using the information provided answer 1-25.

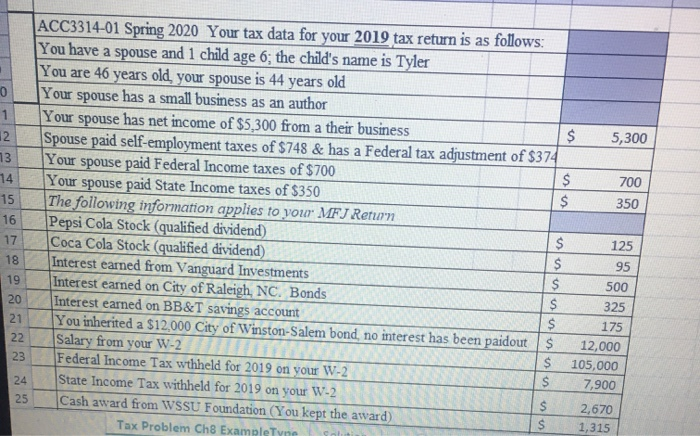

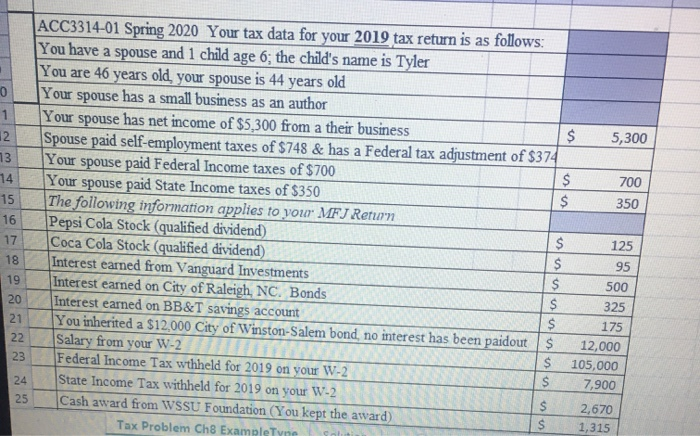

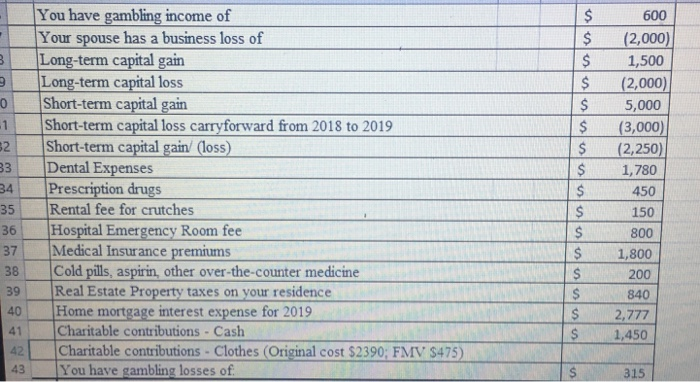

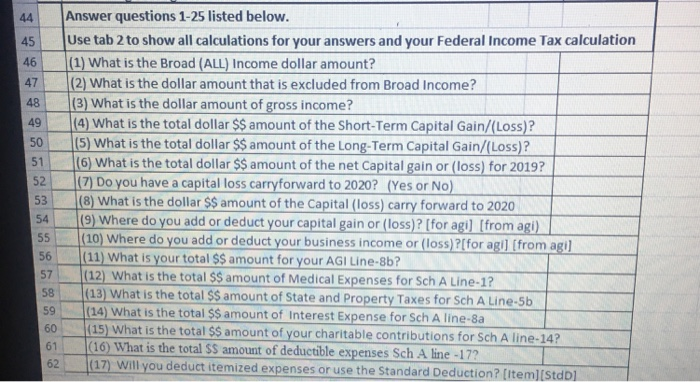

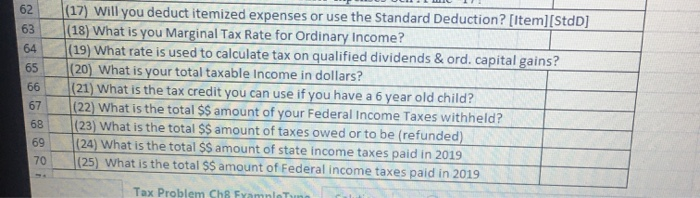

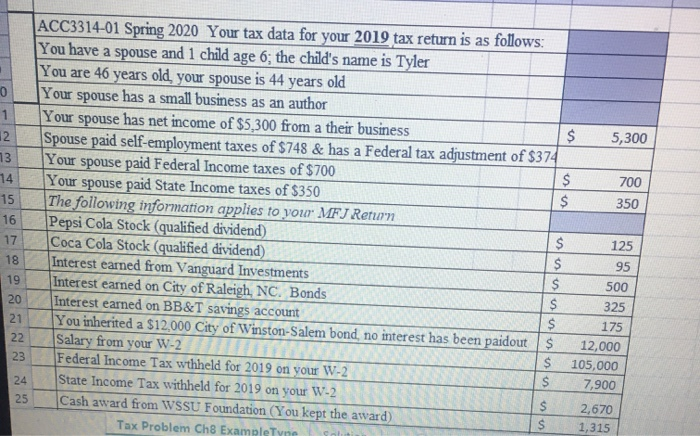

5,300 700 350 ACC3314-01 Spring 2020 Your tax data for your 2019 tax return is as follows: You have a spouse and 1 child age 6; the child's name is Tyler You are 46 years old, your spouse is 44 years old Your spouse has a small business as an author Your spouse has net income of $5,300 from a their business $ Spouse paid self-employment taxes of $748 & has a Federal tax adjustment of $374 Your spouse paid Federal Income taxes of $700 Your spouse paid State Income taxes of $350 The following information applies to your MFJ Return Pepsi Cola Stock (qualified dividend) Coca Cola Stock (qualified dividend) Interest earned from Vanguard Investments Interest earned on City of Raleigh NC. Bonds 20 Interest earned on BB&T savings account $ 21 You inherited a $12,000 City of Winston-Salem bond, no interest has been paidout $ 22 Salary from your W-2 TER $ 23 Federal Income Tax wthheld for 2019 on your W- 2 A S 24 State Income Tax withheld for 2019 on your W-2 Cash award from WSSU Foundation (You kept the award) $ Tay Problem Chama 125 95 500 325 175 12,000 105,000 7,900 1,315 $ $ $ $ NO You have gambling income of Your spouse has a business loss of Long-term capital gain Long-term capital loss Short-term capital gain Short-term capital loss carryforward from 2018 to 2019 Short-term capital gain (loss) Dental Expenses Prescription drugs Rental fee for crutches Hospital Emergency Room fee Medical Insurance premiums Cold pills, aspirin, other over-the-counter medicine Real Estate Property taxes on your residence Home mortgage interest expense for 2019 Charitable contributions - Cash Charitable contributions - Clothes (Original cost $2390; FMV $475) You have gambling losses of 600 (2,000) 1,500 (2,000) 5,000 (3,000) (2,250) 1,780 450 150 800 1,800 200 840 2,777 1,450 315 Answer questions 1-25 listed below. Use tab 2 to show all calculations for your answers and your Federal Income Tax calculation (1) What is the Broad (ALL) Income dollar amount? |(2) What is the dollar amount that is excluded from Broad Income? (3) What is the dollar amount of gross income? (4) What is the total dollar $$ amount of the Short-Term Capital Gain/(Loss)? (5) What is the total dollar $$ amount of the Long-Term Capital Gain/(Loss)? (6) What is the total dollar $$ amount of the net Capital gain or (loss) for 2019? (7) Do you have a capital loss carryforward to 2020? (Yes or No) (8) What is the dollar $$ amount of the Capital (loss) carry forward to 2020 (9) Where do you add or deduct your capital gain or loss)? (for agi) [from agi) (10) Where do you add or deduct your business income or (loss)?[for agi] [from agi] (11) What is your total $$ amount for your AGI Line-8b? (12) What is the total $$ amount of Medical Expenses for Sch A Line-1? (13) What is the total $$ amount of State and Property Taxes for Sch A Line-5b (14) What is the total $$ amount of Interest Expense for Sch A line-8a (15) What is the total $$ amount of your charitable contributions for Sch A line-14? (16) What is the total SS amount of deductible expenses Sch A line-17? 62 (17) Will you deduct itemized expenses or use the Standard Deduction? [item][Std] (17) Will you deduct itemized expenses or use the Standard Deduction? [item][StdD] (18) What is you Marginal Tax Rate for Ordinary Income? (19) What rate is used to calculate tax on qualified dividends & ord. capital gains? (20) What is your total taxable income in dollars? (21) What is the tax credit you can use if you have a 6 year old child? (22) What is the total $$ amount of your Federal Income Taxes withheld? (23) What is the total $$ amount of taxes owed or to be refunded) (24) What is the total $$ amount of state income taxes paid in 2019 (25) What is the total $$ amount of Federal income taxes paid in 2019 Tax Drobilam Cheswa 5,300 700 350 ACC3314-01 Spring 2020 Your tax data for your 2019 tax return is as follows: You have a spouse and 1 child age 6; the child's name is Tyler You are 46 years old, your spouse is 44 years old Your spouse has a small business as an author Your spouse has net income of $5,300 from a their business $ Spouse paid self-employment taxes of $748 & has a Federal tax adjustment of $374 Your spouse paid Federal Income taxes of $700 Your spouse paid State Income taxes of $350 The following information applies to your MFJ Return Pepsi Cola Stock (qualified dividend) Coca Cola Stock (qualified dividend) Interest earned from Vanguard Investments Interest earned on City of Raleigh NC. Bonds 20 Interest earned on BB&T savings account $ 21 You inherited a $12,000 City of Winston-Salem bond, no interest has been paidout $ 22 Salary from your W-2 TER $ 23 Federal Income Tax wthheld for 2019 on your W- 2 A S 24 State Income Tax withheld for 2019 on your W-2 Cash award from WSSU Foundation (You kept the award) $ Tay Problem Chama 125 95 500 325 175 12,000 105,000 7,900 1,315 $ $ $ $ NO You have gambling income of Your spouse has a business loss of Long-term capital gain Long-term capital loss Short-term capital gain Short-term capital loss carryforward from 2018 to 2019 Short-term capital gain (loss) Dental Expenses Prescription drugs Rental fee for crutches Hospital Emergency Room fee Medical Insurance premiums Cold pills, aspirin, other over-the-counter medicine Real Estate Property taxes on your residence Home mortgage interest expense for 2019 Charitable contributions - Cash Charitable contributions - Clothes (Original cost $2390; FMV $475) You have gambling losses of 600 (2,000) 1,500 (2,000) 5,000 (3,000) (2,250) 1,780 450 150 800 1,800 200 840 2,777 1,450 315 Answer questions 1-25 listed below. Use tab 2 to show all calculations for your answers and your Federal Income Tax calculation (1) What is the Broad (ALL) Income dollar amount? |(2) What is the dollar amount that is excluded from Broad Income? (3) What is the dollar amount of gross income? (4) What is the total dollar $$ amount of the Short-Term Capital Gain/(Loss)? (5) What is the total dollar $$ amount of the Long-Term Capital Gain/(Loss)? (6) What is the total dollar $$ amount of the net Capital gain or (loss) for 2019? (7) Do you have a capital loss carryforward to 2020? (Yes or No) (8) What is the dollar $$ amount of the Capital (loss) carry forward to 2020 (9) Where do you add or deduct your capital gain or loss)? (for agi) [from agi) (10) Where do you add or deduct your business income or (loss)?[for agi] [from agi] (11) What is your total $$ amount for your AGI Line-8b? (12) What is the total $$ amount of Medical Expenses for Sch A Line-1? (13) What is the total $$ amount of State and Property Taxes for Sch A Line-5b (14) What is the total $$ amount of Interest Expense for Sch A line-8a (15) What is the total $$ amount of your charitable contributions for Sch A line-14? (16) What is the total SS amount of deductible expenses Sch A line-17? 62 (17) Will you deduct itemized expenses or use the Standard Deduction? [item][Std] (17) Will you deduct itemized expenses or use the Standard Deduction? [item][StdD] (18) What is you Marginal Tax Rate for Ordinary Income? (19) What rate is used to calculate tax on qualified dividends & ord. capital gains? (20) What is your total taxable income in dollars? (21) What is the tax credit you can use if you have a 6 year old child? (22) What is the total $$ amount of your Federal Income Taxes withheld? (23) What is the total $$ amount of taxes owed or to be refunded) (24) What is the total $$ amount of state income taxes paid in 2019 (25) What is the total $$ amount of Federal income taxes paid in 2019 Tax Drobilam Cheswa