Using the information in photo 1 and photo 2, please help answer the following question:

photo 2

question

Thank you in advance for all the help - i guarantee a to whoever answers this question.

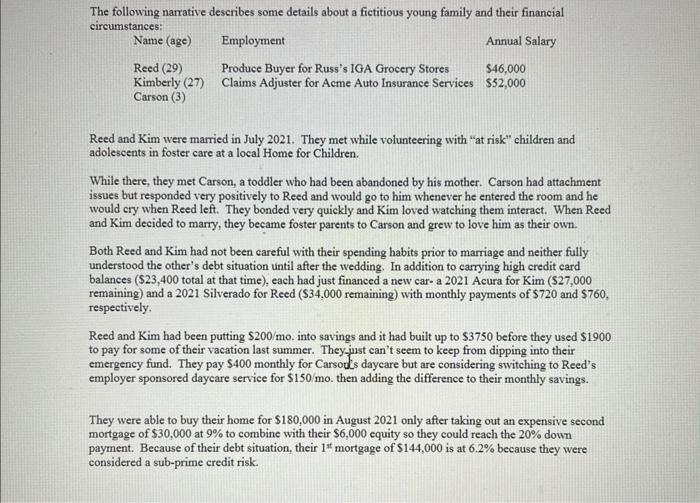

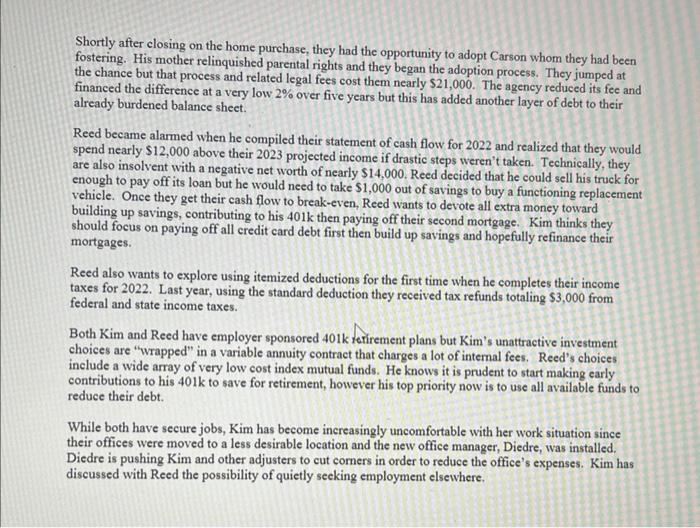

The following narrative describes some details about a fictitious young family and their financial cir Reed and Kim were married in July 2021. They met while volunteering with "at risk" children and adolescents in foster care at a local Home for Children. While there, they met Carson, a toddler who had been abandoned by his mother. Carson had attachment issues but responded very positively to Reed and would go to him whenever he entered the room and he would cry when Reed left. They bonded very quickly and Kim loved watching them interact. When Reed and Kim decided to marry, they became foster parents to Carson and grew to love him as their own. Both Reed and Kim had not been careful with their spending habits prior to marriage and neither fully understood the other's debt situation until after the wedding. In addition to carrying high credit card balances ( $23,400 total at that time), each had just financed a new car- a 2021 Acura for Kim ( $27,000 remaining) and a 2021 Silverado for Reed ( $34,000 remaining) with monthly payments of $720 and $760, respectively. Reed and Kim had been putting $200/mo. into savings and it had built up to $3750 before they used $1900 to pay for some of their vacation last summer. They -iust can't seem to keep from dipping into their emergency fund. They pay $400 monthly for Carsodls daycare but are considering switching to Reed's employer sponsored daycare service for $150/mo. then adding the difference to their monthly savings. They were able to buy their home for $180,000 in August 2021 only after taking out an expensive second mortgage of $30,000 at 9% to combine with their $6,000 equity so they could reach the 20% down payment. Because of their debt situation, their 1 It mortgage of $144,000 is at 6.2% because they were considered a sub-prime credit risk. Shortly after closing on the home purchase, they had the opportunity to adopt Carson whom they had been fostering. His mother relinquished parental rights and they began the adoption process. They jumped at the chance but that process and related legal fees cost them nearly $21,000. The agency reduced its fee and financed the difference at a very low 2% over five years but this has added another layer of debt to their already burdened balance sheet. Reed became alarmed when he compiled their statement of cash flow for 2022 and realized that they would spend nearly $12,000 above their 2023 projected income if drastic steps weren't taken. Technically, they are also insolvent with a negative net worth of nearly $14,000. Reed decided that he could sell his truck for enough to pay off its loan but he would need to take $1,000 out of savings to buy a functioning replacement vehicle. Once they get their cash flow to break-even, Reed wants to devote all extra money toward building up savings, contributing to his 401k then paying off their second mortgage. Kim thinks they should focus on paying off all credit card debt first then build up savings and hopefully refinance their mortgages. Reed also wants to explore using itemized deductions for the first time when he completes their income taxes for 2022. Last year, using the standard deduction they received tax refunds totaling $3,000 from federal and state income taxes. Both Kim and Reed have employer sponsored 401k terirement plans but Kim's unattractive investment choices are "wrapped" in a variable annuity contract that charges a lot of internal fees. Reed's choices include a wide array of very low cost index mutual funds. He knows it is prudent to start making early contributions to his 401k to save for retirement, however his top priority now is to use all available funds to reduce their debt. While both have secure jobs, Kim has become increasingly uncomfortable with her work situation since their offices were moved to a less desirable location and the new office manager, Diedre, was installed. Diedre is pushing Kim and other adjusters to cut corners in order to reduce the office's expenses. Kim has discussed with Reed the possibility of quietly seeking employment elsewhere. How much in truck-related monthly savings will they realize of Reed goes through with selling his truck? Based on their financial statements, what other areas are fertile ground for cutting back in order to get annual expenses below $98,000 ? The following narrative describes some details about a fictitious young family and their financial cir Reed and Kim were married in July 2021. They met while volunteering with "at risk" children and adolescents in foster care at a local Home for Children. While there, they met Carson, a toddler who had been abandoned by his mother. Carson had attachment issues but responded very positively to Reed and would go to him whenever he entered the room and he would cry when Reed left. They bonded very quickly and Kim loved watching them interact. When Reed and Kim decided to marry, they became foster parents to Carson and grew to love him as their own. Both Reed and Kim had not been careful with their spending habits prior to marriage and neither fully understood the other's debt situation until after the wedding. In addition to carrying high credit card balances ( $23,400 total at that time), each had just financed a new car- a 2021 Acura for Kim ( $27,000 remaining) and a 2021 Silverado for Reed ( $34,000 remaining) with monthly payments of $720 and $760, respectively. Reed and Kim had been putting $200/mo. into savings and it had built up to $3750 before they used $1900 to pay for some of their vacation last summer. They -iust can't seem to keep from dipping into their emergency fund. They pay $400 monthly for Carsodls daycare but are considering switching to Reed's employer sponsored daycare service for $150/mo. then adding the difference to their monthly savings. They were able to buy their home for $180,000 in August 2021 only after taking out an expensive second mortgage of $30,000 at 9% to combine with their $6,000 equity so they could reach the 20% down payment. Because of their debt situation, their 1 It mortgage of $144,000 is at 6.2% because they were considered a sub-prime credit risk. Shortly after closing on the home purchase, they had the opportunity to adopt Carson whom they had been fostering. His mother relinquished parental rights and they began the adoption process. They jumped at the chance but that process and related legal fees cost them nearly $21,000. The agency reduced its fee and financed the difference at a very low 2% over five years but this has added another layer of debt to their already burdened balance sheet. Reed became alarmed when he compiled their statement of cash flow for 2022 and realized that they would spend nearly $12,000 above their 2023 projected income if drastic steps weren't taken. Technically, they are also insolvent with a negative net worth of nearly $14,000. Reed decided that he could sell his truck for enough to pay off its loan but he would need to take $1,000 out of savings to buy a functioning replacement vehicle. Once they get their cash flow to break-even, Reed wants to devote all extra money toward building up savings, contributing to his 401k then paying off their second mortgage. Kim thinks they should focus on paying off all credit card debt first then build up savings and hopefully refinance their mortgages. Reed also wants to explore using itemized deductions for the first time when he completes their income taxes for 2022. Last year, using the standard deduction they received tax refunds totaling $3,000 from federal and state income taxes. Both Kim and Reed have employer sponsored 401k terirement plans but Kim's unattractive investment choices are "wrapped" in a variable annuity contract that charges a lot of internal fees. Reed's choices include a wide array of very low cost index mutual funds. He knows it is prudent to start making early contributions to his 401k to save for retirement, however his top priority now is to use all available funds to reduce their debt. While both have secure jobs, Kim has become increasingly uncomfortable with her work situation since their offices were moved to a less desirable location and the new office manager, Diedre, was installed. Diedre is pushing Kim and other adjusters to cut corners in order to reduce the office's expenses. Kim has discussed with Reed the possibility of quietly seeking employment elsewhere. How much in truck-related monthly savings will they realize of Reed goes through with selling his truck? Based on their financial statements, what other areas are fertile ground for cutting back in order to get annual expenses below $98,000