Answered step by step

Verified Expert Solution

Question

1 Approved Answer

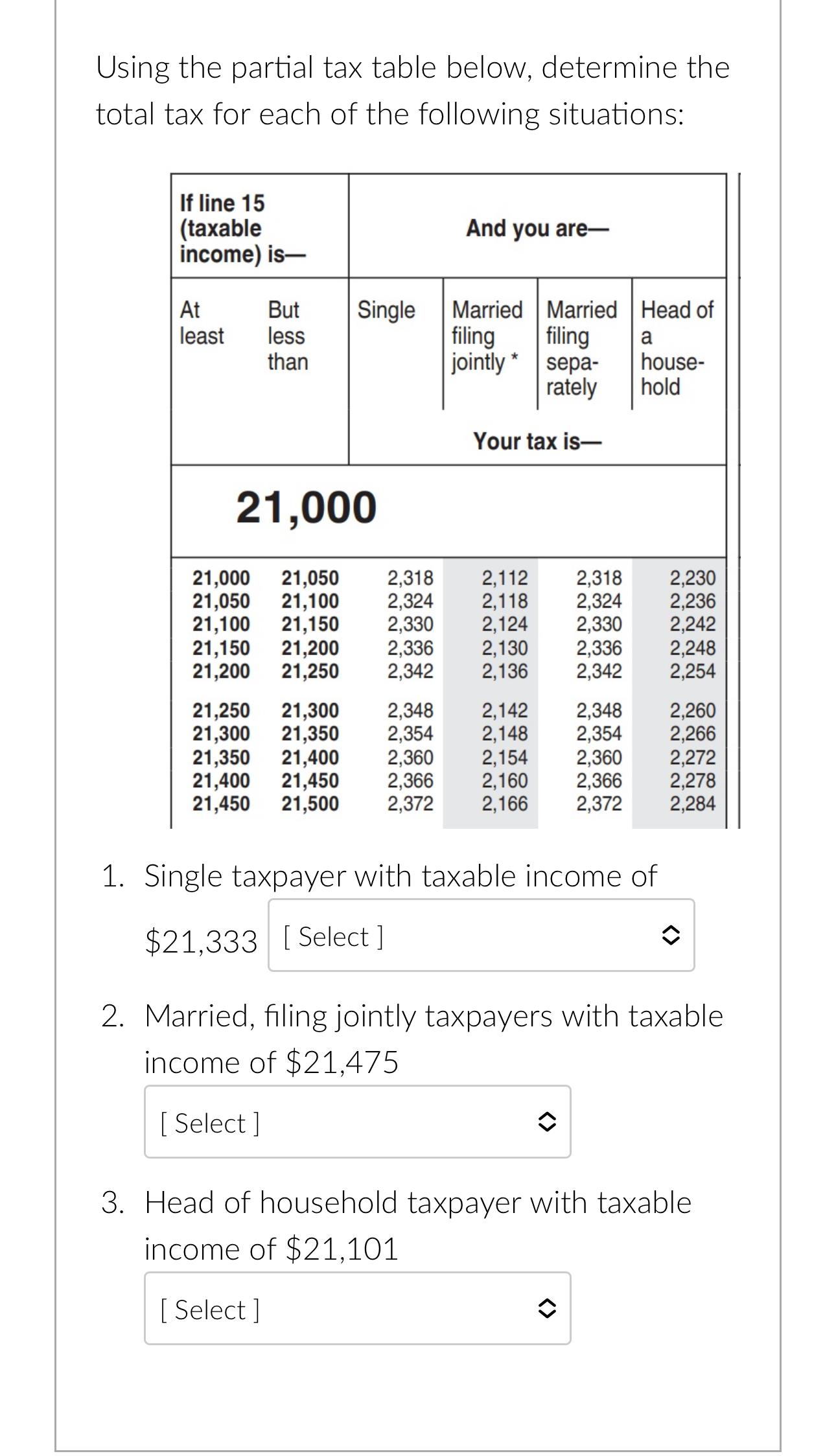

Using the partial tax table below, determine the total tax for each of the following situations: If line 15 (taxable income) is- At least

Using the partial tax table below, determine the total tax for each of the following situations: If line 15 (taxable income) is- At least But less than Single 21,000 And you are- Married Married filing filing jointly* sepa- rately Your tax is- 21,000 21,050 2,318 21,050 21,100 2,324 2,118 21,100 21,150 2,330 21,150 21,200 2,336 21,200 21,250 2,342 2,112 2,318 2,324 2,124 2,330 2,130 2,136 2,336 2,342 Head of a house- hold 21,250 21,300 2,348 2,142 2,348 21,300 21,350 2,354 2,148 2,354 21,350 21,400 2,360 2,154 2,360 2,272 2,160 2,366 2,278 21,400 21,450 2,366 21,450 21,500 2,372 2,166 2,372 2,284 1. Single taxpayer with taxable income of $21,333 [Select] 2,230 2,236 2,242 2,248 2,254 2,260 2,266 2. Married, filing jointly taxpayers with taxable income of $21,475 [Select] 3. Head of household taxpayer with taxable income of $21,101 [ Select]

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Single taxpayer with taxable income of 21333 According to the provided tax table th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started