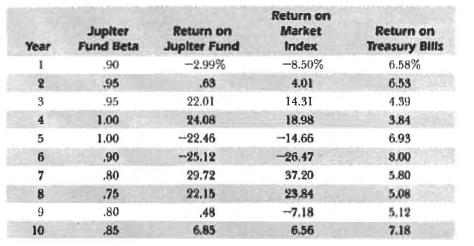

27. You are given the following historical performance information on the capital markets and the jupiter Fund,

Question:

27. You are given the following historical performance information on the capital markets and the jupiter Fund, a common stock mutual fund.

a. Compute the Jupiter Fund's average beta over the ten-year period. What investment percentages in the market index and Treasury bills are required in order to produce a beta equal to the fund's average beta?

b. Compute the year-by-year returns that would have been earned on a portfolio invested in the market index and Treasury bills in the proportions calculated in part (a).

c. Compute the year-by-year returns that would have been earned on a portfolio invested in the market index and Treasury bills in the proportions needed to matchJupiter'S beta year by year. (Note: These proportions will change yearly as the fund's beta changes yearly.)

d. One measure of a fund's market timing ability is the average difference between (1) what the fund would have earned annually by investing in the market index and Treasury bills so that the year-by-year beta equals the fund's actual year-by-year beta and (2) what the fund would have earned annually by investing in the market index and Treasury bills so that the year-by-year beta equals the fund's average beta. Given your previous calculations, evaluate the market timing ability ofJupiter's manager.

e. One measure of a fund's security selection ability is the average difference between (1) the fund's annual returns and (2) what the fund would have earned annually by investing in the market index and Treasury bills so that the year-by-year beta equals the fund's actual year-by-year beta. CalculateJupiter's average return and then, using your previous calculations, evaluate the security selection ability ofJupiter's manager.

Step by Step Answer:

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey