Question

Using the information in the pictures find the tax, child credit, and total tax using IF statements. The program is in C, please help input

Using the information in the pictures find the tax, child credit, and total tax using IF statements. The program is in C, please help input IF statements into this code under the TODO.

#include

#include

int main(int argc, char **argv) {

double agi = 0.0;

char c = 'N';

double tax = 0.0;

double childCredit = 0.0;

double totalTax = 0.0;

int numChildren = 0;

printf("Please enter your adjusted gross income (AGI): ");

scanf("%lf", &agi);

getchar();

printf("Do you have any children? (Y) or (N)? ");

c = getchar();

if(c == 'y' || c == 'Y') {

printf("How many children do you have? ");

scanf("%d", &numChildren);

}

//TODO: compute the tax, child credit, and total tax here

printf("AGI: $%10.2f ", agi);

printf("Tax: $%10.2f ", tax);

printf("Child Credit: $%10.2f ", childCredit);

printf("Total Tax: $%10.2f ", totalTax);

return 0;

}

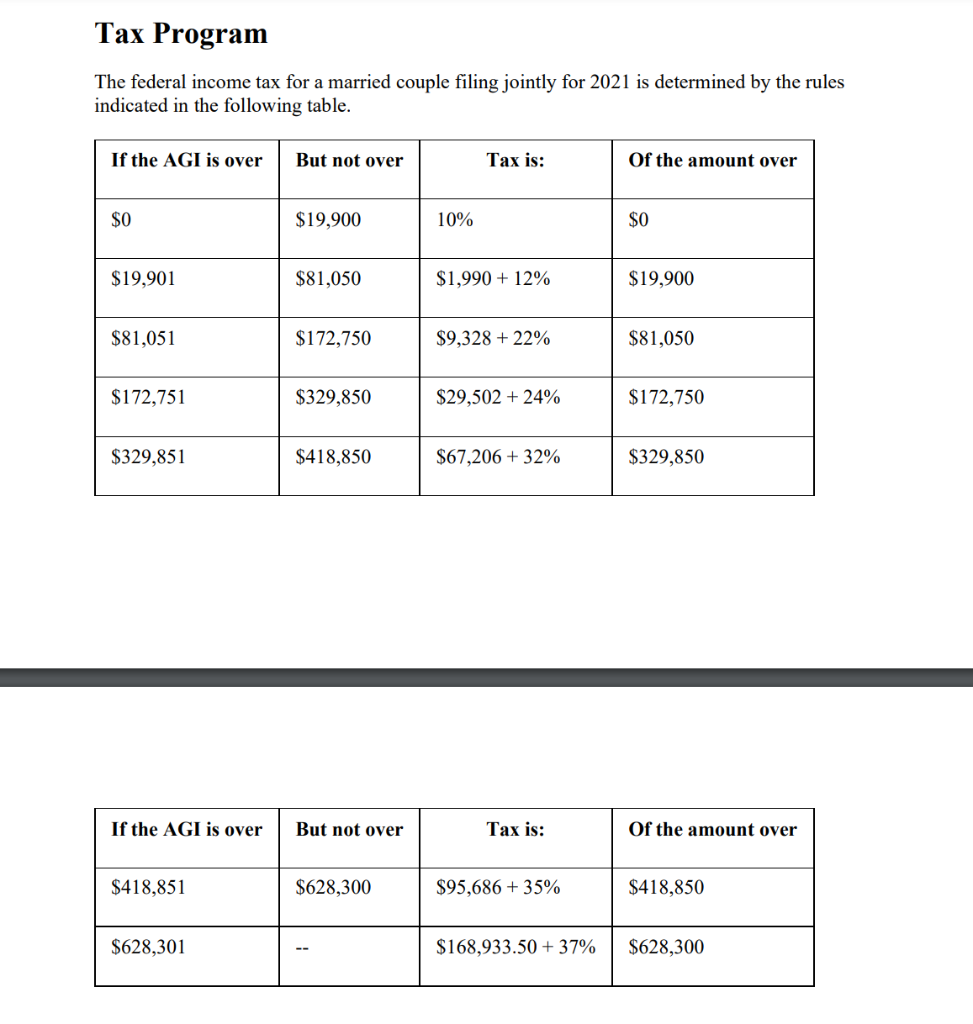

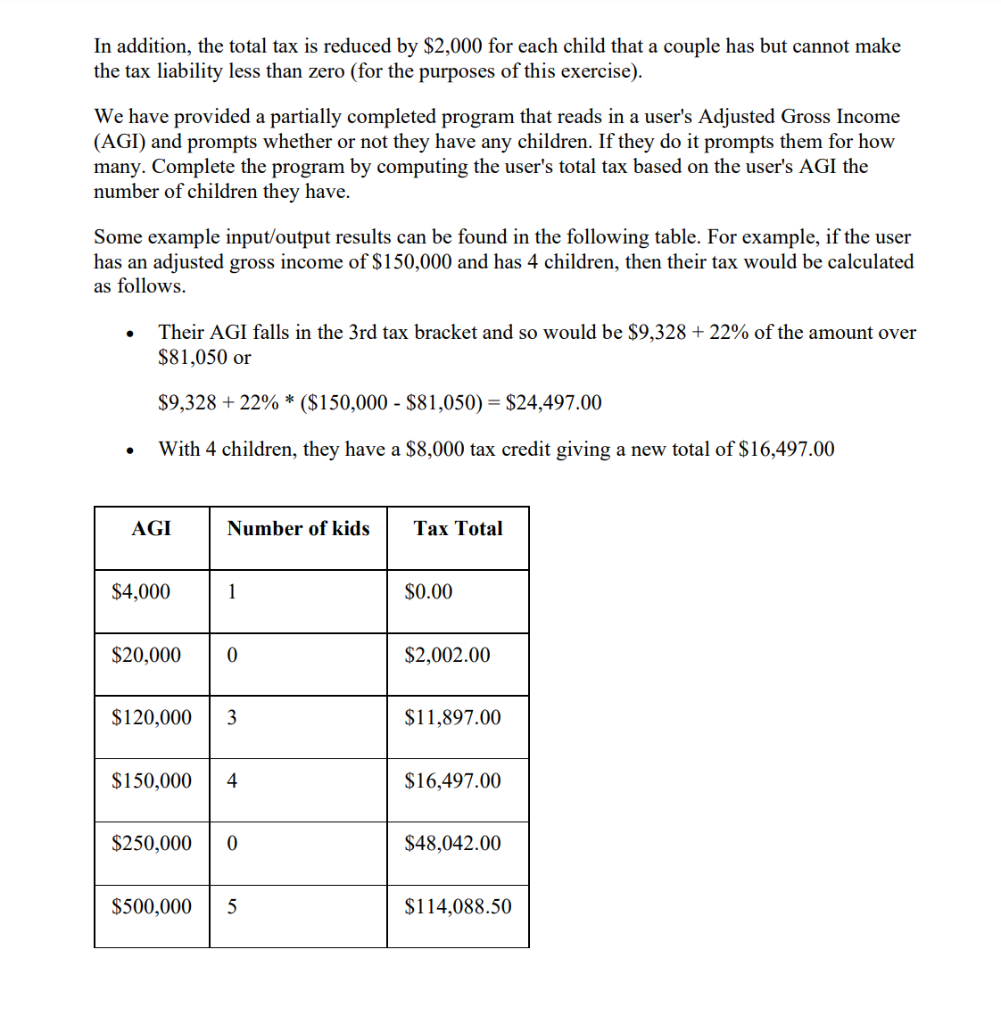

The federal income tax for a married couple filing jointly for 2021 is determined by the rules indicated in the following table. In addition, the total tax is reduced by $2,000 for each child that a couple has but cannot make the tax liability less than zero (for the purposes of this exercise). We have provided a partially completed program that reads in a user's Adjusted Gross Income (AGI) and prompts whether or not they have any children. If they do it prompts them for how many. Complete the program by computing the user's total tax based on the user's AGI the number of children they have. Some example input/output results can be found in the following table. For example, if the user has an adjusted gross income of $150,000 and has 4 children, then their tax would be calculated as follows. - Their AGI falls in the 3rd tax bracket and so would be $9,328+22% of the amount over $81,050 or $9,328+22%($150,000$81,050)=$24,497.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started