Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the information in the following chart, and PE Multiples, what is the per - share intrinsic value of Firm A s equity? That is

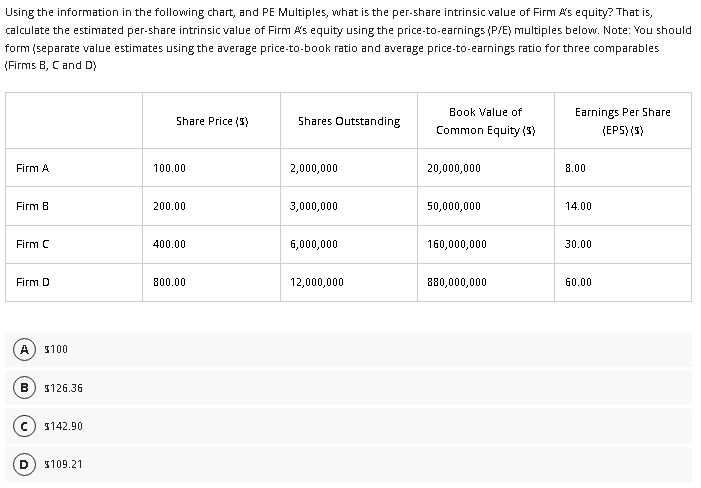

Using the information in the following chart, and PE Multiples, what is the pershare intrinsic value of Firm As equity? That is calculate the estimated pershare intrinsic value of Firm As equity using the pricetoearnings PE multiples below. Note: You should form separate value estimates using the average pricetobook ratio and average pricetoearnings ratio for three comparables Firms B C and D

Share Price $

Shares Outstanding

Book Value of Common Equity $

Earnings Per Share EPS$

Firm A

Firm B

Firm C

Firm D

$

$

$

$Using the information in the following chart, and PE Multiples, what is the pershare intrinsic value of Firm As equity? That is

calculate the estimated pershare intrinsic value of Firm equity using the pricetoearnings multiples below. Note: You should

form separate value estimates using the average pricetobook ratio and average pricetoearnings ratio for three comparables

Firms B C and D

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started