Question

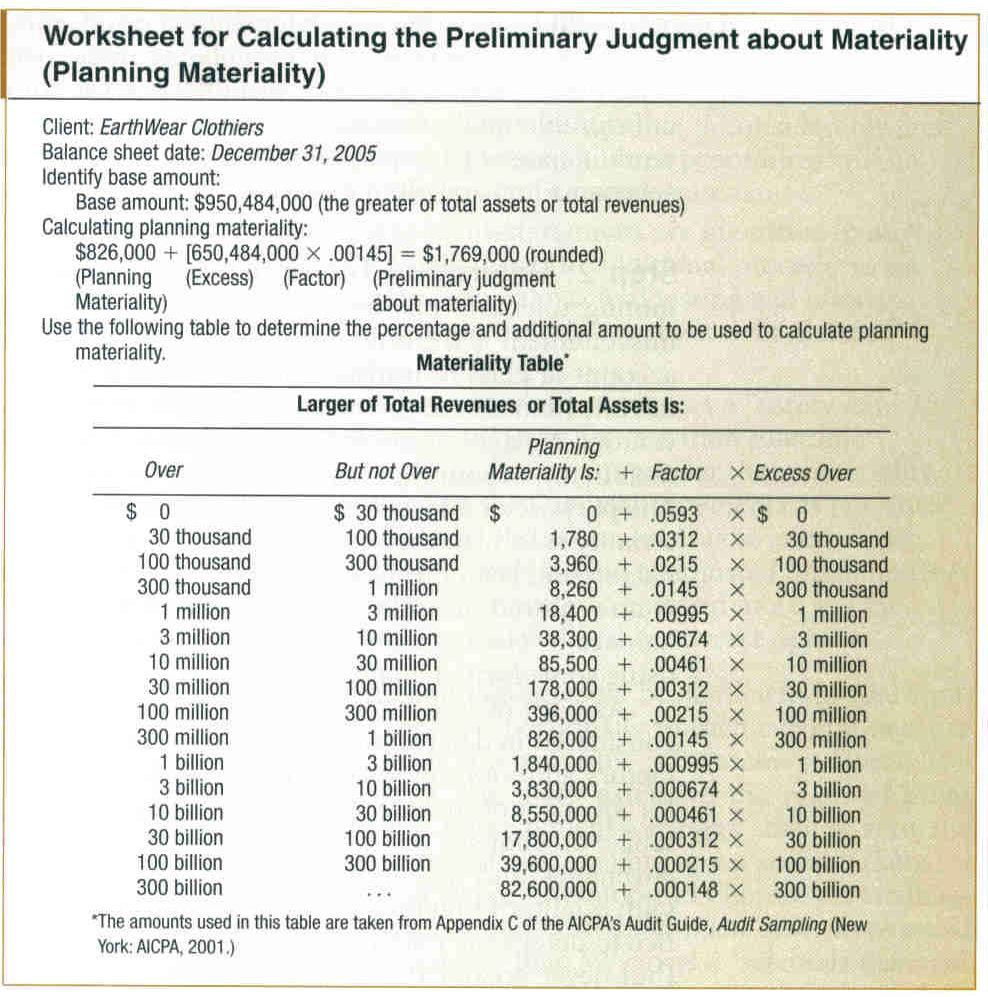

Using the preliminary materiality number calculated from #1, determine a performance materiality (tolerable misstatement) for the four significant accounts listed below: Cash - Current Year

Using the preliminary materiality number calculated from #1, determine a performance materiality (tolerable misstatement) for the four significant accounts listed below:

Cash - Current Year Balance of $50,000

Accounts Receivable - Current Year Balance of $200,000

Property, Plant & Equipment - Current Year Balance of $350,000

Accounts Payable - Current Year Balance of $100,000

No other accounts are scoped into the current year audit, and therefore do not need to be considered in making your performance materiality assessments. Unlike the Oceanview Marine case, the total amount allocated for tolerable statement should equal preliminary materiality.

Show your quantitative calculations, and then document your adjustment(s) to performance materiality based on qualitative considerations, if any. More specifically, do you believe that the tolerable misstatement amount for each account should be adjusted (up or down) based on the stated qualitative risk factors noted for each account? Round all final answers to the nearest thousand.

Cash - Current Year Balance of $50,000. All company cash accounts are reconciled every month by the Cash Manager, and reviewed by the bakery's Controller. There have been 3 different people employed as the Cash Manager during the last year, and the company has opened some new cash accounts to handle day-to-day operating expenses.

Accounts Receivable - Current Year Balance of $200,000. As the bakery has expanded into the regional market, it has extended moderate lines of credit to new customers in the last year. According to the A/R Manager, collections from customers operating outside the city has been somewhat difficult, which has led to some receivables being aged longer than in previous years. In reviewing the workpapers from last year, you were reminded that the majority of the audit adjustments last year, though immaterial in aggregate, were in A/R.

Property, Plant & Equipment - Current Year Balance of $350,000 - Numerous controls have been tested regarding PP&E, all of which were found to be designed and operating effectively. In addition, there have been no material additions or dispositions related to fixed assets during the current year.

Accounts Payable - Current Year Balance of $100,000 - Similar to PP&E, numerous controls have been tested regarding A/P, all of which were found to be designed and operating effectively. No new suppliers or vendors were added to the A/P listing during the year, and the individual supplier balances of A/P did not fluctuate significantly from prior year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started