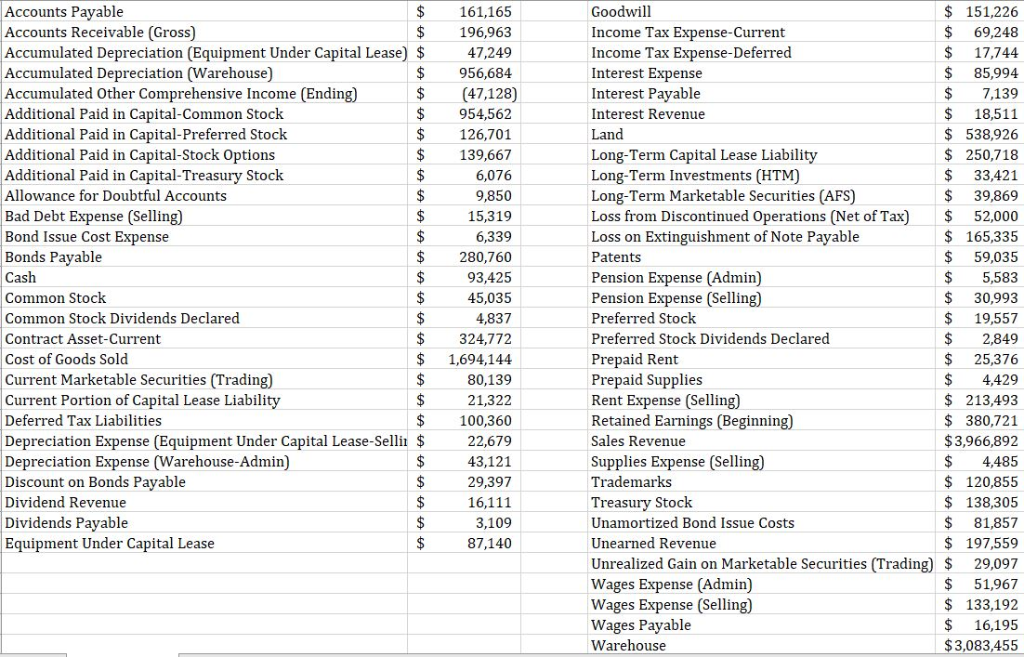

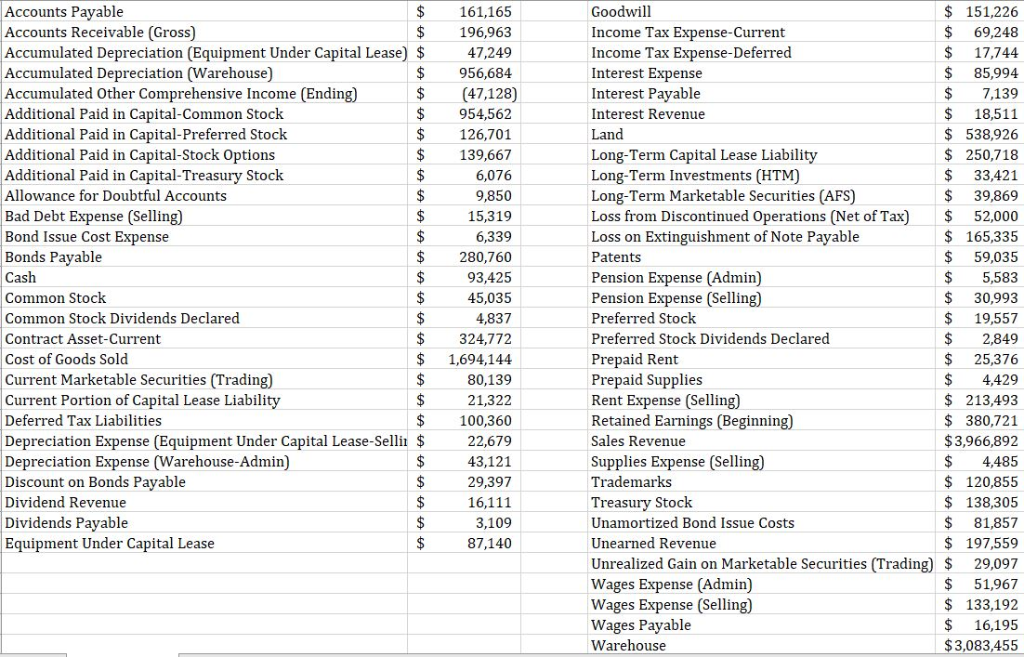

Using the List of Accounts provided separately in an Excel spreadsheet (see Canvas), create a multiple-step income statement, statement of retained earnings, and classified balance sheet for the year ending December 31, 2019. The multiple-step income statement should also include a section for basic per-share amounts for the Income from Continuing Operations and the Net Income line items (see textbook or notes). Also, create your own company name. These statements should be in an appropriate format (See Chapters 4-5 for examples). This means that the multiple-step income statement should present gross profit, operating, nonoperating, and nonrecurring items separately. This also means that the classified balance sheet should present current and long-term items separately. The statement of retained earnings only needs to present the Retained Earnings column from a Statement of Stockholders Equity. For purposes of the per-share section, assume that basic and diluted EPS are the same amount (i.e., there are no dilutive securities). Also, assume that the weighted-average number of shares outstanding for both basic and diluted is equal to 300,000 shares.

$161,165 $196,963 Accumulated Depreciation (Equipment Under Capital Lease) $47,249 $956,684 Accounts Payable Accounts Receivable (Gross) $ 151,226 Income Tax Expense-Current Income Tax Expense-Deferred Interest Expense Interest Pavable Interest Revenue Land Long-Term Capital Lease Liability Long-Term Investments (HTM) Long-Term Marketable Securities (AFS) 17,744 $85,994 7,139 Accumulated Depreciation (Warehouse) Accumulated Other Comprehensive Income (Ending) Additional Paid in Capital-Common Stock Additional Paid in Capital-Preferred Stock Additional Paid in Capital-Stock Options Additional Paid in Capital-Treasury Stock Allowance for Doubtful Accounts Bad Debt Expense (Selling) Bond Issue Cost Expense $(47,128) $954,562 $126,701 $139,667 6,076 9,850 15,319 6,339 $280,760 $93,425 45,035 4,837 $324,772 $ 1,694,144 $80,139 21,322 $100,360 Depreciation Expense (Equipment Under Capital Lease-Sellin $ 22,679 43,121 29,397 16,111 3,109 87,140 $ 538,926 $ 250,718 $ 33,421 Loss from Discontinued Operations (Net of Tax) 52,000 $165,33!5 $59,035 $5,583 $30,993 $ 19,557 Loss on Extinguishment of Note Payable Patents Pension Expense (Admin) Pension Expense (Selling) Preferred Stock Preferred Stock Dividends Declared Common Stock Common Stock Dividends Declared Contract Asset-Current Cost of Goods Sold Current Marketable Securities(Trading Current Portion of Capital Lease Liability Deferred Tax Liabilities paid Ren Prepaid Supplies Rent Expense (Selling) Retained Earnings (Beginning Sales Revenue Supplies Expense (Selling) Trademarks $ 25,376 4,429 $ 213,493 $ 380.721 $3,966,892 4,485 $ 120,85!5 $ 138,305 81,857 $ 197,559 Unrealized Gain on Marketable Securities (Trading) $ 29,097 $ 51,967 s 133,192 $ 16,195 $3,083,455 Depreciation Expense (Warehouse-Admin) Discount on Bonds Pavable Dividend Revenue Dividends Payable Equipment Under Capital Lease rea Unamortized Bond Issue Costs Unearned Revenue ense ages Expense (Selling Warehouse $161,165 $196,963 Accumulated Depreciation (Equipment Under Capital Lease) $47,249 $956,684 Accounts Payable Accounts Receivable (Gross) $ 151,226 Income Tax Expense-Current Income Tax Expense-Deferred Interest Expense Interest Pavable Interest Revenue Land Long-Term Capital Lease Liability Long-Term Investments (HTM) Long-Term Marketable Securities (AFS) 17,744 $85,994 7,139 Accumulated Depreciation (Warehouse) Accumulated Other Comprehensive Income (Ending) Additional Paid in Capital-Common Stock Additional Paid in Capital-Preferred Stock Additional Paid in Capital-Stock Options Additional Paid in Capital-Treasury Stock Allowance for Doubtful Accounts Bad Debt Expense (Selling) Bond Issue Cost Expense $(47,128) $954,562 $126,701 $139,667 6,076 9,850 15,319 6,339 $280,760 $93,425 45,035 4,837 $324,772 $ 1,694,144 $80,139 21,322 $100,360 Depreciation Expense (Equipment Under Capital Lease-Sellin $ 22,679 43,121 29,397 16,111 3,109 87,140 $ 538,926 $ 250,718 $ 33,421 Loss from Discontinued Operations (Net of Tax) 52,000 $165,33!5 $59,035 $5,583 $30,993 $ 19,557 Loss on Extinguishment of Note Payable Patents Pension Expense (Admin) Pension Expense (Selling) Preferred Stock Preferred Stock Dividends Declared Common Stock Common Stock Dividends Declared Contract Asset-Current Cost of Goods Sold Current Marketable Securities(Trading Current Portion of Capital Lease Liability Deferred Tax Liabilities paid Ren Prepaid Supplies Rent Expense (Selling) Retained Earnings (Beginning Sales Revenue Supplies Expense (Selling) Trademarks $ 25,376 4,429 $ 213,493 $ 380.721 $3,966,892 4,485 $ 120,85!5 $ 138,305 81,857 $ 197,559 Unrealized Gain on Marketable Securities (Trading) $ 29,097 $ 51,967 s 133,192 $ 16,195 $3,083,455 Depreciation Expense (Warehouse-Admin) Discount on Bonds Pavable Dividend Revenue Dividends Payable Equipment Under Capital Lease rea Unamortized Bond Issue Costs Unearned Revenue ense ages Expense (Selling Warehouse