Answered step by step

Verified Expert Solution

Question

1 Approved Answer

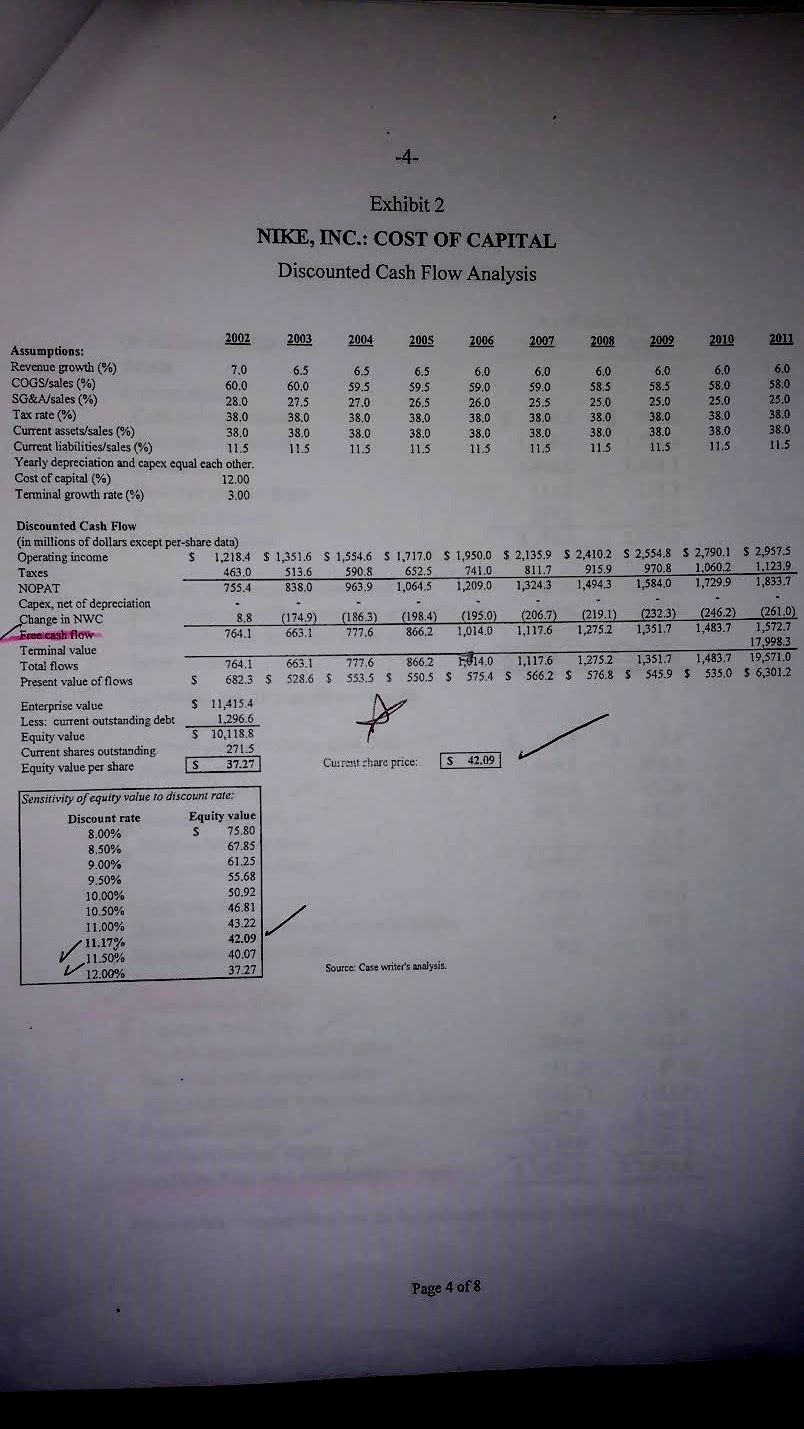

Using the information presented in exhibit 2 and my calculated WACC, estimate the stock price for Nike? Wd = 10.19% Rd(1-T) = 4.44% Wc= 100.00%

Using the information presented in exhibit 2 and my calculated WACC, estimate the stock price for Nike?

Wd = 10.19%

Rd(1-T) = 4.44%

Wc= 100.00% - Wd = 89.81%

Rs = 9.81%

WACC = 9.26%

That is part of the WACC = Wd(Rd)(1-T) + Ws(Rs)

That is part of the WACC = Wd(Rd)(1-T) + Ws(Rs)

-4 Exhibit 2 NIKE, INC.: COST OF CAPITAL Discounted Cash Flow Analysis 2 2002 2003 2004 2005 2006 200 200820092010 2011 Assumptions: Revenue growth (%) COGS/sales (%) SG&A/sales (%) Tax rate (%) Current assets/sales (%) Current liabilities/sales (%) Yearly depreciation and capex equal each other. Cost of capital (%) Terminal growth rate (%) 70 6.5 58.0 58.0 25.0 38.0 38.0 60,0 27.5 58.5 59.5 26.5 38.0 59.0 58.5 28.0 38.0 38.0 38.0 38.038.0 38.038.0 38.0 38.0 38.0 38.0 38.0 38.0 12.00 3.00 Discounted Cash Flow (in millions of dollars except per-share data) Operating income Taxes NOPAT Capex, net of depreciation 1,218.4 S 1,351.6 S 1,554.6 S 1,717.0 s 1,950.0 s 2,135.9 S 2410.2 s 2,554.8 S 2,790.1 S 2.9575 463,0- 513.6 590 8 652.5 741.0811 7 915.9 9708_1 0602- 1,123.9 7534 755.4 8380 55.4 838.0 963.9 1,064.5 1,209.0 1,324.3 1,494.3 1,584.01,729.9 1,833.7 9639 1,064.5 1,209.0 Capex 195.0 206.7 32.3) (246.2) (261.0) 174.9 663.1 186.3) (198.4) 777.6 866.2 1,014.0 1,117.6 12752 1,317 1,483.7 1,572.7 ge in NWC 764.1 Terminal value Total flows Present value of flows 17,998.3 4.0 1,117.6 1,2752 1,351.71,483.7 19,571.0 S 682.3 528.6 $53.3 550.5 5754 s s662 S 5768 s459 5350 s 6.3012 764.1663.1- 777.6-866.2314 0-1,117.6 1,2752 1,351.7 1,483,7 19,571,0 682.3 528.6 553.5 $ 550.5 S 575.4 5662 S 576.8 S 545.9 535.0 S 6,301.2 s 114154 S 11,415.4 Enterprise value Less: current outstanding debt Equity value Current shares outstanding Equity value per share 1.296.6 S 10,118.8 271.5 37.27 [342.09] Cusrent chare price S 42.09 Sensitivity of eguity value to discount rate Discount rate 8.00% 8.50% 9.00% 9.50% 10.00% 10.50% 11 .00% 11.17% 11 ,50% 12.00 % Equity value S 75.80 67.85 61.25 55.68 50.92 46.81 43.22 42.09 40.07 37.27 Source: Case writer's analysis Page 4 of8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started