Answered step by step

Verified Expert Solution

Question

1 Approved Answer

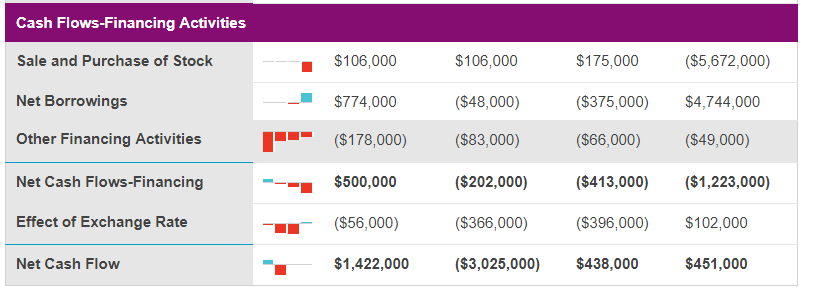

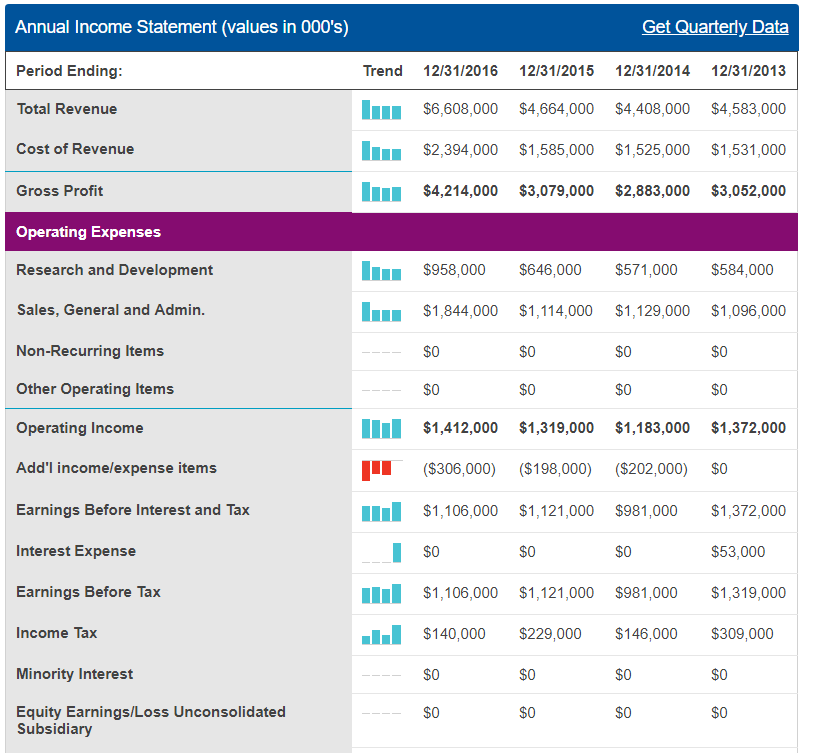

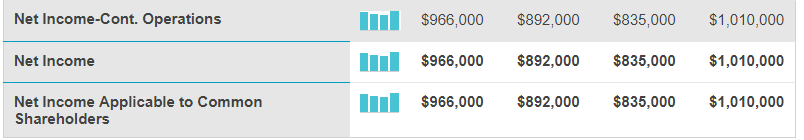

Using the most recent annual report of the corporation that you've been researching in these past weeks, please calculate the free cash flow for the

Using the most recent annual report of the corporation that you've been researching in these past weeks, please calculate the free cash flow for the most recent year. Please let us know if your corporation has positive free cash flow. Why is a positive free cash flow considered favorable? Can free cash flow be a negative number? What does a lack of free cash flow indicate for a business? Please indicate why free cash flow may be a better indicator than Cash Flows from Operating Activities of financial strength.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started