Answered step by step

Verified Expert Solution

Question

1 Approved Answer

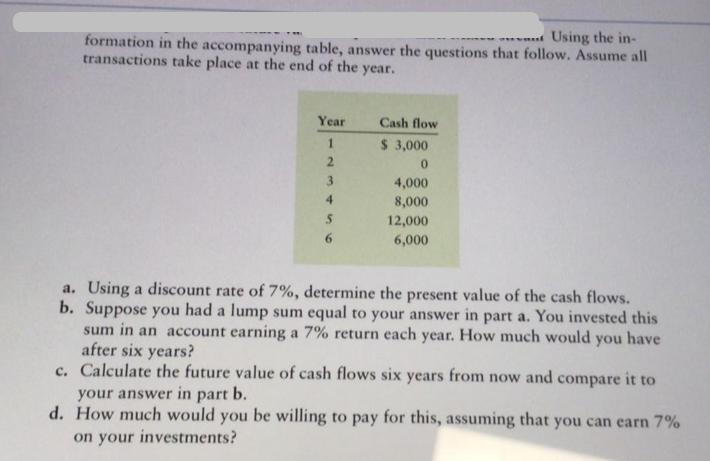

Using the in- formation in the accompanying table, answer the questions that follow. Assume all transactions take place at the end of the year.

Using the in- formation in the accompanying table, answer the questions that follow. Assume all transactions take place at the end of the year. Year 1 2 3 5 Cash flow $ 3,000 0 4,000 8,000 12,000 6,000 a. Using a discount rate of 7%, determine the present value of the cash flows. b. Suppose you had a lump sum equal to your answer in part a. You invested this sum in an account earning a 7% return each year. How much would you have after six years? c. Calculate the future value of cash flows six years from now and compare it to your answer in part b. d. How much would you be willing to pay for this, assuming that you can earn 7% on your investments?

Step by Step Solution

★★★★★

3.44 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the present value of the cash flows we need to discount each cash flow to its present value using the given discount rate of 7 The present value PV of each cash flow can be calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started