Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the information and the template for journal entries below, prepare the adjusting journal entries for the following transactions. No explanations are required. 1) On

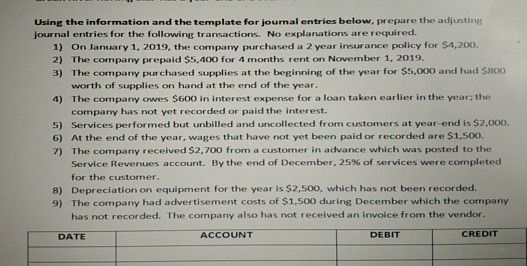

Using the information and the template for journal entries below, prepare the adjusting journal entries for the following transactions. No explanations are required. 1) On January 1, 2019, the company purchased a 2 year insurance policy for $4,200. 2) The company prepaid $5,000 for 4 months rent on November 1, 2019. 3) The company purchased supplies at the beginning of the year for $5,000 and had $800 worth of supplies on hand at the end of the year. 4) The company owes $600 in interest expense for a loan taken earlier in the year; the company has not yet recorded or paid the interest. 5) Services performed but unbilled and uncollected from customers at year end is $2,000. 6) At the end of the year, wages that have not yet been paid or recorded are $1,500. 7) The company received $2.700 from a customer in advance which was posted to the Service Revenues account. By the end of December, 25% of services were completed for the customer. 8) Depreciation on equipment for the year is $2,500, which has not been recorded. 9) The company had advertisement costs of $1,500 during December which the company has not recorded. The company also has not received an invoice from the vendor. DATE ACCOUNT DEBIT CREDIT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started