Answered step by step

Verified Expert Solution

Question

1 Approved Answer

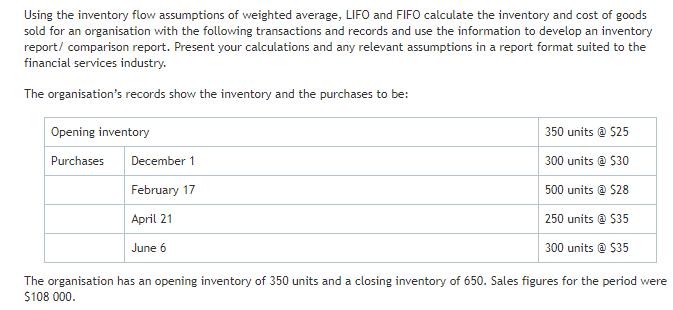

Using the inventory flow assumptions of weighted average, LIFO and FIFO calculate the inventory and cost of goods sold for an organisation with the

Using the inventory flow assumptions of weighted average, LIFO and FIFO calculate the inventory and cost of goods sold for an organisation with the following transactions and records and use the information to develop an inventory report/ comparison report. Present your calculations and any relevant assumptions in a report format suited to the financial services industry. The organisation's records show the inventory and the purchases to be: Opening inventory Purchases December 1 February 17 April 21 June 6 350 units @ $25 300 units @ $30 500 units @ $28 250 units @ $35 300 units @ $35 The organisation has an opening inventory of 350 units and a closing inventory of 650. Sales figures for the period were $108 000.

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Inventory Report for XYZ Company Introduction The purpose of this report is to calculate inventory and cost of goods sold for XYZ Company using the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started