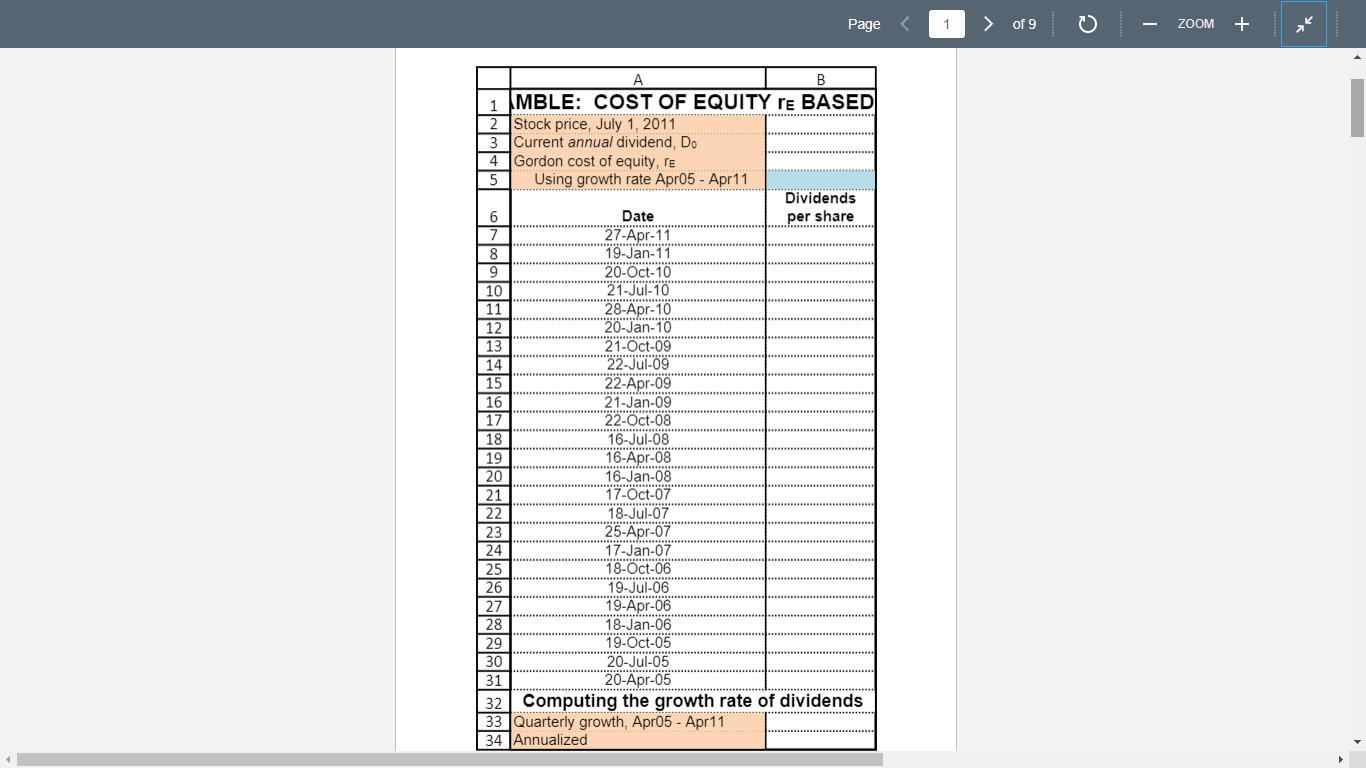

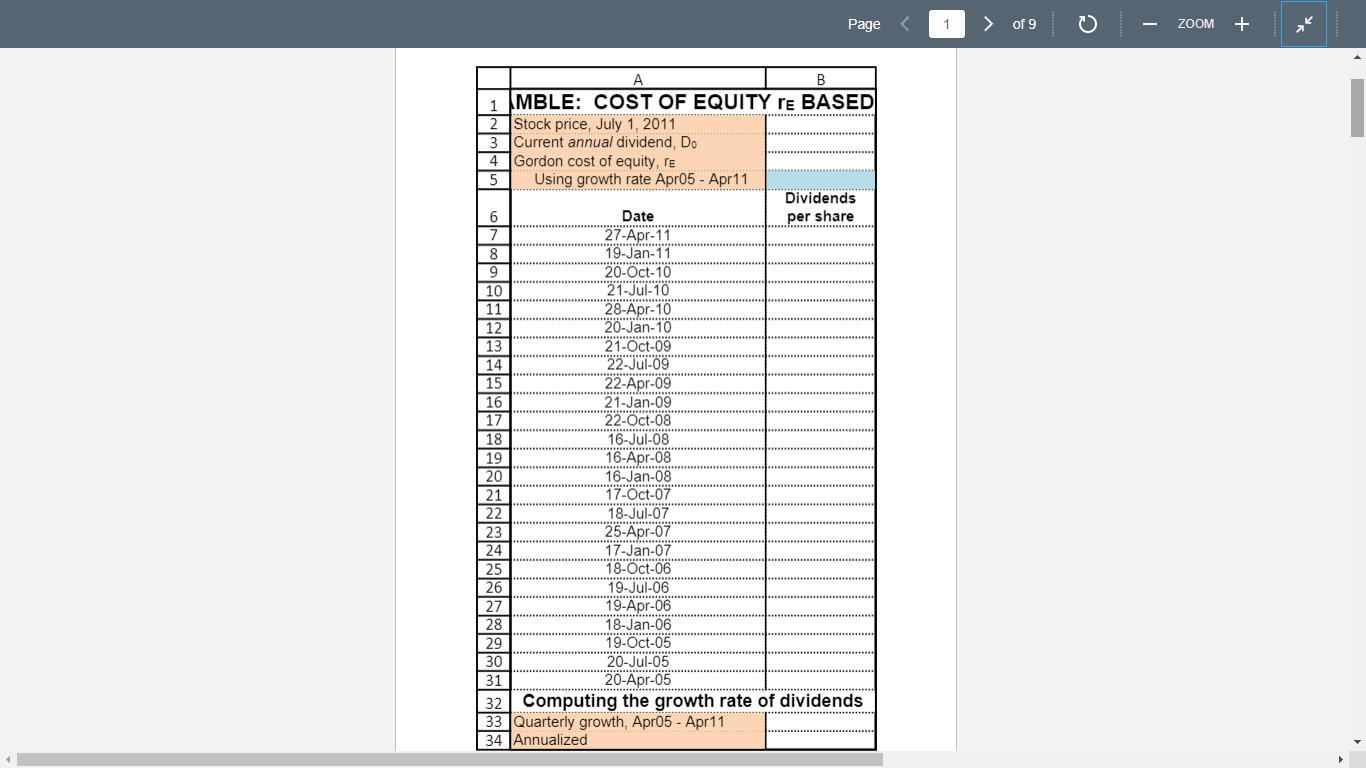

Using the Gordon formula for dividends, find the cost of common equity for the Procter and Gamble Company (P&G, official NYSE ticker symbol PG, www.pg.com) on July 1, 2011. Use Yahoo! Finance to download the closing stock price (not adjusted) on July 1, 2011 and the history of dividends for the last six years. Note: the fiscal year for the company ends on June 30 of each calendar year.

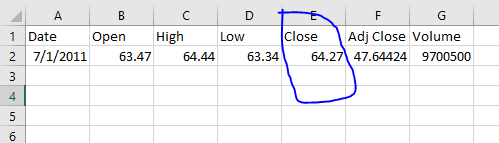

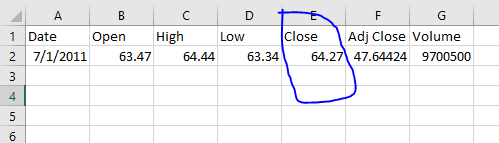

the closing stock price is 64.27 on July 2011

the above info

the above info

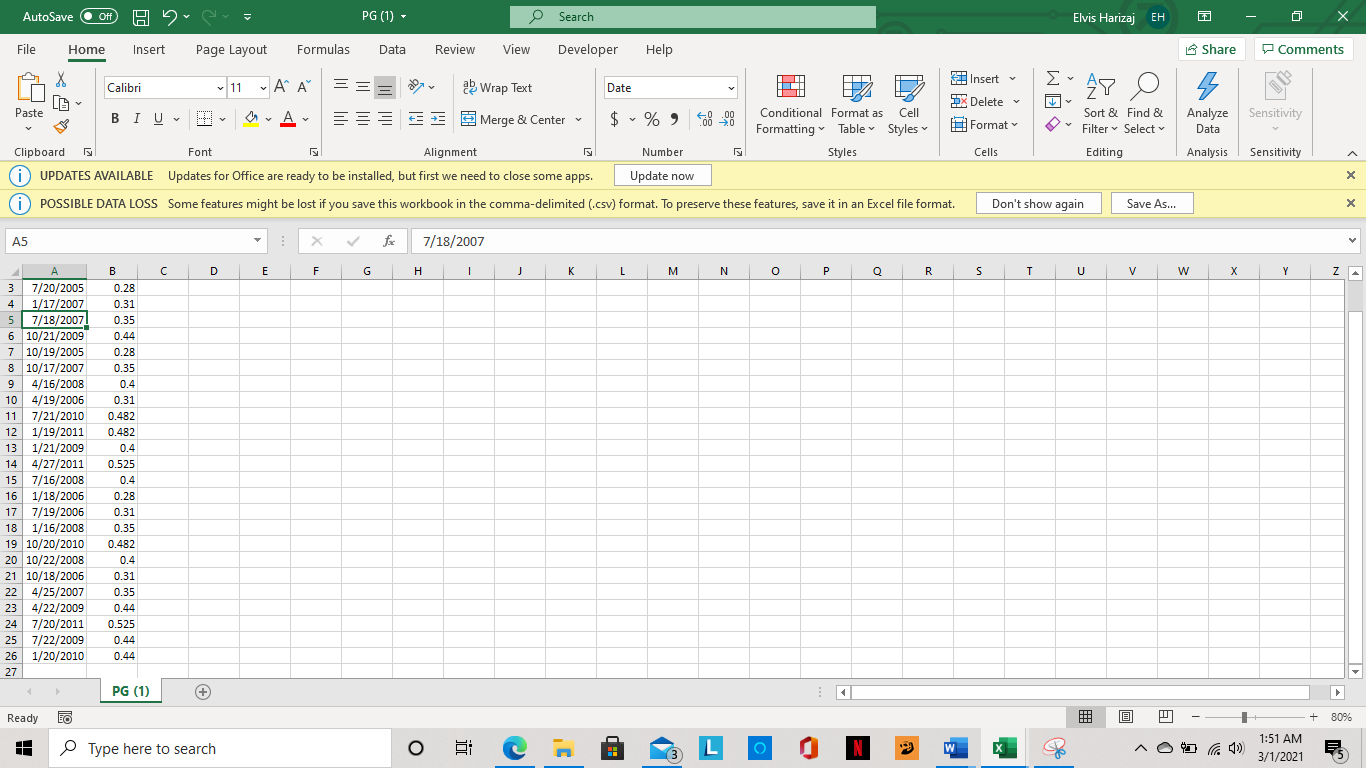

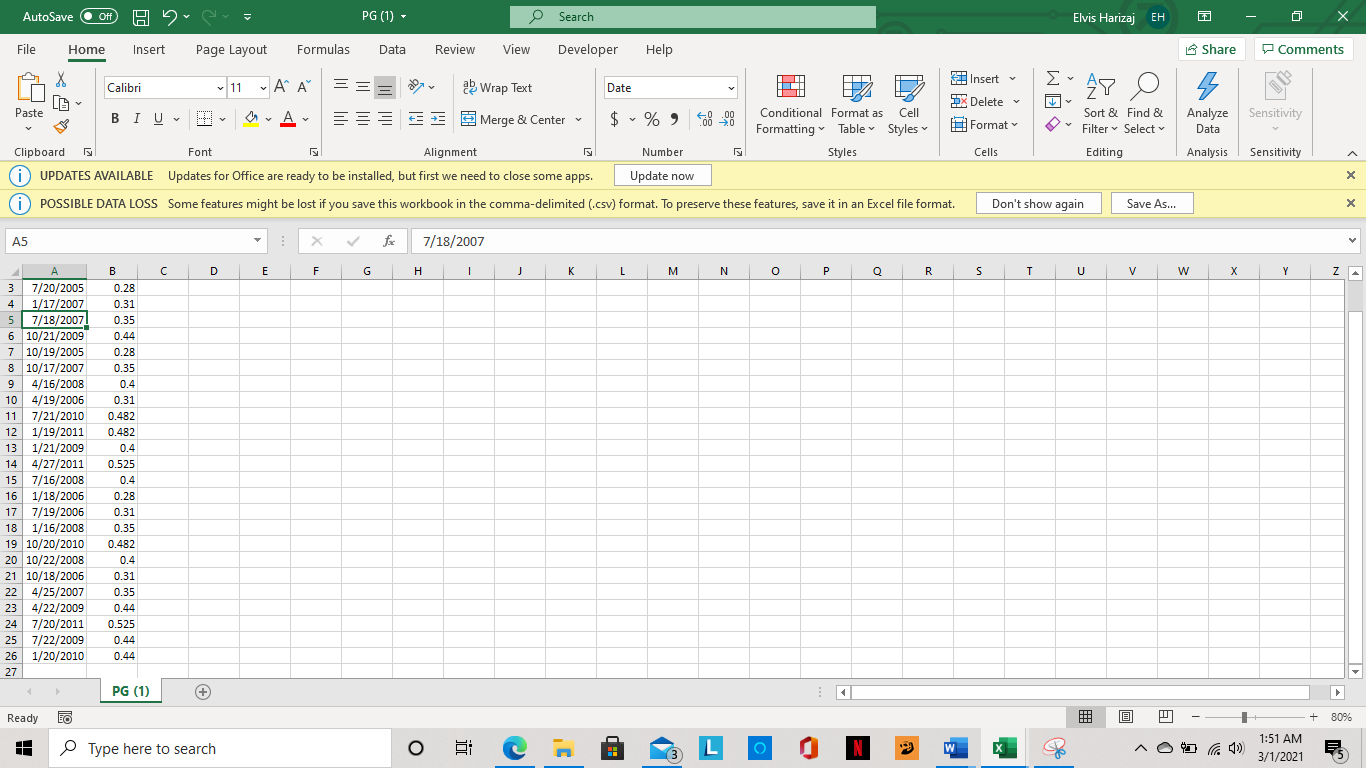

| Date | Dividends |

| 4/28/2010 | 0.482 |

| 7/20/2005 | 0.28 |

| 1/17/2007 | 0.31 |

| 7/18/2007 | 0.35 |

| 10/21/2009 | 0.44 |

| 10/19/2005 | 0.28 |

| 10/17/2007 | 0.35 |

| 4/16/2008 | 0.4 |

| 4/19/2006 | 0.31 |

| 7/21/2010 | 0.482 |

| 1/19/2011 | 0.482 |

| 1/21/2009 | 0.4 |

| 4/27/2011 | 0.525 |

| 7/16/2008 | 0.4 |

| 1/18/2006 | 0.28 |

| 7/19/2006 | 0.31 |

| 1/16/2008 | 0.35 |

| 10/20/2010 | 0.482 |

| 10/22/2008 | 0.4 |

| 10/18/2006 | 0.31 |

| 4/25/2007 | 0.35 |

| 4/22/2009 | 0.44 |

| 7/20/2011 | 0.525 |

| 7/22/2009 | 0.44 |

| 1/20/2010 | 0.44 |

A B C D F G 1 Date Open High Low Close Adj Close Volume 2 7/1/2011 63.47 64.44 63.34 64.27 47.64424 9700500 3 4 5 6 Share Comments 47 O % AutoSave Off be PG (1) - Search Elvis Harizaj EH File Home Insert Page Layout Formulas Data Review View Developer Help Insert Calibri 11 A A = ab Wrap Text Date DX Delete v Paste BIU A Cell $ %, -20 ESE 3 Merge & Center Conditional Format as Sort & Find & Formatting Table Styles Format Filter Select Clipboard Font Alignment Number Styles Cells Editing i UPDATES AVAILABLE Updates for Office are ready to be installed, but first we need to close some apps. Update now ( POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the comma-delimited (.csv) format. To preserve these features, save it in an Excel file format. Don't show again Save As... Analyze Sensitivity Data Analysis Sensitivity A5 7/18/2007 C D E E F H J K L M N o P Q R s T U V W Y Z A 3 3 7/20/2005 4 1/17/2007 5 5 7/18/2007 6 10/21/2009 7 10/19/2005 8 8 10/17/2007 9 9 4/16/2008 10 4/19/2006 11 7/21/2010 "1721/2010 12 1/19/2011 13 1/21/2009 14 4/27/2011 15 7/16/2008 16 1/18/2006 * Tier 17 7/19/2006 18 1/16/2008 19 10/20/2010 20 10/22/2008 21 10/18/2006 22 4/25/2007 23 4/22/2009 24 7/20/2011 25 7/22/2009 26 1/20/2010 27 3913938587:3310!! B 0.28 0.31 0.35 0.35 0.44 0.28 0.35 0.33 0.4 0.31 0.482 0.482 0.4 0. 0.525 0.4 0.28 0.31 0.35 0.482 0.4 0.31 0.35 0.44 0.525 0.44 0.44 PG (1) (+ Ready + 80% H Type here to search o L 1 IE W 640 1:51 AM 3/1/2021 Page 1 > of 9 ZOOM + ITI B 1 MBLE: COST OF EQUITY RE BASED 2 Stock price, July 1, 2011 3 Current annual dividend, Do Gordon cost of equity, re 5 Using growth rate Apr05 - Apr 11 Dividends 6 Date per share 7 27-Apr-11 8 19-Jan-11 9 20-Oct-10 10 21-Jul-10 11 28-Apr-10 12 20-Jan-10 13 21-Oct-09 14 22-Jul-09 15 22-Apr-09 16 21-Jan-09 17 22-Oct-08 18 16-Jul-08 19 16-Apr-08 20 16-Jan-08 21 17-Oct-07 22 18-Jul-07 23 25-Apr-07 24 17-Jan-07 25 18-Oct-06 26 19-Jul-06 27 19-Apr-06 28 18-Jan-06 29 19-Oct-05 30 20-Jul-05 31 20-Apr-05 32 Computing the growth rate of dividends 33 Quarterly growth, Apr05 - Apr 11 34 Annualized A B C D F G 1 Date Open High Low Close Adj Close Volume 2 7/1/2011 63.47 64.44 63.34 64.27 47.64424 9700500 3 4 5 6 Share Comments 47 O % AutoSave Off be PG (1) - Search Elvis Harizaj EH File Home Insert Page Layout Formulas Data Review View Developer Help Insert Calibri 11 A A = ab Wrap Text Date DX Delete v Paste BIU A Cell $ %, -20 ESE 3 Merge & Center Conditional Format as Sort & Find & Formatting Table Styles Format Filter Select Clipboard Font Alignment Number Styles Cells Editing i UPDATES AVAILABLE Updates for Office are ready to be installed, but first we need to close some apps. Update now ( POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the comma-delimited (.csv) format. To preserve these features, save it in an Excel file format. Don't show again Save As... Analyze Sensitivity Data Analysis Sensitivity A5 7/18/2007 C D E E F H J K L M N o P Q R s T U V W Y Z A 3 3 7/20/2005 4 1/17/2007 5 5 7/18/2007 6 10/21/2009 7 10/19/2005 8 8 10/17/2007 9 9 4/16/2008 10 4/19/2006 11 7/21/2010 "1721/2010 12 1/19/2011 13 1/21/2009 14 4/27/2011 15 7/16/2008 16 1/18/2006 * Tier 17 7/19/2006 18 1/16/2008 19 10/20/2010 20 10/22/2008 21 10/18/2006 22 4/25/2007 23 4/22/2009 24 7/20/2011 25 7/22/2009 26 1/20/2010 27 3913938587:3310!! B 0.28 0.31 0.35 0.35 0.44 0.28 0.35 0.33 0.4 0.31 0.482 0.482 0.4 0. 0.525 0.4 0.28 0.31 0.35 0.482 0.4 0.31 0.35 0.44 0.525 0.44 0.44 PG (1) (+ Ready + 80% H Type here to search o L 1 IE W 640 1:51 AM 3/1/2021 Page 1 > of 9 ZOOM + ITI B 1 MBLE: COST OF EQUITY RE BASED 2 Stock price, July 1, 2011 3 Current annual dividend, Do Gordon cost of equity, re 5 Using growth rate Apr05 - Apr 11 Dividends 6 Date per share 7 27-Apr-11 8 19-Jan-11 9 20-Oct-10 10 21-Jul-10 11 28-Apr-10 12 20-Jan-10 13 21-Oct-09 14 22-Jul-09 15 22-Apr-09 16 21-Jan-09 17 22-Oct-08 18 16-Jul-08 19 16-Apr-08 20 16-Jan-08 21 17-Oct-07 22 18-Jul-07 23 25-Apr-07 24 17-Jan-07 25 18-Oct-06 26 19-Jul-06 27 19-Apr-06 28 18-Jan-06 29 19-Oct-05 30 20-Jul-05 31 20-Apr-05 32 Computing the growth rate of dividends 33 Quarterly growth, Apr05 - Apr 11 34 Annualized

the above info

the above info