Answered step by step

Verified Expert Solution

Question

1 Approved Answer

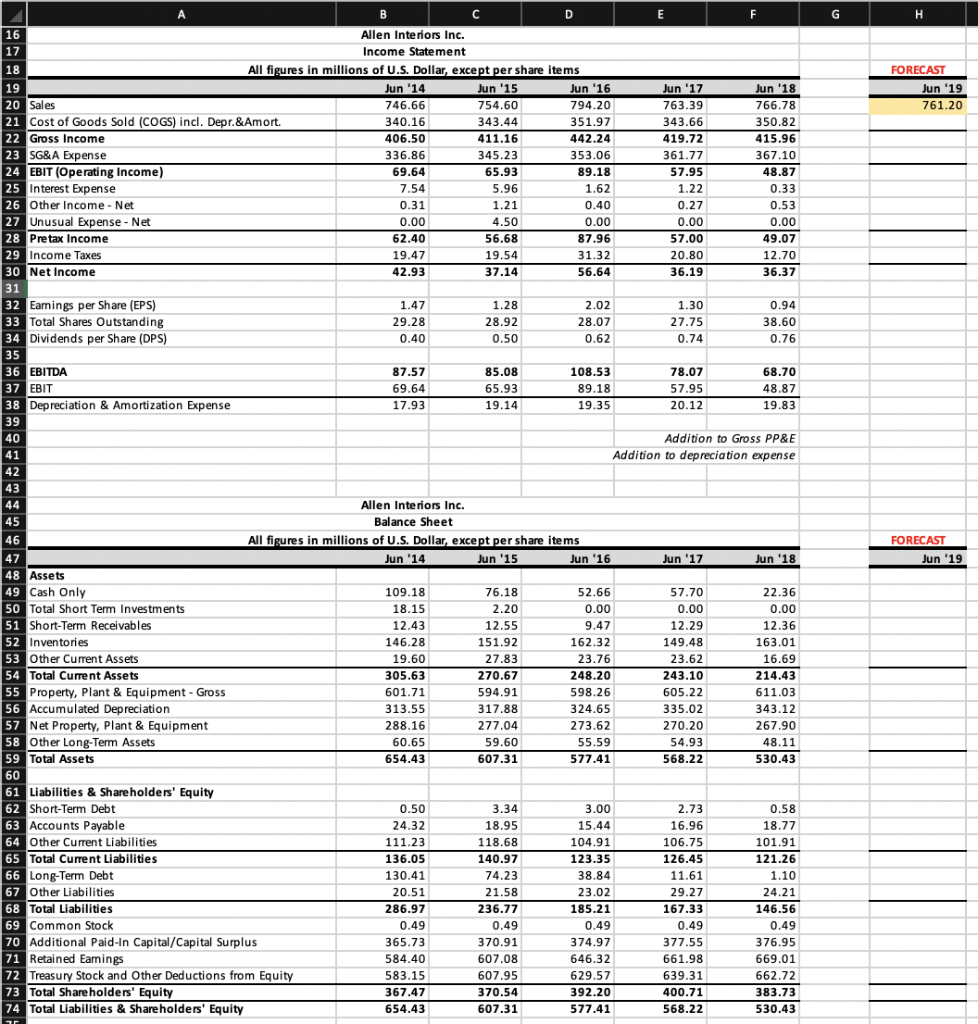

Using the historical financial statements for Allen Interiors, forecast the June 30, 2019 Income Statement and Balance Sheet. Use the percent of Sales method and

| Using the historical financial statements for Allen Interiors, forecast the June 30, 2019 Income Statement and Balance Sheet. | ||||||||

| Use the percent of Sales method and the following assumptions: | ||||||||

| (1) Sales in FY 2019 will be $761.20. | ||||||||

| (2) Tax rate will be 25%. | ||||||||

| (3) Each item that changes with sales will be the five-year average percentage of sales. | ||||||||

| (4) Gross Property, Plant & Equipment will increase to $675. | ||||||||

| (5) Addition to Gross PP&E will follow a straight-line depreciation (20 years with no salvage value). | ||||||||

| (6) Dividends in 2019 will be $0.80 per share. | ||||||||

| (7) Interest rate on all debt (short-term and long-term) is 4.0%. | ||||||||

| (8) Use Long-Term Debt as your plug-in figure in the Balance Sheet (please use 4 decimal places to show your answer). | ||||||||

| Use your judgement on other items. | ||||||||

| A. In cell H77 calculate the difference in Long-Term Debt between 2018 and 2019. | ||||||||

B. Interpret the amo unt in A above. Why are these funds needed or not needed in 2019? unt in A above. Why are these funds needed or not needed in 2019? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started