Answered step by step

Verified Expert Solution

Question

1 Approved Answer

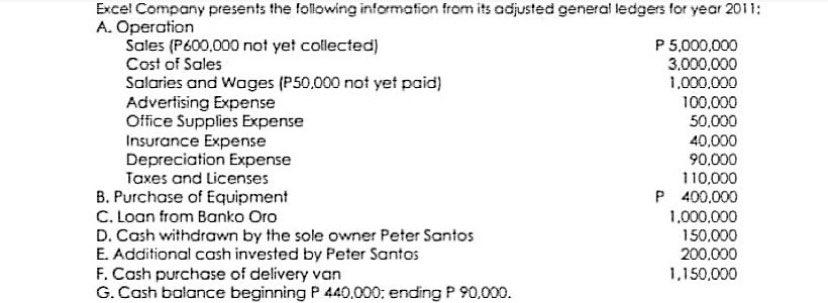

Using the information, prepare a Cash Flows Statement for Excel Company (indirect method). Excel Company presents the following information from its adjusted general ledgers for

Using the information, prepare a Cash Flows Statement for Excel Company (indirect method).

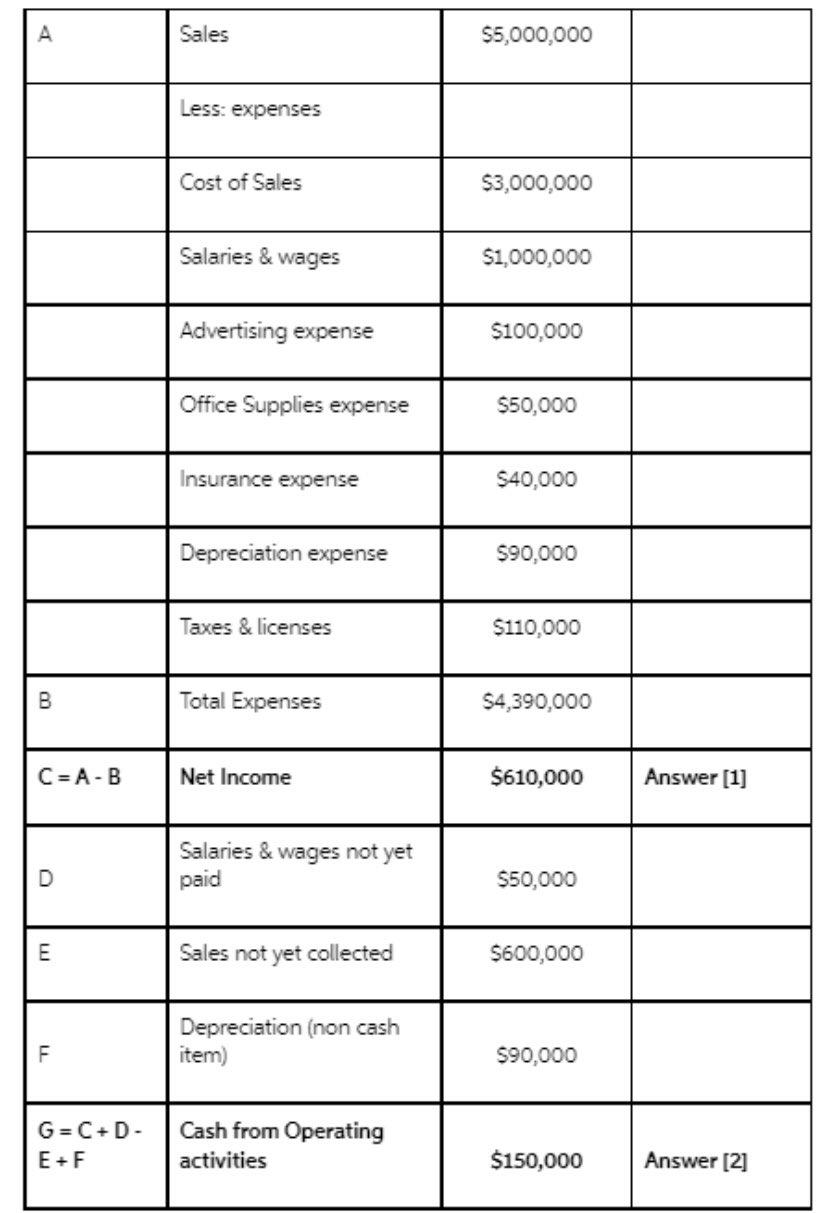

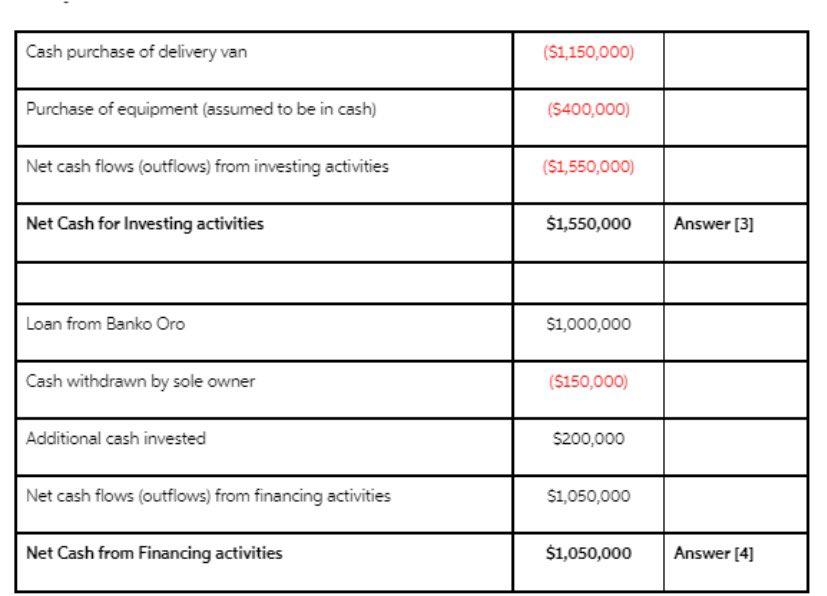

Excel Company presents the following information from its adjusted general ledgers for year 2011: A. Operation Sales (P600,000 not yet collected) P 5,000,000 Cost of Sales 3.000.000 Salaries and Wages (P50,000 not yet paid) 1.000.000 Advertising Expense 100.000 Office Supplies Expense 50,000 Insurance Expense 40.000 Depreciation Expense 90.000 Taxes and licenses 110.000 B. Purchase of Equipment P 400.000 C. Loan from Banko Oro 1,000,000 D. Cash withdrawn by the sole owner Peter Santos 150.000 E. Additional cash invested by Peter Santos 200.000 F. Cash purchase of delivery van 1,150,000 G. Cash balance beginning P 440,000: ending P 90,000. Sales $5,000,000 Less: expenses Cost of Sales $3,000,000 Salaries & wages $1,000,000 Advertising expense $100,000 Office Supplies expense $50,000 Insurance expense $40,000 Depreciation expense $90,000 Taxes & licenses $110,000 B Total Expenses $4,390,000 C=A-B Net Income $610,000 Answer [1] Salaries & wages not yet D paid $50,000 E Sales not yet collected $600,000 Depreciation (non cash item) F $90,000 G=C+D- E+F Cash from Operating activities $150,000 Answer [2] Cash purchase of delivery van ($1,150,000) Purchase of equipment (assumed to be in cash) ($400,000) Net cash flows (outflows) from investing activities ($1,550,000) Net Cash for Investing activities $1,550,000 Answer [3] Loan from Banko Oro $1,000,000 Cash withdrawn by sole owner ($150,000) Additional cash invested $200,000 Net cash flows (outfiows) from financing activities $1,050,000 Net Cash from Financing activities $1,050,000 Answer [4]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started