Answered step by step

Verified Expert Solution

Question

1 Approved Answer

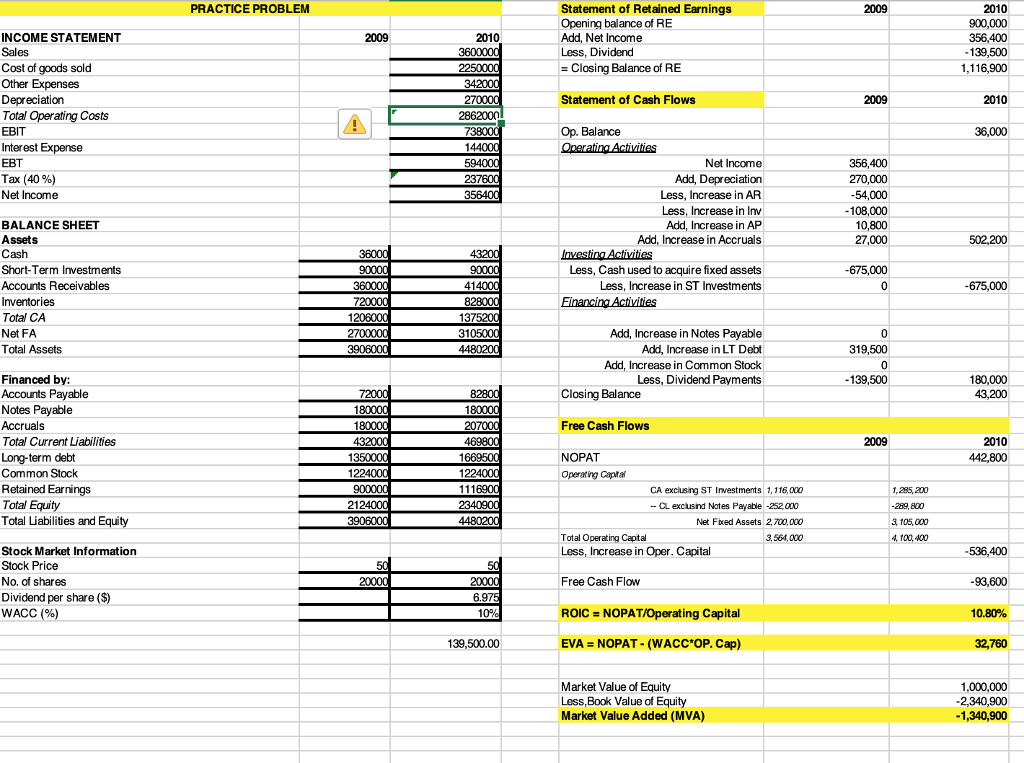

Using the info in the example below, please explain how to get the 2009 & 2010 numbers in the Statement of Retained Returns, Statement of

Using the info in the example below, please explain how to get the 2009 & 2010 numbers in the Statement of Retained Returns, Statement of Cash Flows, Free Cash Flows, ROIC, EVA and MVA.

PRACTICE PROBLEM Statement of Retained Earnings Opening balance of RE Add, Net Income Less, Dividend = Closing Balance of RE 2009 900,000 INCOME STATEMENT Sales Cost of goods sold Other Expenses Depreciation Total Operating Costs EBIT Interest Expense 2009 2010 139,500 1,116,900 34 Statement of Cash Flows 2010 Op. Balance 36,000 14400 59400 Net Income Add, Depreciation Less, Increase in AR Less, Increase in Inv Add, Increase in AP Add, Increase in Accruals 356,400 270,000 54,000 108,000 10,800 27,000 ax Net Income BALANCE SHEET Assets Cash Short-Term Investments Accounts Receivables Inventories Total CA Net FA Total Assets 675,000 Less, Cash used to acquire fixed assets Less, Increase in ST Investments -675,000 120600 310500 Add, Increase in Notes Payable Add, Increase in LT Debt Add, Increase in Common Stock Less, Dividend Payments 319,500 Financed by: Notes Payable Total Current Liabilities 139,500 180,000 Closing Balance 180000 180000 Free Cash Flows 442,800 NOPAT Operaning Capa Common Stock Retained Earnings Total Equity Total Liabilities and Equity 122400 122400 111690 CA exclus ng STInestments 1,116,000 1,285, 200 289,800 3, 105,000 100, 400 - CL exclusind Notes Payable -252 000 Net Fxed Assets 2, 700, 000 Total Operating Captal Less, Increase in Oper. Capital 3,564,000 Stock Market Information Stock Price No. of shares Dividend per share ($) WACC (96) 536,400 93,600 10.80% 32,760 Free Cash Flow ROIC NOPAT/Operating Capital 139,500.00 EVA NOPAT- (WACC OP. Cap) Market Value of Equity Less,Book Value of Equity Market Value Added (MVA) 1,000,000 900 -1,340,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started