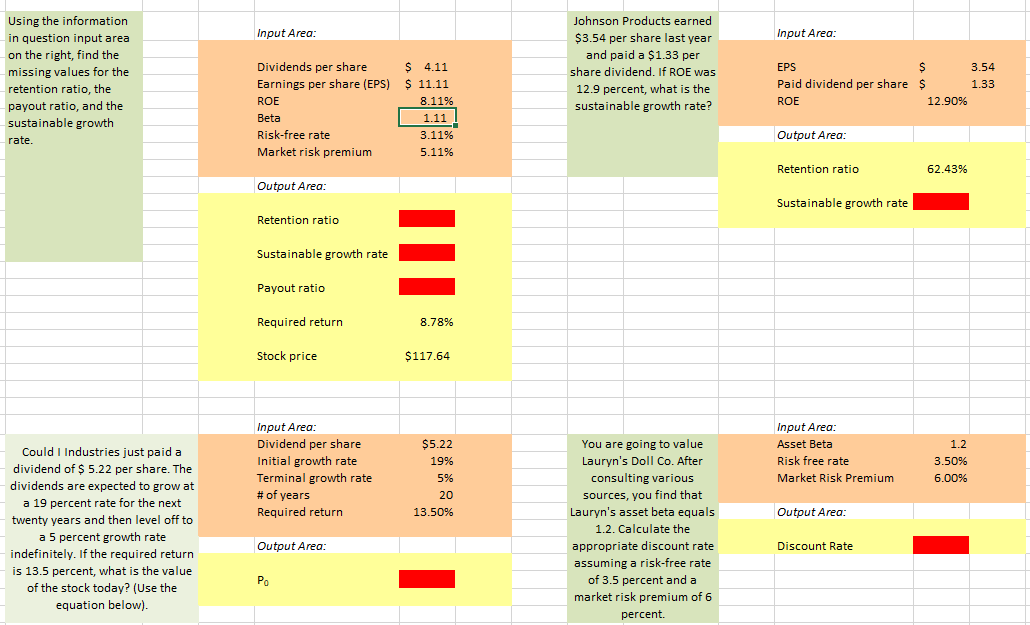

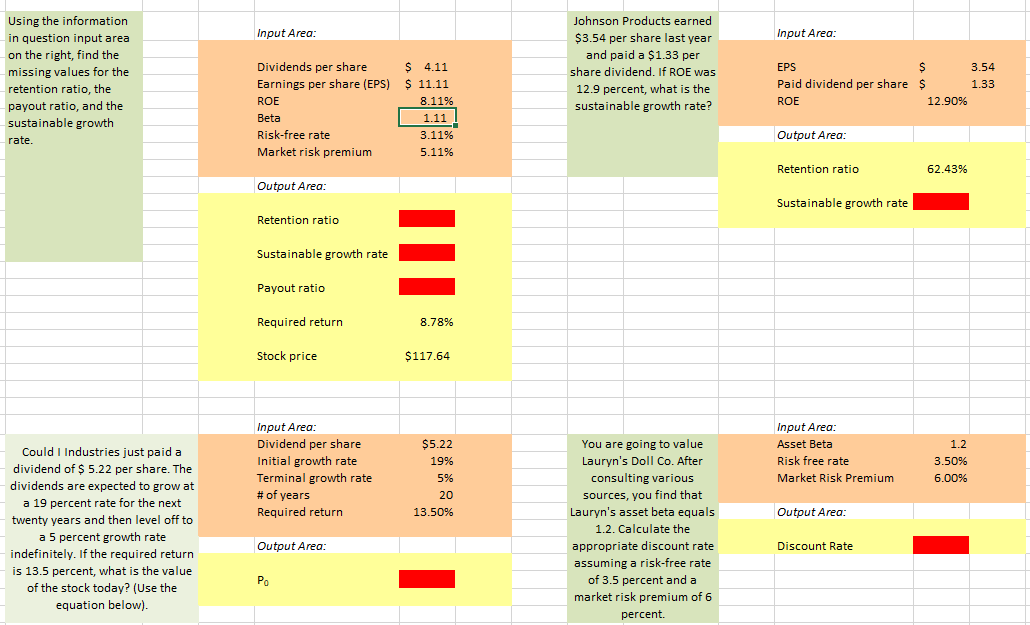

Using the information Input Area: Input Area: Johnson Products earned $3.54 per share last year and paid a $1.33 per share dividend. If ROE was in question input area on the right, find the missing values for the retention ratio, the payout ratio, and the sustainable growth rate Dividends per share $ 4.11 Earnings per share (EPS) $ 11.11 ROE 8.11% Beta 1.11 Risk-free rate 3.11% Market risk premium 5.11% EPS $ 3.54 Paid dividend per share $ 1.33 ROE 12.90% 12.9 percent, what is the sustainable growth rate? Output Area: Retention ratio 62.43% Output Area: Sustainable growth rate Retention ratio Sustainable growth rate Payout ratio Required return 8.78% Stock price $117.64 Input Area: Asset Beta $5.22 1.2. 19% Risk free rate 3.50% Input Area: Dividend per share Initial growth rate Terminal growth rate # of years Required return 5% Market Risk Premium 6.00% 20 13.50% Output Area: Could I Industries just paid a dividend of $ 5.22 per share. The dividends are expected to grow at a 19 percent rate for the next twenty years and then level off to a 5 percent growth rate indefinitely. If the required return is 13.5 percent, what is the value of the stock today? (Use the equation below). You are going to value Lauryn's Doll Co. After consulting various sources, you find that Lauryn's asset beta equals 1.2. Calculate the appropriate discount rate assuming a risk-free rate of 3.5 percent and a market risk premium of 6 percent. Output Area: Discount Rate Po Using the information Input Area: Input Area: Johnson Products earned $3.54 per share last year and paid a $1.33 per share dividend. If ROE was in question input area on the right, find the missing values for the retention ratio, the payout ratio, and the sustainable growth rate Dividends per share $ 4.11 Earnings per share (EPS) $ 11.11 ROE 8.11% Beta 1.11 Risk-free rate 3.11% Market risk premium 5.11% EPS $ 3.54 Paid dividend per share $ 1.33 ROE 12.90% 12.9 percent, what is the sustainable growth rate? Output Area: Retention ratio 62.43% Output Area: Sustainable growth rate Retention ratio Sustainable growth rate Payout ratio Required return 8.78% Stock price $117.64 Input Area: Asset Beta $5.22 1.2. 19% Risk free rate 3.50% Input Area: Dividend per share Initial growth rate Terminal growth rate # of years Required return 5% Market Risk Premium 6.00% 20 13.50% Output Area: Could I Industries just paid a dividend of $ 5.22 per share. The dividends are expected to grow at a 19 percent rate for the next twenty years and then level off to a 5 percent growth rate indefinitely. If the required return is 13.5 percent, what is the value of the stock today? (Use the equation below). You are going to value Lauryn's Doll Co. After consulting various sources, you find that Lauryn's asset beta equals 1.2. Calculate the appropriate discount rate assuming a risk-free rate of 3.5 percent and a market risk premium of 6 percent. Output Area: Discount Rate Po