Question

Using the information provided, answer the following questions: Analyse Hamish's summary of relevant cash flows to identify the line items that you think should be

Using the information provided, answer the following questions:

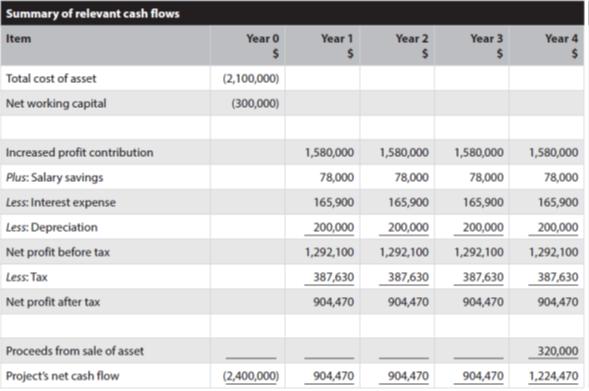

Analyse Hamish's summary of relevant cash flows to identify the line items that you think should be checked and/or corrected.

Using this analysis, create a revised incremental cash flow analysis.

Identify potential alternative methods for analysing the financial performance of the project. Indicate which of these would be appropriate if Vodafone Australia is not interested in the time value of money when making its capital budgeting decisions, and create another summary of relevant cash flows to illustrate additional analysis.

Identify the additional qualitative, quantitative and behavioural issues that may impact the decision to proceed with the investment.

Discuss and critically assess the implications of the board's stipulated minimum return of 18% on new projects.

Hamish Burrell has a business internship with Vodafone Australia during the summer university break, and you have been given the task of overseeing Hamish's work. You have decided that Hamish should construct a discounted cash flow model to analyse a new packaging system at the Reading (USA) plant.

As production has increased over recent years, the existing packaging system has struggled to cope. This is creating a bottleneck and has resulted in increased levels of work-in-progress and finished goods inventories on hand. Overall, Vodafone Australia expects the new system to improve the Reading plant's delivery capacity. This would improve the profit contribution by $1,580,000 per annum. Other changes (not included in profit contribution) include annual salary savings of $78,000 and an immediate $300,000 reduction in inventories.

The purchase price of the assembly system is $2,000,000 and it will cost $100,000 to install. The entire cost will be financed with a bank term loan at an interest rate of 7.9% per annum. The new system could be sold for $320,000 at the end of Year 4. The tax authority allows 15% prime cost (straight line) depreciation on assembly lines and the Vodafone Australia same rate would be used for financial accounting purposes. All figures are in Australian dollars. The Vodafone Australia board has declared that it will only accept projects where the net present value (NPV) exceeds an 18% return.

Vodafone's organisation-wide effective tax rate is 30%.

Hamish has forwarded her summary of relevant cash flows to you for review:

Summary of relevant cash flows Item Total cost of asset Net working capital Increased profit contribution Plus: Salary savings Less: Interest expense Less: Depreciation Net profit before tax Less: Tax Net profit after tax Proceeds from sale of asset Project's net cash flow Year 0 (2,100,000) (300,000) Year 1 Year 2 (2,400,000) 904,470 s Year 3 904,470 Year 4 45 1,580,000 1,580,000 1,580,000 1,580,000 78,000 78,000 78,000 78,000 165,900 165,900 165,900 165,900 200,000 200,000 200,000 200,000 1,292,100 1,292,100 1,292,100 1,292,100 387,630 387,630 387,630 387,630 904,470 904,470 904,470 904,470 320,000 904,470 1,224,470

Step by Step Solution

3.56 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

The provided image appears to be a summary of relevant cash flows for a project analysis Unfortunately the image is not clearly visible but I can provide some guidance on how to approach the tasks bas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started