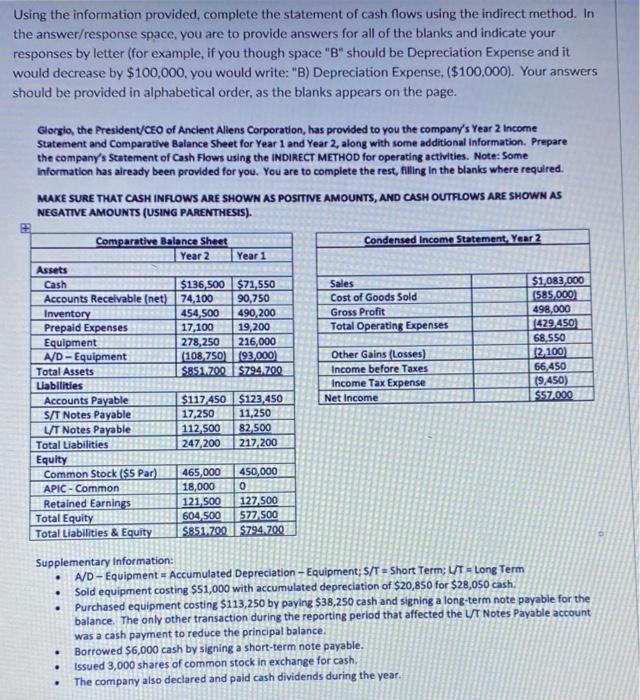

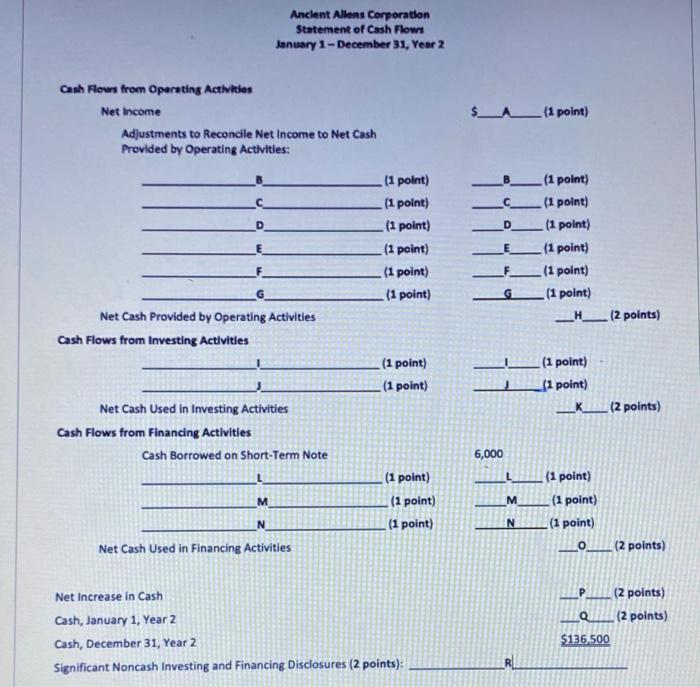

Using the information provided, complete the statement of cash flows using the indirect method. In the answer/response space, you are to provide answers for all of the blanks and indicate your responses by letter (for example, if you though space "B" should be Depreciation Expense and it would decrease by $100,000. you would write: "B) Depreciation Expense. ($100,000). Your answers should be provided in alphabetical order, as the blanks appears on the page. Giorgio, the President/CEO of Ancient Allens Corporation, has provided to you the company's Year 2 Income Statement and Comparative Balance Sheet for Year 1 and Year 2, along with some additional information. Prepare the company's Statement of Cash Flows using the INDIRECT METHOD for operating activities. Note: Some Information has already been provided for you. You are to complete the rest, filling in the blanks where required. MAKE SURE THAT CASH INFLOWS ARE SHOWN AS POSITIVE AMOUNTS, AND CASH OUTFLOWS ARE SHOWN AS NEGATIVE AMOUNTS (USING PARENTHESIS). Condensed Income Statement Year 2 Sales Cost of Goods Sold Gross Profit Total Operating Expenses Comparative Balance Sheet Year 2 Year 1 Assets Cash $136,500 $71,550 Accounts Receivable (net) 74,100 90,750 Inventory 454,500 490,200 Prepaid Expenses 17,100 19,200 Equipment 278,250 216,000 A/D - Equipment (108 750 193.000 Total Assets $851.700 $794 700 Liabilities Accounts Payable $117 450 $123,450 SIT Notes Payable 17,250 11,250 LIT Notes Payable 112.500 82.500 Total Liabilities 247,200 217,200 Equity Common Stock ($5 Par 465,000 450,000 APIC - Common 18,000 0 Retained Earnings 121,500 127500 Total Equity 604,500 577 500 Total Liabilities & Equity 58517008794,700 $1,083,000 1585.000) 498,000 (429 450 68.550 2.100) 66 450 19.450) $57.000 Other Gains (Losses) Income before Taxes Income Tax Expense Net Income . Supplementary Information: A/D-Equipment - Accumulated Depreciation - Equipment; S/T = Short Term; L/T = Long Term Sold equipment costing $51,000 with accumulated depreciation of $20,850 for $28,050 cash, Purchased equipment costing $113,250 by paying $38,250 cash and signing a long-term note payable for the balance. The only other transaction during the reporting period that affected the UT Notes Payable account was a cash payment to reduce the principal balance, Borrowed $6,000 cash by signing a short-term note payable. Issued 3,000 shares of common stock in exchange for cash. The company also declared and paid cash dividends during the year. . Ancient Aliens Corporation Statement of Cash Flows January 1-December 31, Year 2 Cash Flows from Operating Activities Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: $_____(1 point) D (1 point) (1 point) (1 point) (1 point) (1 point) (1 point) E (1 point) (1 point) (1 point) (1 point) (1 point) (1 point) _H__ (2 points) Net Cash Provided by Operating Activities Cash Flows from Investing Activities (1 point) (1 point) (1 point) 11 point) (2 points) Net Cash Used in Investing Activities Cash Flows from Financing Activities Cash Borrowed on Short-Term Note 6,000 L M (1 point) (1 point) (1 point) M (1 point) (1 point) (1 point) _O__ (2 points) IN N Net Cash Used in Financing Activities Net Increase in Cash Cash, January 1, Year 2 Cash, December 31, Year 2 Significant Noncash Investing and Financing Disclosures (2 points) (2 points) La (2 points) $136,500