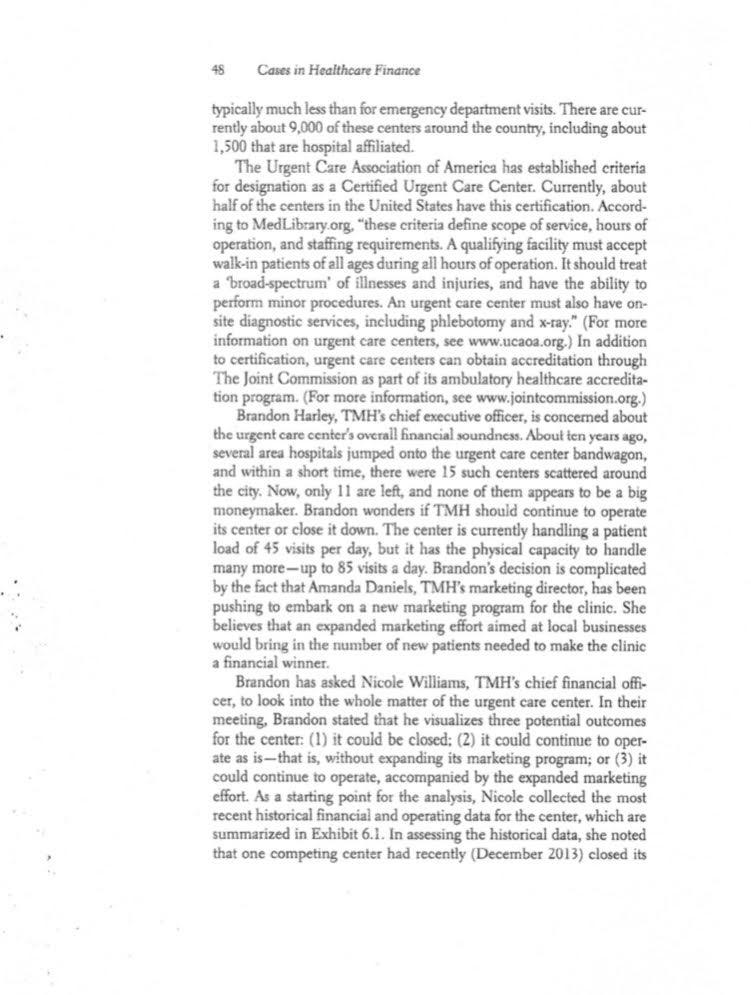

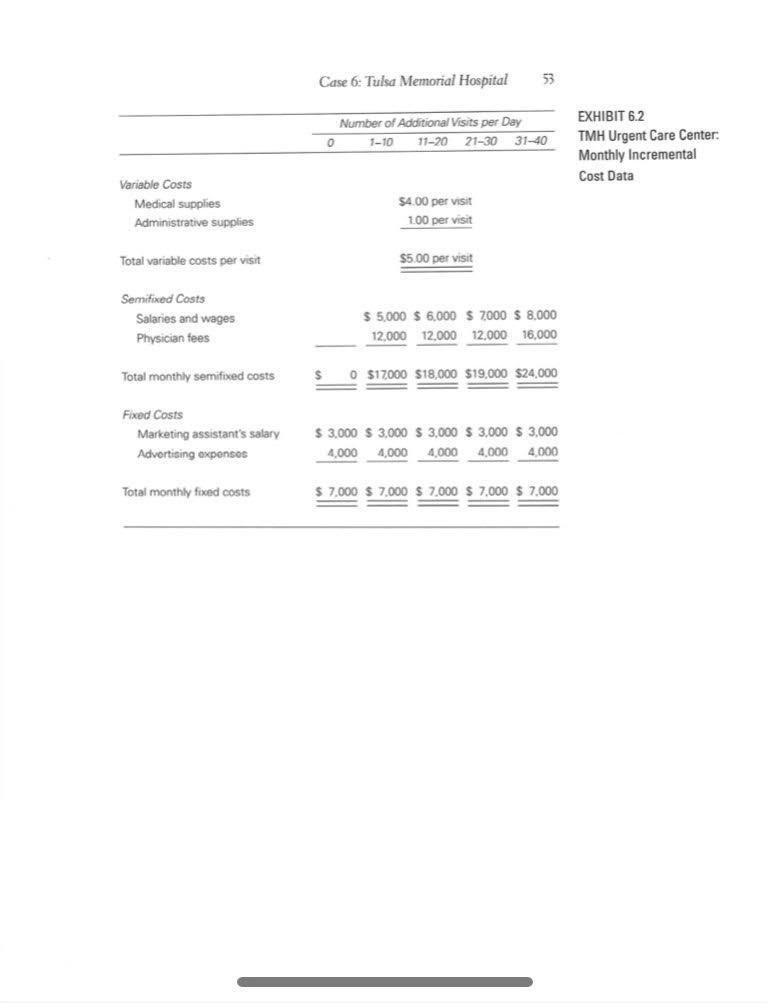

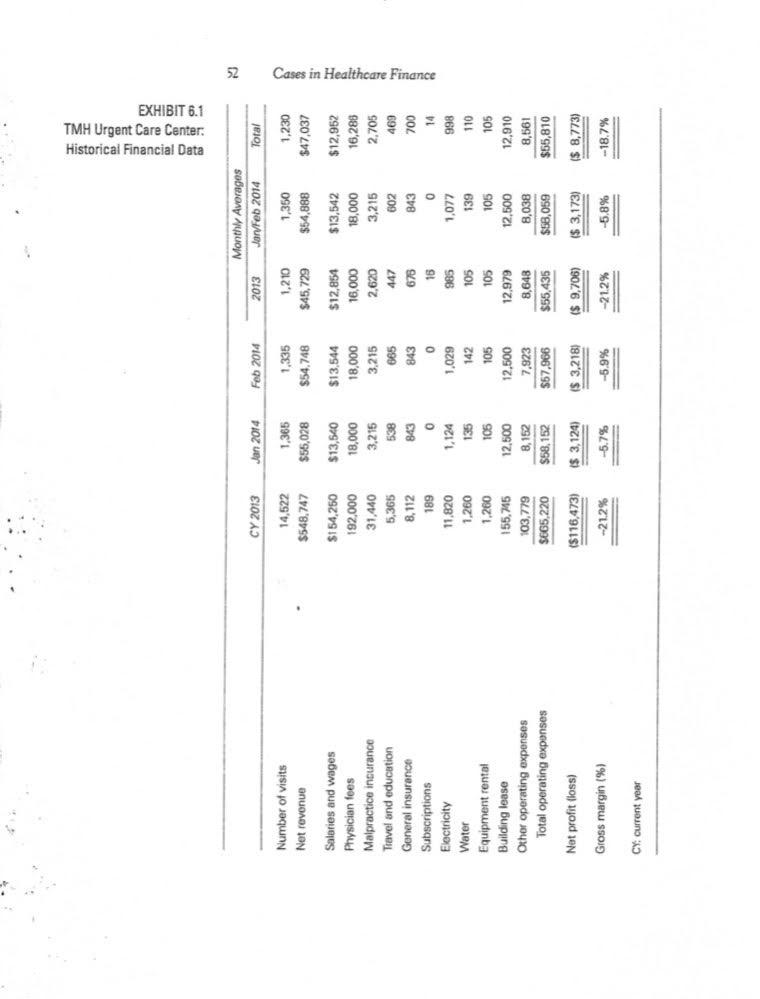

45 Cases in Healthcare Finance typically much less than for emergency department visits. There are cur- rently about 9,000 of these centers around the country, including about 1,500 that are hospital affiliated. The Urgent Care Association of America has established criteria for designation as a Certified Urgent Care Center. Currently, about half of the centers in the United States have this certification. Accord- ing to MedLibrary.org. "these criteria define scope of service, hours of operation, and staffing requirements. A qualifying facility must accept walk-in patients of all ages during all hours of operation. It should treat a broad-spectrum of illnesses and injuries, and have the ability to perform minor procedures. An urgent care center must also have on- site diagnostic services, including phlebotomy and x-ray." (For more information on urgent care centers, see www.ucaoa.org.) In addition to certification, urgent care centers can obtain accreditation through The Joint Commission as part of its ambulatory healthcare accredita- tion program. (For more information, see www.jointcommission.org.) Brandon Harley, TMH's chief executive officer, is concerned about the urgent care center's overall financial soundness. About ten years ago, several area hospitals jumped onto the urgent care center bandwagon, and within a short time, there were 15 such centers scattered around the city. Now, only 11 are left, and none of them appears to be a big moneymaker. Brandon wonders if TMH should continue to operate its center or close it down. The center is currently handling a patient load of 45 visits per day, but it has the physical capacity to handle many more-up to 85 visits a day. Brandon's decision is complicated by the fact that Amanda Daniels, TMH's marketing director, has been pushing to embark on a new marketing program for the clinic. She believes that an expanded marketing effort aimed at local businesses would bring in the number of new patients needed to make the clinic a financial winner Brandon has asked Nicole Williams, TMH's chief financial offi- cer, to look into the whole matter of the urgent care center. In their meeting, Brandon stated that he visualizes three potential outcomes for the center: (1) it could be closed: (2) it could continue to oper- ate as is--that is, without expanding its marketing program; or (3) it could continue to operate, accompanied by the expanded marketing effort. As a starting point for the analysis, Nicole collected the most recent historical financial and operating data for the center, which are summarized in Exhibit 6.1. In assessing the historical data, she noted that one competing center had recently (December 2013) closed its Case 6: Tulsa Memorial Hospital 49 doors. Furthermore, a review of several years of financial data revealed that TMH's urgent care center does not have a pronounced seasonal utilization pattern. Next, Nicole met several times with the center's administrative director. The primary purpose of the meetings was to estimate the addi- tional costs that would have to be borne if center volume rose above the current January/February average level of 45 visits per day. Any incre- mental usage would require additional expenditures for administrative and medical supplies, estimated to be $4.00 per patient visit for medical supplies, such as tongue blades and rubber gloves, and $1.00 per patient visit for administrative supplies, such as file folders and clinical record sheets. Because of the relatively low volume level, the urgent care cen- ter has purposely been staffed at the bare minimum. In fact, some center employees have started to grumble about not being able to do their jobs well because of overwork. Thus, any increase in the number of patient visits would require immediate administrative and medical staffing increases. Furthermore, as the number of visits increase, the center would have to hire additional staff members. The incremental costs associated with increased volume are summarized in Exhibit 6.2. The urgent care center's building is leased on a long-term basis. TMH could cancel the lease, but the lease contract calls for a can- celation penalty of three months' rent, or $37,500 at the current lease rate. In addition, Nicole was startled to read in the newspaper that Baptist Hospital, TMH's major competitor, had just bought the city's largest primary care practice, and Baptist's CEO was quoted as say ing that more group practice acquisitions are planned as the hospital moved to embrace healthcare reform. Nicole wondered whether Bap- tist's actions would influence the decision regarding the urgent care center's fate Finally, Nicole met with Amanda to learn more about the proposed marketing program. The primary focus of the new marketing program would be on occupational health services (OHS). OHS involves provid- ing medical care to local businesses, including physical examinations for managers and employees, treatment of illnesses that occur during working hours, and treatment of work-related injuries, especially those covered by workers' compensation. Although some of the clinic's cur- rent business is OHS related, Amanda believes that a strong market- ing effort, coupled with specialized OHS record keeping, could bring additional patients to the clinic. The proposed marketing expansion ; Historical Financial Data TMH Urgent Care Center EXHIBIT 6.1 52 Monthly Averages Jar/Feb 2014 CY 2013 Jan 2014 Feb 2014 2013 Total Number of visits Net revenue 14,522 $548,747 1,365 $55,028 1,335 $54.748 1,210 $45,729 1,350 $54,888 1,230 $47,037 $154,250 192,000 31,440 $13,540 18,000 3,215 538 843 $12,854 16,000 2,620 447 $12,952 16,288 2,705 5,365 469 $13,544 18,000 3.215 665 843 0 1,029 142 Cases in Healthcare Finance $13,542 18,000 3,215 602 843 0 1,077 139 Salaries and wages Physician fees Malpractice insurance Travel and education General insurance Subscriptions Electricity Water Equipment rental Building lease Other operating expenses Total operating expenses 678 700 14 0 16 985 105 998 110 8,112 189 11.820 1.260 1.260 155,75 103,779 5665,220 105 135 105 12,500 8,152 $58,152 105 12,500 7,923 105 12.979 8,648 $55,435 105 12,500 8,038 $58,059 12,910 8,561 $55,810 $57,966 Net profit floss) ($116,473) $ 3,124) i$ 3,218) ($ 9,706) ($ 3,173) ($ 8,773) Gross margin (%) - 21.2% --5.7% -5.9% -212% -5.8% -18.7% Cy: current year 45 Cases in Healthcare Finance typically much less than for emergency department visits. There are cur- rently about 9,000 of these centers around the country, including about 1,500 that are hospital affiliated. The Urgent Care Association of America has established criteria for designation as a Certified Urgent Care Center. Currently, about half of the centers in the United States have this certification. Accord- ing to MedLibrary.org. "these criteria define scope of service, hours of operation, and staffing requirements. A qualifying facility must accept walk-in patients of all ages during all hours of operation. It should treat a broad-spectrum of illnesses and injuries, and have the ability to perform minor procedures. An urgent care center must also have on- site diagnostic services, including phlebotomy and x-ray." (For more information on urgent care centers, see www.ucaoa.org.) In addition to certification, urgent care centers can obtain accreditation through The Joint Commission as part of its ambulatory healthcare accredita- tion program. (For more information, see www.jointcommission.org.) Brandon Harley, TMH's chief executive officer, is concerned about the urgent care center's overall financial soundness. About ten years ago, several area hospitals jumped onto the urgent care center bandwagon, and within a short time, there were 15 such centers scattered around the city. Now, only 11 are left, and none of them appears to be a big moneymaker. Brandon wonders if TMH should continue to operate its center or close it down. The center is currently handling a patient load of 45 visits per day, but it has the physical capacity to handle many more-up to 85 visits a day. Brandon's decision is complicated by the fact that Amanda Daniels, TMH's marketing director, has been pushing to embark on a new marketing program for the clinic. She believes that an expanded marketing effort aimed at local businesses would bring in the number of new patients needed to make the clinic a financial winner Brandon has asked Nicole Williams, TMH's chief financial offi- cer, to look into the whole matter of the urgent care center. In their meeting, Brandon stated that he visualizes three potential outcomes for the center: (1) it could be closed: (2) it could continue to oper- ate as is--that is, without expanding its marketing program; or (3) it could continue to operate, accompanied by the expanded marketing effort. As a starting point for the analysis, Nicole collected the most recent historical financial and operating data for the center, which are summarized in Exhibit 6.1. In assessing the historical data, she noted that one competing center had recently (December 2013) closed its Case 6: Tulsa Memorial Hospital 49 doors. Furthermore, a review of several years of financial data revealed that TMH's urgent care center does not have a pronounced seasonal utilization pattern. Next, Nicole met several times with the center's administrative director. The primary purpose of the meetings was to estimate the addi- tional costs that would have to be borne if center volume rose above the current January/February average level of 45 visits per day. Any incre- mental usage would require additional expenditures for administrative and medical supplies, estimated to be $4.00 per patient visit for medical supplies, such as tongue blades and rubber gloves, and $1.00 per patient visit for administrative supplies, such as file folders and clinical record sheets. Because of the relatively low volume level, the urgent care cen- ter has purposely been staffed at the bare minimum. In fact, some center employees have started to grumble about not being able to do their jobs well because of overwork. Thus, any increase in the number of patient visits would require immediate administrative and medical staffing increases. Furthermore, as the number of visits increase, the center would have to hire additional staff members. The incremental costs associated with increased volume are summarized in Exhibit 6.2. The urgent care center's building is leased on a long-term basis. TMH could cancel the lease, but the lease contract calls for a can- celation penalty of three months' rent, or $37,500 at the current lease rate. In addition, Nicole was startled to read in the newspaper that Baptist Hospital, TMH's major competitor, had just bought the city's largest primary care practice, and Baptist's CEO was quoted as say ing that more group practice acquisitions are planned as the hospital moved to embrace healthcare reform. Nicole wondered whether Bap- tist's actions would influence the decision regarding the urgent care center's fate Finally, Nicole met with Amanda to learn more about the proposed marketing program. The primary focus of the new marketing program would be on occupational health services (OHS). OHS involves provid- ing medical care to local businesses, including physical examinations for managers and employees, treatment of illnesses that occur during working hours, and treatment of work-related injuries, especially those covered by workers' compensation. Although some of the clinic's cur- rent business is OHS related, Amanda believes that a strong market- ing effort, coupled with specialized OHS record keeping, could bring additional patients to the clinic. The proposed marketing expansion ; Historical Financial Data TMH Urgent Care Center EXHIBIT 6.1 52 Monthly Averages Jar/Feb 2014 CY 2013 Jan 2014 Feb 2014 2013 Total Number of visits Net revenue 14,522 $548,747 1,365 $55,028 1,335 $54.748 1,210 $45,729 1,350 $54,888 1,230 $47,037 $154,250 192,000 31,440 $13,540 18,000 3,215 538 843 $12,854 16,000 2,620 447 $12,952 16,288 2,705 5,365 469 $13,544 18,000 3.215 665 843 0 1,029 142 Cases in Healthcare Finance $13,542 18,000 3,215 602 843 0 1,077 139 Salaries and wages Physician fees Malpractice insurance Travel and education General insurance Subscriptions Electricity Water Equipment rental Building lease Other operating expenses Total operating expenses 678 700 14 0 16 985 105 998 110 8,112 189 11.820 1.260 1.260 155,75 103,779 5665,220 105 135 105 12,500 8,152 $58,152 105 12,500 7,923 105 12.979 8,648 $55,435 105 12,500 8,038 $58,059 12,910 8,561 $55,810 $57,966 Net profit floss) ($116,473) $ 3,124) i$ 3,218) ($ 9,706) ($ 3,173) ($ 8,773) Gross margin (%) - 21.2% --5.7% -5.9% -212% -5.8% -18.7% Cy: current year