Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the information provided below for Ben Lewis, an Australian resident taxpayer, determine the capital gains tax consequences of his share sales for the 2021/22

Using the information provided below for Ben Lewis, an Australian resident taxpayer, determine the capital gains tax consequences of his share sales for the 2021/22 income year.

Use a spreadsheet or word-processing program to type up your answer.

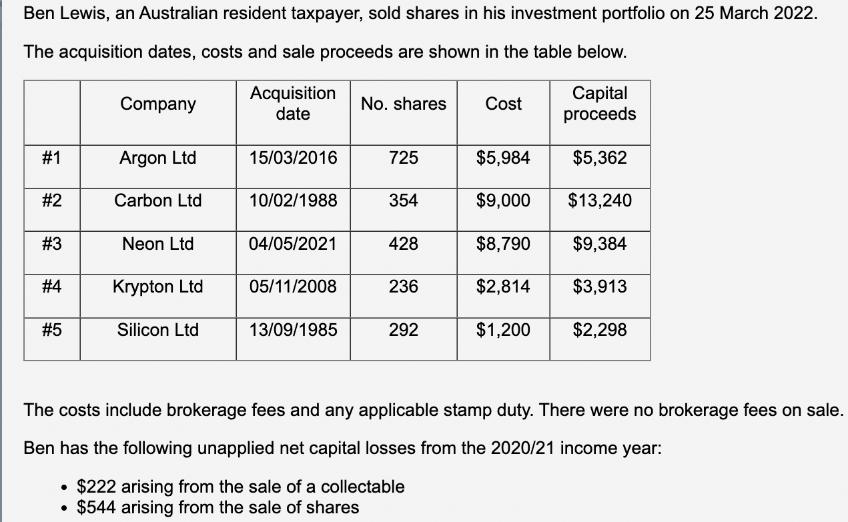

Ben Lewis, an Australian resident taxpayer, sold shares in his investment portfolio on 25 March 2022. The acquisition dates, costs and sale proceeds are shown in the table below. #1 #2 #3 #4 #5 Company Argon Ltd Carbon Ltd Neon Ltd Krypton Ltd Silicon Ltd Acquisition date 15/03/2016 10/02/1988 04/05/2021 05/11/2008 13/09/1985 No. shares 725 354 428 236 292 Cost $5,984 $9,000 $8,790 $2,814 $1,200 Capital proceeds $5,362 $13,240 $9,384 $3,913 $2,298 The costs include brokerage fees and any applicable stamp duty. There were no brokerage fees on sale. Ben has the following unapplied net capital losses from the 2020/21 income year: $222 arising from the sale of a collectable $544 arising from the sale of shares

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To determine the capital gains tax consequences of Ben Lewiss share sales for the 202122 income year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started