Question: Using the number on the table below determine the tax treatment to the partner who receives the distribution indicated, and then assuming the partnership

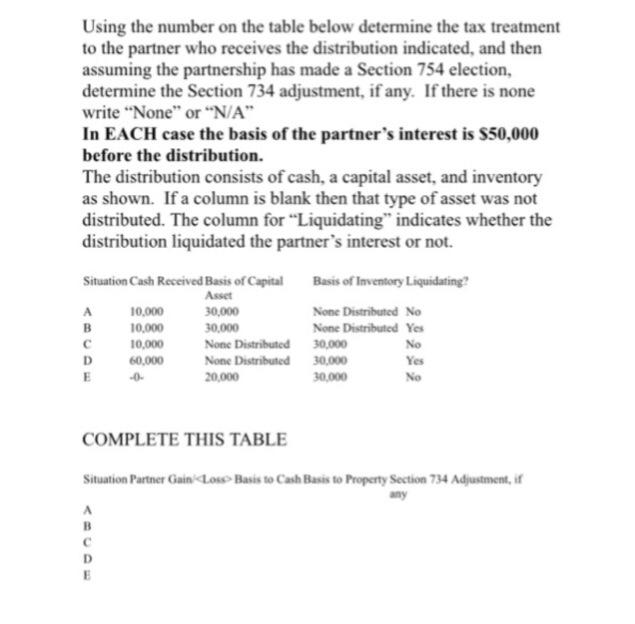

Using the number on the table below determine the tax treatment to the partner who receives the distribution indicated, and then assuming the partnership has made a Section 754 election, determine the Section 734 adjustment, if any. If there is none write "None" or "N/A" In EACH case the basis of the partner's interest is $50,000 before the distribution. The distribution consists of cash, a capital asset, and inventory as shown. If a column is blank then that type of asset was not distributed. The column for "Liquidating" indicates whether the distribution liquidated the partner's interest or not. Situation Cash Received Basis of Capital Basis of Inventory Liquidating? Asset 30,000 30,000 None Distributed 30,000 None Distributed 30,000 A 10,000 None Distributed No 10,000 None Distributed Yes 10,000 No D 60,000 Yes E 0- 20,000 30,000 No COMPLETE THIS TABLE Situation Partner Gain'Los Basis to Cash Basis to Property Section 734 Adjustment, if any A D

Step by Step Solution

There are 3 Steps involved in it

situation Partner Gain Basis To Cash Bas... View full answer

Get step-by-step solutions from verified subject matter experts