Question

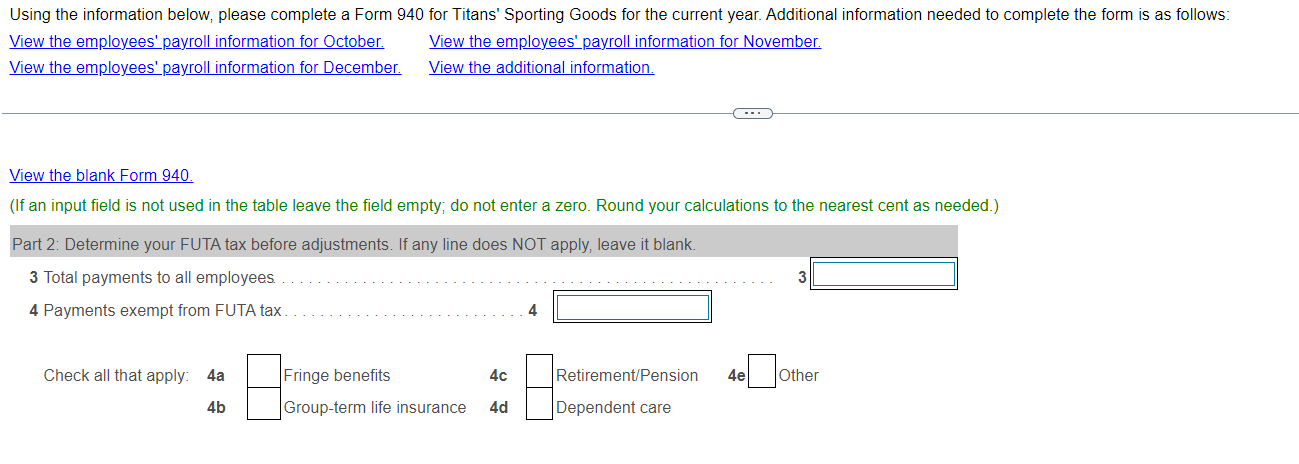

Using the information below, please complete a Form 940 for Titans' Sporting Goods for the current year. Additional information needed to complete the form is

Using the information below, please complete a Form 940 for Titans' Sporting Goods for the current year. Additional information needed to complete the form is as follows:

October

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Lillian Park | $2,850 | $138,700 | $176.70 | $41.33 | $534.00 |

| William Long | 3,460 | 39,700 | 214.52 | 50.17 | 422.00 |

| Tom Waxman | 3,700 | 43,850 | 229.40 | 53.65 | 534.00 |

| $10,010 | $222,250 | $620.62 | $145.15 | $1,490.00 | |

November

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Lillian Park | $2,980 | $141,680 | $184.76 | $43.21 | $603.00 |

| William Long | 4,000 | 43,700 | 248.00 | 58.00 | 469.00 |

| Tom Waxman | 3,760 | 47,610 | 233.12 | 54.52 | 561.00 |

| $10,740 | $232,990 | $665.88 | $155.73 | $1,633.00 | |

December

|

|

|

| FICA |

| |

| Employee | Monthly Earnings | YTD Earnings | Social Security | Medicare | Federal Income Tax |

| Lillian Park | $4,200 | $145,880 | $69.44 | $60.90 | $868.00 |

| William Long | 3,860 | 47,560 | 239.32 | 55.97 | 478.00 |

| Tom Waxman | 4,420 | 52,030 | 274.04 | 64.09 | 706.00 |

| $12,480 | $245,470 | $582.80 | $180.96 | $2,052.00 | |

| a. | State reporting number: 025-319-2 |

| b. | No FUTA tax deposits were made for this year. |

| c. | Titans' three employees for the year all earned over $7,000. |

(Assume that none of the FUTA wages paid were excluded from state unemployment tax and that no credit reduction applies.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started