28. Consider the following annual returns produced by a MiniFund, a mutual fund investing in small stocks:

Question:

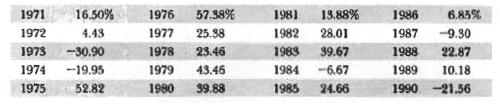

28. Consider the following annual returns produced by a MiniFund, a mutual fund investing in small stocks:

Referring to Table 1.1, use the Treasury bill returns as the riskfree return and the common stock returns as the market return, and calculate the following risk-adjusted return measures for the small stock mutual fund:

a. Ex postalpha

b. Reward-to-volatility ratio

c. Reward-to-variability ratio Comment on the mutual fund's risk-adjusted performance. What problems are associated with using a large capitalization index such as the S&P 500 (the source of the common stock returns) as the benchmark in evaluating this small company mutual fund?

Step by Step Answer:

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey