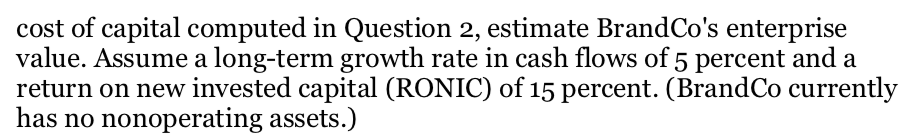

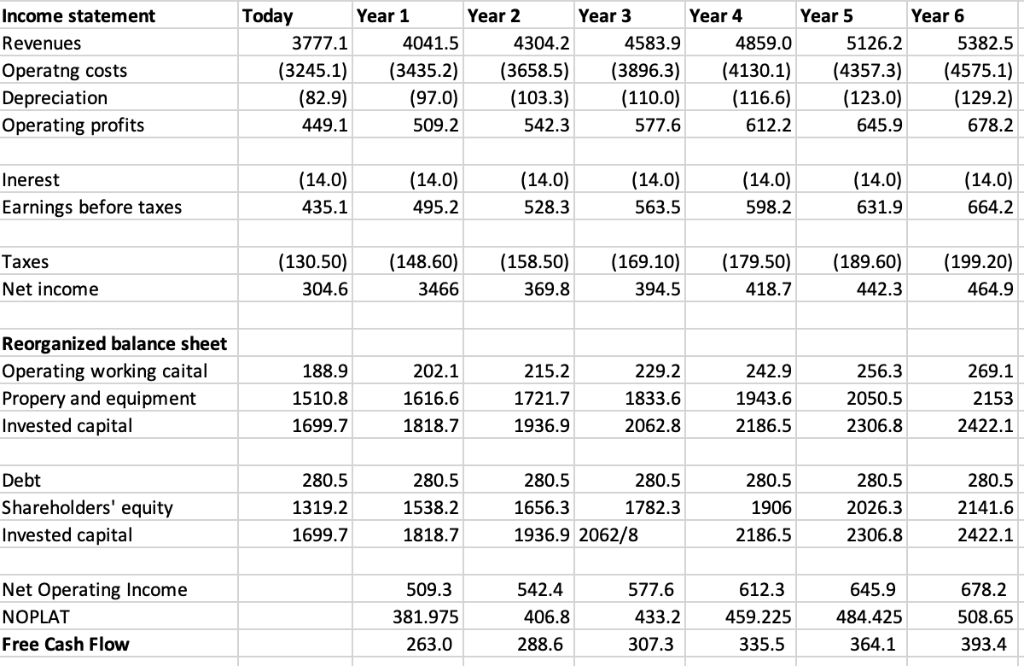

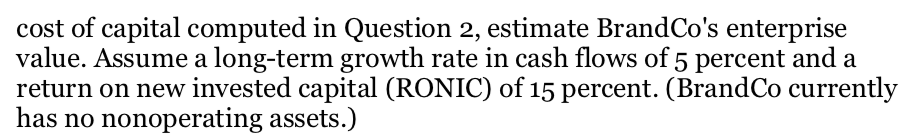

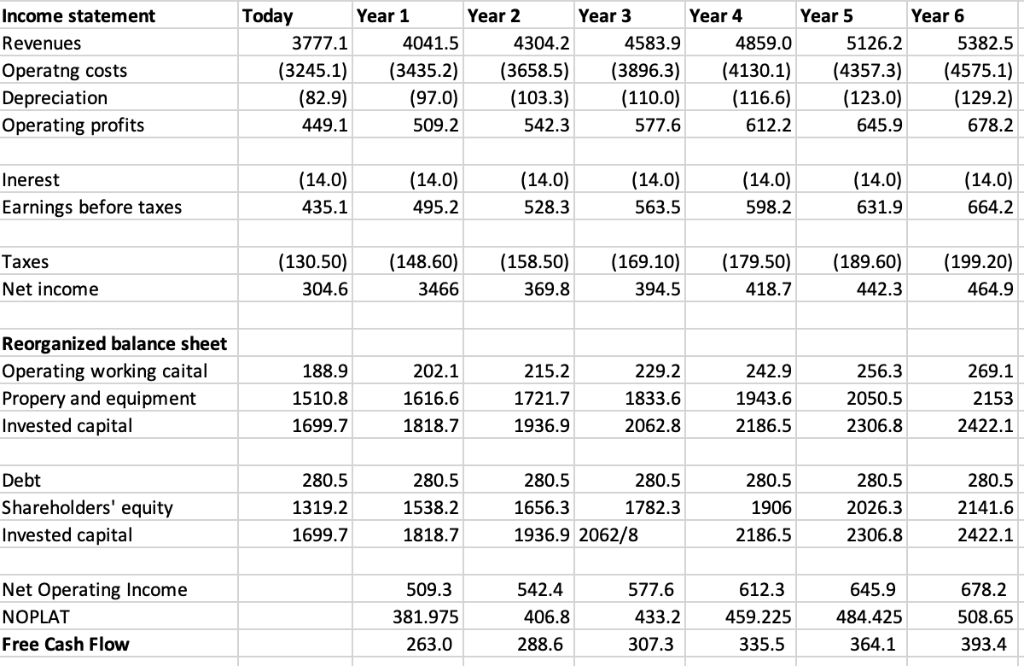

Using the next five years of free cash flow computed in Question 1, ain estimated continuing value at the end of year 5, and the weighted average cost of capital computed in Question 2, estimate BrandCo's enterprise value. Assume a long-term growth rate in cash flows of 5 percent and a return on new invested capital (RONIC) of 15 percent. (BrandCo currently has no nonoperating assets.) Today Year 1 Year 5 Income statement Revenues Operatng costs Depreciation Operating profits Year 2 Year 3 Year 4 Year 6 4041.5 5382.5 3245 (3435.2 3658.5) (3896. (4130.1)(4357.3) (4575.1) (97.0)103.3) (110.0 (116.6 123.0 (129.2) 678.2 3777.1 4304.2 4583.9 4859.0 5126.2 509.2 577.6 612.2 Inerest Earnings before taxes 435.1 495.2 528.3 563.5 598.2 Taxes Net income (130.50)(148.60 (158.50(169.10 (179.50) (189.60)(199.20) 3466 369.8 394.5 Reorganized balance sheet Operating working caital Propery and equipment Invested capital 188.9 1510.8 1699.7 202.1 1616.6 1818.7 229.2 1833.6 2062.8 256.3 2050.5 2306.8 269.1 2153 2422.1 1721.7 1936.9 1943.6 2186.5 Shareholders' equity Invested capital 280.5 1319.2 1699.71818.71936.9 2062/8 280.5 1538.2 280.5 1656.3 280.5 1782.3 280.5 1906 2186.5 280.5 2026.3 2306.8 280.5 2141.6 2422.1 Net Operating Income NOPLAT Free Cash Flow 509.3 381.975 263.0 406.8 288.6 577.6 433.2 307.3 612.3 459.225484.425 678.2 508.65 393.4 335.5 Proportiorn of total Marginal Conribution Cost oftax rate(30 After-tax of to weighted capital Source of Capital Debt Equity WACC capital% capital 6.98 93.02 100 percent) verage 3% 12% 5.60% 12% 2.40% 0.39% 11.16% 11.55% Using the next five years of free cash flow computed in Question 1, ain estimated continuing value at the end of year 5, and the weighted average cost of capital computed in Question 2, estimate BrandCo's enterprise value. Assume a long-term growth rate in cash flows of 5 percent and a return on new invested capital (RONIC) of 15 percent. (BrandCo currently has no nonoperating assets.) Today Year 1 Year 5 Income statement Revenues Operatng costs Depreciation Operating profits Year 2 Year 3 Year 4 Year 6 4041.5 5382.5 3245 (3435.2 3658.5) (3896. (4130.1)(4357.3) (4575.1) (97.0)103.3) (110.0 (116.6 123.0 (129.2) 678.2 3777.1 4304.2 4583.9 4859.0 5126.2 509.2 577.6 612.2 Inerest Earnings before taxes 435.1 495.2 528.3 563.5 598.2 Taxes Net income (130.50)(148.60 (158.50(169.10 (179.50) (189.60)(199.20) 3466 369.8 394.5 Reorganized balance sheet Operating working caital Propery and equipment Invested capital 188.9 1510.8 1699.7 202.1 1616.6 1818.7 229.2 1833.6 2062.8 256.3 2050.5 2306.8 269.1 2153 2422.1 1721.7 1936.9 1943.6 2186.5 Shareholders' equity Invested capital 280.5 1319.2 1699.71818.71936.9 2062/8 280.5 1538.2 280.5 1656.3 280.5 1782.3 280.5 1906 2186.5 280.5 2026.3 2306.8 280.5 2141.6 2422.1 Net Operating Income NOPLAT Free Cash Flow 509.3 381.975 263.0 406.8 288.6 577.6 433.2 307.3 612.3 459.225484.425 678.2 508.65 393.4 335.5 Proportiorn of total Marginal Conribution Cost oftax rate(30 After-tax of to weighted capital Source of Capital Debt Equity WACC capital% capital 6.98 93.02 100 percent) verage 3% 12% 5.60% 12% 2.40% 0.39% 11.16% 11.55%