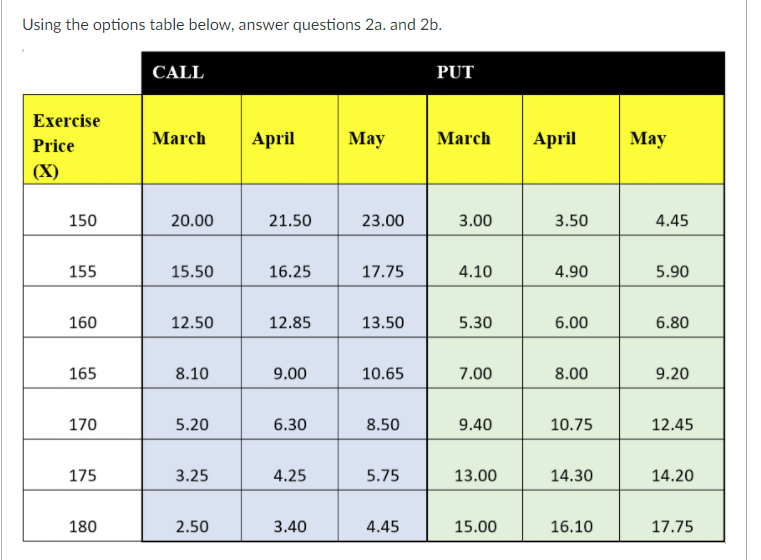

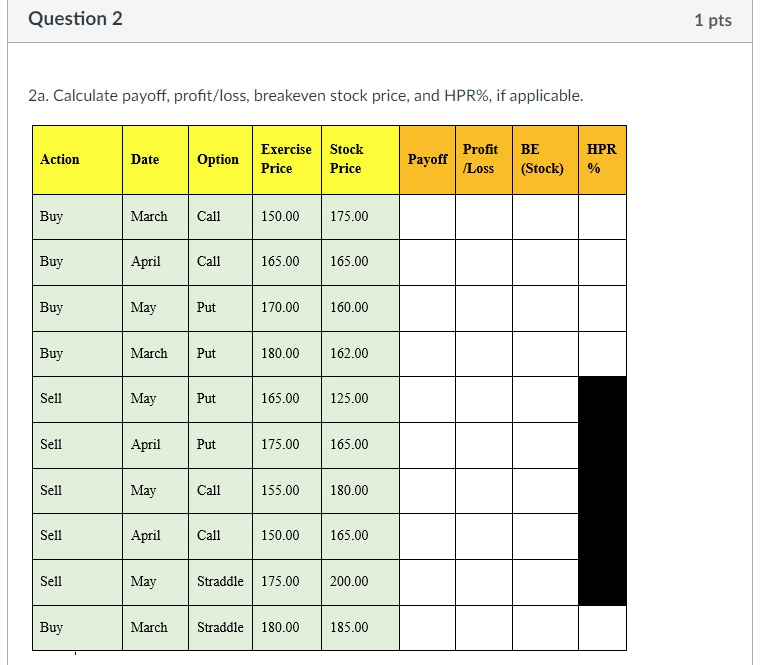

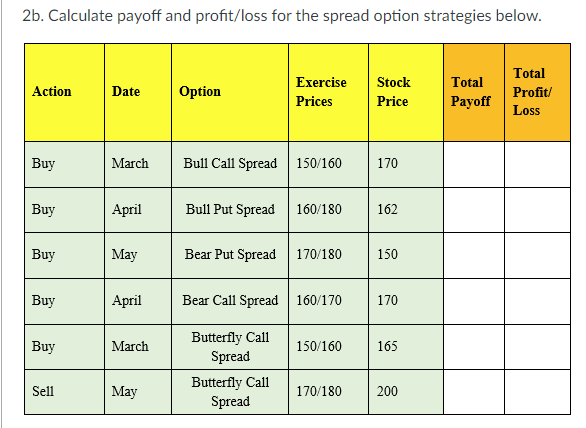

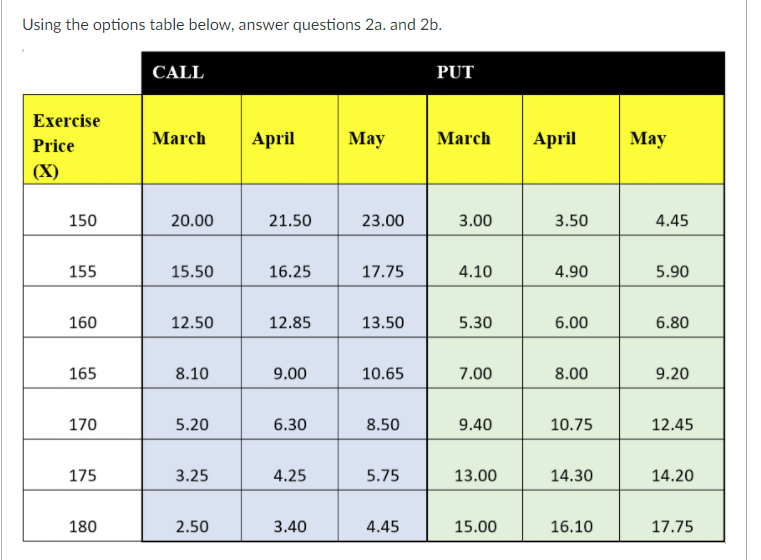

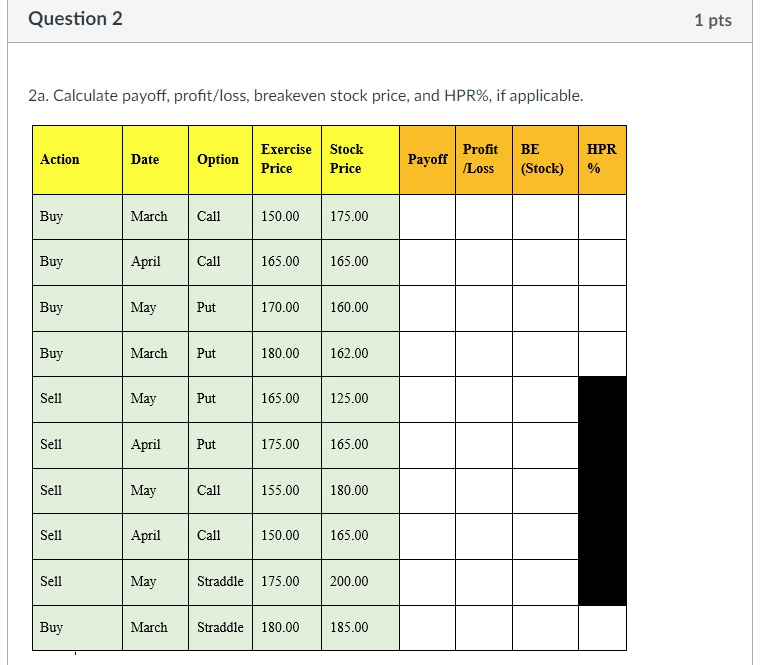

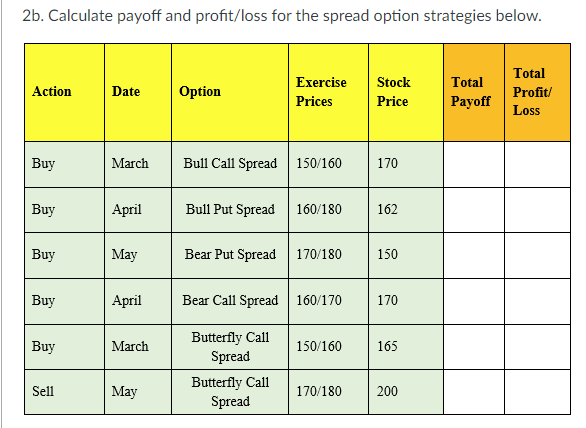

Using the options table below, answer questions 2a. and 2b. CALL PUT Exercise Price (X) March April May March April May 150 20.00 21.50 23.00 3.00 3.50 4.45 155 15.50 16.25 17.75 4.10 4.90 5.90 160 12.50 12.85 13.50 5.30 6.00 6.80 165 8.10 9.00 10.65 7.00 8.00 9.20 170 5.20 6.30 8.50 9.40 10.75 12.45 175 3.25 4.25 5.75 13.00 14.30 14.20 180 2.50 3.40 4.45 15.00 16.10 17.75 Question 2 1 pts 2a. Calculate payoff, profit/loss, breakeven stock price, and HPR%, if applicable. Action Date Option Exercise Stock Price Price Payoff Profit Loss BE (Stock) HPR % Buy March Call 150.00 175.00 Buy April Call 165.00 165.00 Buy May Put 170.00 160.00 Buy March Put 180.00 162.00 Sell May Put 165.00 125.00 Sell April Put 175.00 165.00 Sell May Call 155.00 180.00 Sell April Call 150.00 165.00 Sell May Straddle 175.00 200.00 Buy March Straddle | 180.00 185.00 2b. Calculate payoff and profit/loss for the spread option strategies below. Action Date Option Exercise Prices Stock Price Total Payoff Total Profit Loss Buy March Bull Call Spread 150/160 170 Buy April Bull Put Spread 160/180 162 Buy May Bear Put Spread 170/180 150 Buy April Bear Call Spread 160/170 170 Buy March 150/160 165 Butterfly Call Spread Butterfly Call Spread Sell May 170/180 200 Using the options table below, answer questions 2a. and 2b. CALL PUT Exercise Price (X) March April May March April May 150 20.00 21.50 23.00 3.00 3.50 4.45 155 15.50 16.25 17.75 4.10 4.90 5.90 160 12.50 12.85 13.50 5.30 6.00 6.80 165 8.10 9.00 10.65 7.00 8.00 9.20 170 5.20 6.30 8.50 9.40 10.75 12.45 175 3.25 4.25 5.75 13.00 14.30 14.20 180 2.50 3.40 4.45 15.00 16.10 17.75 Question 2 1 pts 2a. Calculate payoff, profit/loss, breakeven stock price, and HPR%, if applicable. Action Date Option Exercise Stock Price Price Payoff Profit Loss BE (Stock) HPR % Buy March Call 150.00 175.00 Buy April Call 165.00 165.00 Buy May Put 170.00 160.00 Buy March Put 180.00 162.00 Sell May Put 165.00 125.00 Sell April Put 175.00 165.00 Sell May Call 155.00 180.00 Sell April Call 150.00 165.00 Sell May Straddle 175.00 200.00 Buy March Straddle | 180.00 185.00 2b. Calculate payoff and profit/loss for the spread option strategies below. Action Date Option Exercise Prices Stock Price Total Payoff Total Profit Loss Buy March Bull Call Spread 150/160 170 Buy April Bull Put Spread 160/180 162 Buy May Bear Put Spread 170/180 150 Buy April Bear Call Spread 160/170 170 Buy March 150/160 165 Butterfly Call Spread Butterfly Call Spread Sell May 170/180 200