Using the information for the new company of Faulkner and Montgomery CPAs for January 2020, completing the company's first accounting cycle for January 2020, the traditional accounting worksheet, and prepare January 31, 2020, financial Statements in proper form.

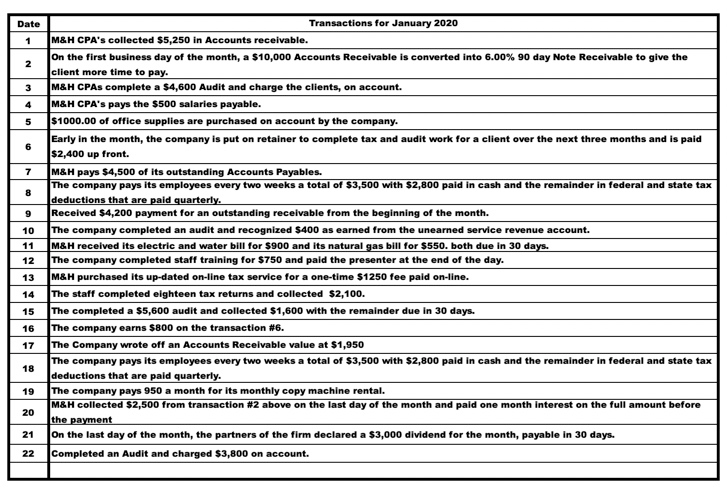

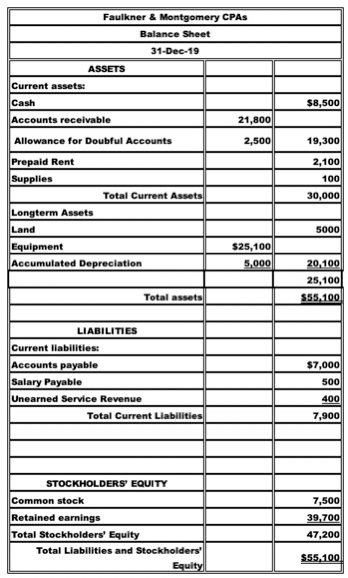

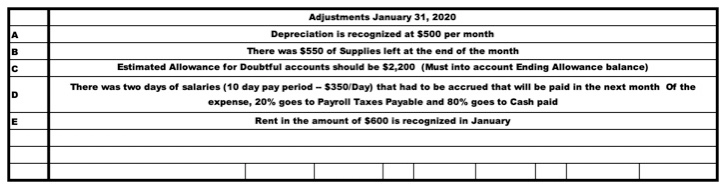

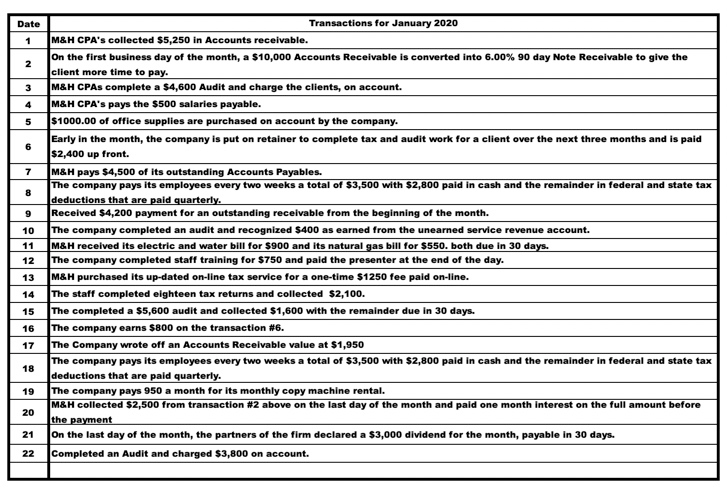

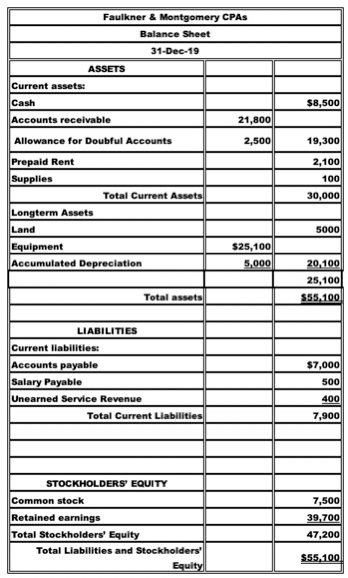

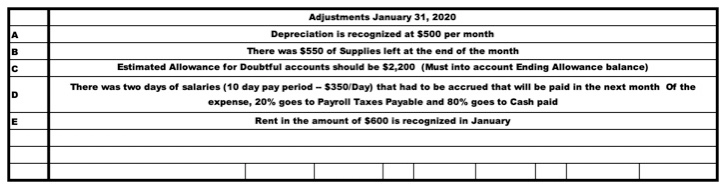

Date 1 2 3 4 5 6 7 8 9 10 11 Transactions for January 2020 M&H CPA's collected $5,250 in Accounts receivable. On the first business day of the month, a $10,000 Accounts Receivable is converted into 6.00% 90 day Note Receivable to give the client more time to pay. M&H CPAs complete a $4,600 Audit and charge the clients, on account. M&H CPA's pays the $500 salaries payable. $1000.00 of office supplies are purchased on account by the company. Early in the month, the company is put on retainer to complete tax and audit work for a client over the next three months and is paid $2,400 up front. M&H pays $4,500 of its outstanding Accounts Payables. The company pays its employees every two weeks a total of $3,500 with $2,800 paid in cash and the remainder in federal and state tax deductions that are paid quarterly. Received $4,200 payment for an outstanding receivable from the beginning of the month. The company completed an audit and recognized $400 as earned from the unearned service revenue account. M&H received its electric and water bill for $900 and its natural gas bill for $550. both due in 30 days. The company completed staff training for $750 and paid the presenter at the end of the day. M&H purchased its up-dated on-line tax service for a one-time $1250 fee paid on-line. The staff completed eighteen tax returns and collected $2,100. The completed a $5,600 audit and collected $1,600 with the remainder due in 30 days. The company earns $800 on the transaction #6. The Company wrote off an Accounts Receivable value at $1,950 The company pays its employees every two weeks a total of $3,500 with $2,800 paid in cash and the remainder in federal and state tax deductions that are paid quarterly. The company pays 950 a month for its monthly copy machine rental. M&H collected $2,500 from transaction #2 above on the last day of the month and paid one month interest on the full amount before the payment on the last day of the month, the partners of the firm declared a $3,000 dividend for the month, payable in 30 days. Completed an Audit and charged $3,800 on account. WINE 14 15 16 17 18 19 20 21 22 Faulkner & Montgomery CPAS Balance Sheet 31-Dec-19 ASSETS $8,500 21,800 2,500 19,300 Current assets: Cash Accounts receivable Allowance for Doubful Accounts Prepaid Rent Supplies Total Current Assets Longterm Assets Land Equipment Accumulated Depreciation 2,100 100 30,000 5000 $25,100 5,000 20,100 25,100 $55.100) Total assets $7,000 LIABILITIES Current liabilities: Accounts payable Salary Payable Unearned Service Revenue Total Current Liabilities 500 400 7,900 7,500 39,700 STOCKHOLDERS' EQUITY Common stock Retained earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 47,200 $55,100 B Adjustments January 31, 2020 Depreciation is recognized at $500 per month There was $550 of Supplies left at the end of the month Estimated Allowance for Doubtful accounts should be $2,200 (Must into account Ending Allowance balance) There was two days of salaries (10 day pay period - $350/Day) that had to be accrued that will be paid in the next month of the expense, 20% goes to Payroll Taxes Payable and 80% goes to Cash paid Rent in the amount of $600 is recognized in January D E Date 1 2 3 4 5 6 7 8 9 10 11 Transactions for January 2020 M&H CPA's collected $5,250 in Accounts receivable. On the first business day of the month, a $10,000 Accounts Receivable is converted into 6.00% 90 day Note Receivable to give the client more time to pay. M&H CPAs complete a $4,600 Audit and charge the clients, on account. M&H CPA's pays the $500 salaries payable. $1000.00 of office supplies are purchased on account by the company. Early in the month, the company is put on retainer to complete tax and audit work for a client over the next three months and is paid $2,400 up front. M&H pays $4,500 of its outstanding Accounts Payables. The company pays its employees every two weeks a total of $3,500 with $2,800 paid in cash and the remainder in federal and state tax deductions that are paid quarterly. Received $4,200 payment for an outstanding receivable from the beginning of the month. The company completed an audit and recognized $400 as earned from the unearned service revenue account. M&H received its electric and water bill for $900 and its natural gas bill for $550. both due in 30 days. The company completed staff training for $750 and paid the presenter at the end of the day. M&H purchased its up-dated on-line tax service for a one-time $1250 fee paid on-line. The staff completed eighteen tax returns and collected $2,100. The completed a $5,600 audit and collected $1,600 with the remainder due in 30 days. The company earns $800 on the transaction #6. The Company wrote off an Accounts Receivable value at $1,950 The company pays its employees every two weeks a total of $3,500 with $2,800 paid in cash and the remainder in federal and state tax deductions that are paid quarterly. The company pays 950 a month for its monthly copy machine rental. M&H collected $2,500 from transaction #2 above on the last day of the month and paid one month interest on the full amount before the payment on the last day of the month, the partners of the firm declared a $3,000 dividend for the month, payable in 30 days. Completed an Audit and charged $3,800 on account. WINE 14 15 16 17 18 19 20 21 22 Faulkner & Montgomery CPAS Balance Sheet 31-Dec-19 ASSETS $8,500 21,800 2,500 19,300 Current assets: Cash Accounts receivable Allowance for Doubful Accounts Prepaid Rent Supplies Total Current Assets Longterm Assets Land Equipment Accumulated Depreciation 2,100 100 30,000 5000 $25,100 5,000 20,100 25,100 $55.100) Total assets $7,000 LIABILITIES Current liabilities: Accounts payable Salary Payable Unearned Service Revenue Total Current Liabilities 500 400 7,900 7,500 39,700 STOCKHOLDERS' EQUITY Common stock Retained earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 47,200 $55,100 B Adjustments January 31, 2020 Depreciation is recognized at $500 per month There was $550 of Supplies left at the end of the month Estimated Allowance for Doubtful accounts should be $2,200 (Must into account Ending Allowance balance) There was two days of salaries (10 day pay period - $350/Day) that had to be accrued that will be paid in the next month of the expense, 20% goes to Payroll Taxes Payable and 80% goes to Cash paid Rent in the amount of $600 is recognized in January D E