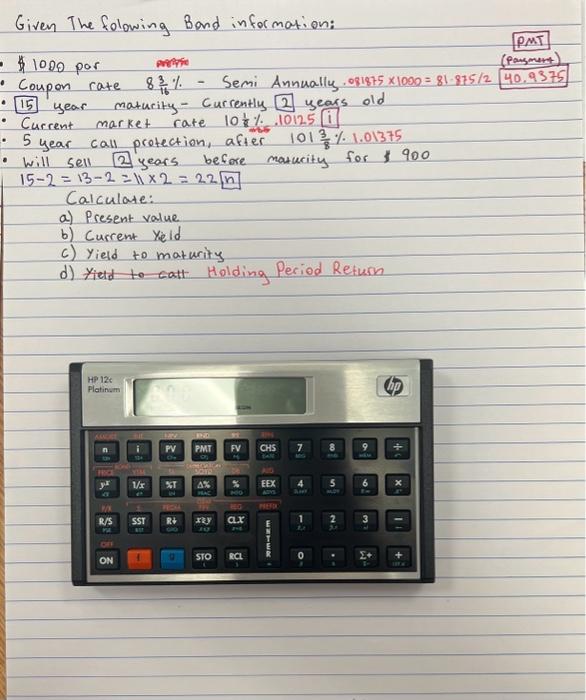

Using the given data pleas explain how to find (a-b) using the HP 12c financial calculator. In adition explain using the TVM (Time Value Money) function keys as they would be pressed in a sequential order to arrive at the answers. I have done couple of simple formating and calulations to show my inshal thught prosses.

Given The folowing Band information: PMT $1000 por Coupon rate 8163% - Semi Annually. 0818751000=81.875/240.9375 - [15] year maturity - Currently [2] years old - Current market rate 1081%.10125 [i] - 5 year call protection, after 10183%1.01375 - will sell 2 years before matucity for $900 152=132=112=22n Calculate: a) Present value b) Current Yeid c) Yield to maturity d) Yietd to catt Holding Period Return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started