Question

Using the percent of sales method, calculate required new funds. Does the company need to raise funds? If yes, state and explain one internal and

Using the percent of sales method, calculate required new funds. Does the company need to raise funds? If yes, state and explain one internal and one external method company can use to raise the necessary funds.

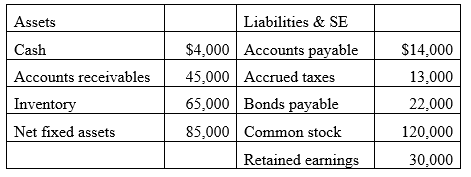

The balance sheet below is typical of the firms historical averages. It is expecting sales to increase by 12% over the last year sales of $245,000. The company is operating at capacity and its current assets and current liabilities change spontaneously with change in sales. Retained earnings at the beginning of the year were $20,000 and the company paid dividends of $8,000 during the year. Calculate all numbers to four places after the decimal point until the final answer is figured out.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started