Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the problem in the photo solve the following questions: 1. What is the NPV of the project? 2, What is the IRR of the

Using the problem in the photo solve the following questions:

1. What is the NPV of the project?

2, What is the IRR of the project?

3, Should the project be undertaken? Why or why not? Discuss factors that might influence the decision making Use both quantitative and qualitative factors in your evaluation.

HINTS: 1. Ignore opportunity costs 2. Compute relevant cash flows 3, Operating cash flows = EBIT + Depreciation - Tax

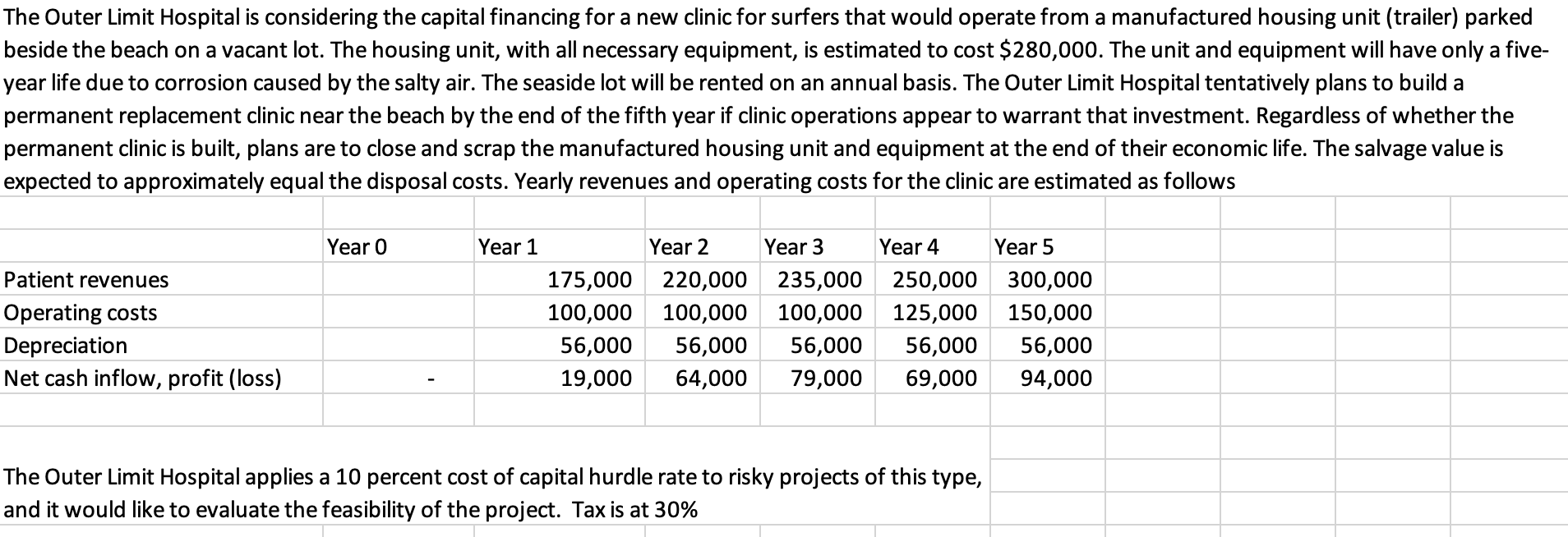

The Outer Limit Hospital is considering the capital financing for a new clinic for surfers that would operate from a manufactured housing unit (trailer) parked beside the beach on a vacant lot. The housing unit, with all necessary equipment, is estimated to cost $280,000. The unit and equipment will have only a five-year life due to corrosion caused by the salty air. The seaside lot will be rented on an annual basis. The Outer Limit Hospital tentatively plans to build a permanent replacement clinic near the beach by the end of the fifth year if clinic operations appear to warrant that investment. Regardless of whether the permanent clinic is built, plans are to close and scrap the manufactured housing unit and equipment at the end of their economic life. The salvage value is expected to approximately equal the disposal costs. Yearly revenues and operating costs for the clinic are estimated as follows

The Outer Limit Hospital is considering the capital financing for a new clinic for surfers that would operate from a manufactured housing unit (trailer) parked beside the beach on a vacant lot. The housing unit, with all necessary equipment, is estimated to cost $280,000. The unit and equipment will have only a five-year life due to corrosion caused by the salty air. The seaside lot will be rented on an annual basis. The Outer Limit Hospital tentatively plans to build a permanent replacement clinic near the beach by the end of the fifth year if clinic operations appear to warrant that investment. Regardless of whether the permanent clinic is built, plans are to close and scrap the manufactured housing unit and equipment at the end of their economic life. The salvage value is expected to approximately equal the disposal costs. Yearly revenues and operating costs for the clinic are estimated as follows Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started