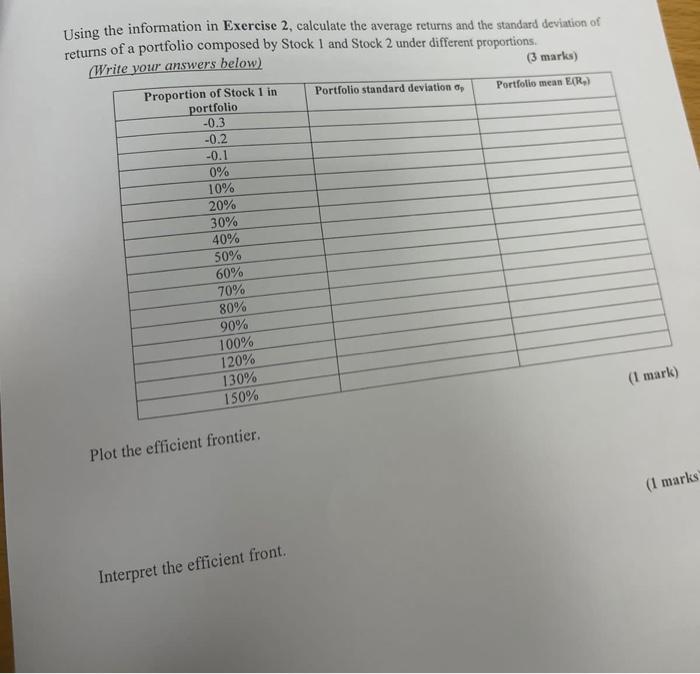

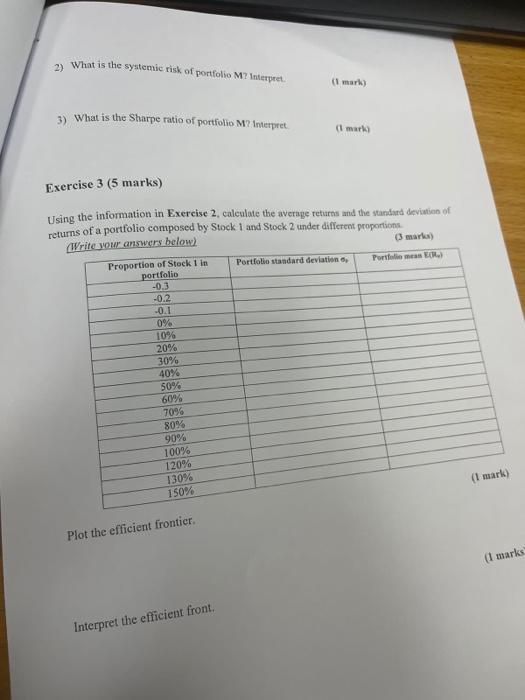

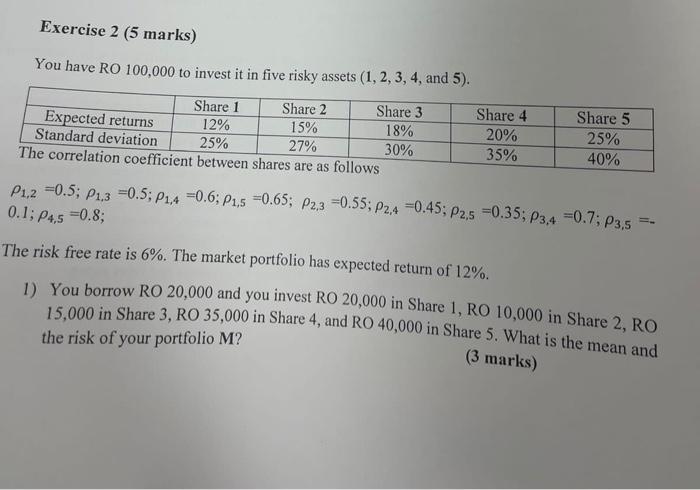

Using the information in Exercise 2, calculate the average returns and the standard deviation of returns of a portfolio composed by Stock 1 and Stock 2 under different proportions. (H. Han un answers below) (3 marks) Plot the efficient frontier. Interpret the efficient front. 3) What is the Sharpe ratio of portfolio M? interpret (t mark) Exercise 3 (5 marks) Using the information in Exercise 2, caleulate the average returns and the standard deviation of retums of a portfolio composed by Stock 1 and Stock 2 under different proportions. (We-ita wn answers below). (3 marks) Plot the efficient frontier. Interpret the efficient front. You have RO 100,000 to invest it in five risky assets (1,2,3,4, and 5). 1,2=0.5;1,3=0.5;1,4=0.6;1,5=0.65;2,3=0.55;2,4=0.45;2,5=0.35;3,4=0.7;3,5=0.1;4,5=0.8; The risk free rate is 6%. The market portfolio has expected return of 12%. 1) You borrow RO 20,000 and you invest RO 20,000 in Share 1, RO 10,000 in Share 2, RO 15,000 in Share 3, RO 35,000 in Share 4, and RO 40,000 in Share 5. What is the mean and the risk of your portfolio M ? (3 marks) Using the information in Exercise 2, calculate the average returns and the standard deviation of returns of a portfolio composed by Stock 1 and Stock 2 under different proportions. (H. Han un answers below) (3 marks) Plot the efficient frontier. Interpret the efficient front. 3) What is the Sharpe ratio of portfolio M? interpret (t mark) Exercise 3 (5 marks) Using the information in Exercise 2, caleulate the average returns and the standard deviation of retums of a portfolio composed by Stock 1 and Stock 2 under different proportions. (We-ita wn answers below). (3 marks) Plot the efficient frontier. Interpret the efficient front. You have RO 100,000 to invest it in five risky assets (1,2,3,4, and 5). 1,2=0.5;1,3=0.5;1,4=0.6;1,5=0.65;2,3=0.55;2,4=0.45;2,5=0.35;3,4=0.7;3,5=0.1;4,5=0.8; The risk free rate is 6%. The market portfolio has expected return of 12%. 1) You borrow RO 20,000 and you invest RO 20,000 in Share 1, RO 10,000 in Share 2, RO 15,000 in Share 3, RO 35,000 in Share 4, and RO 40,000 in Share 5. What is the mean and the risk of your portfolio M