Answered step by step

Verified Expert Solution

Question

1 Approved Answer

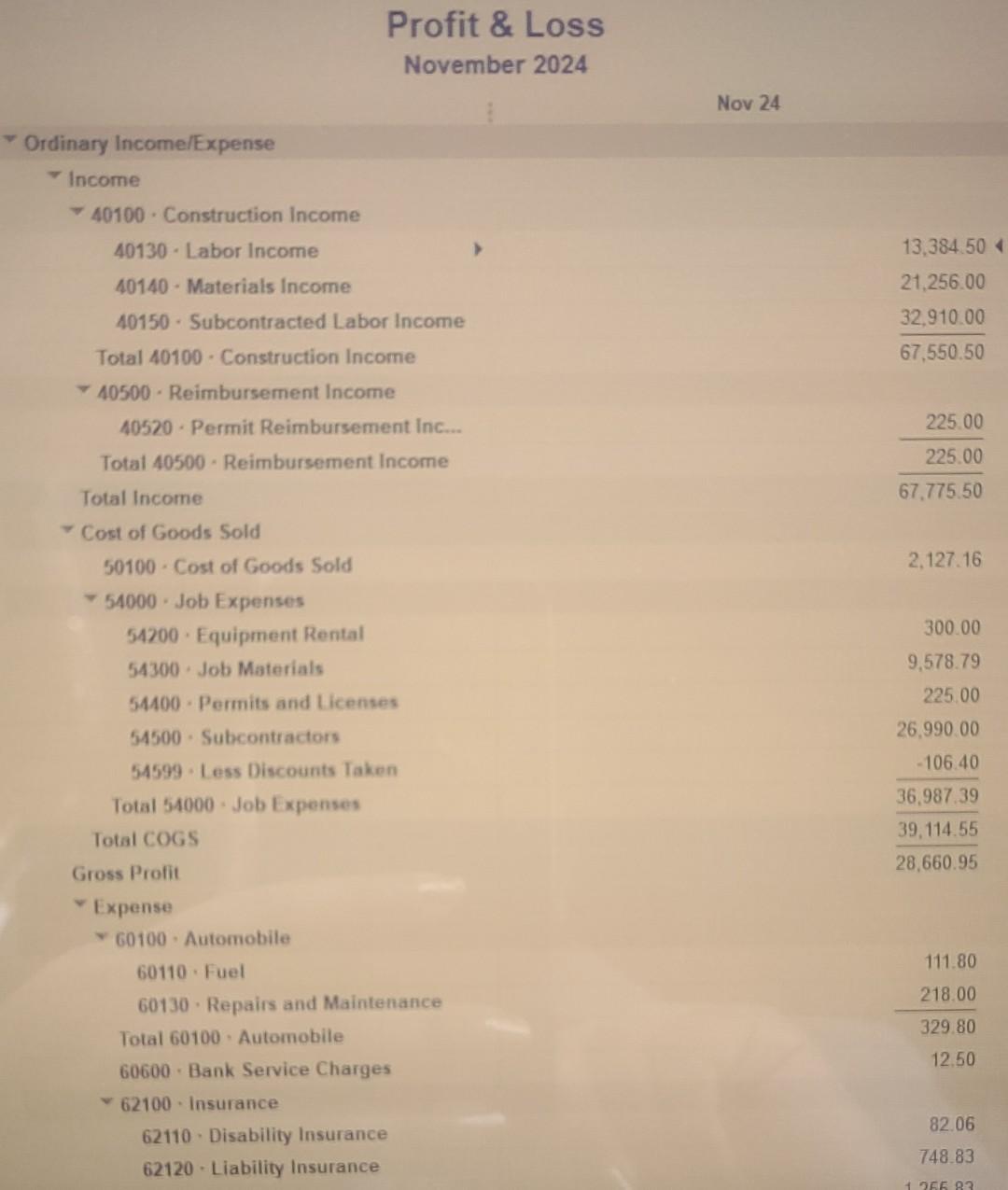

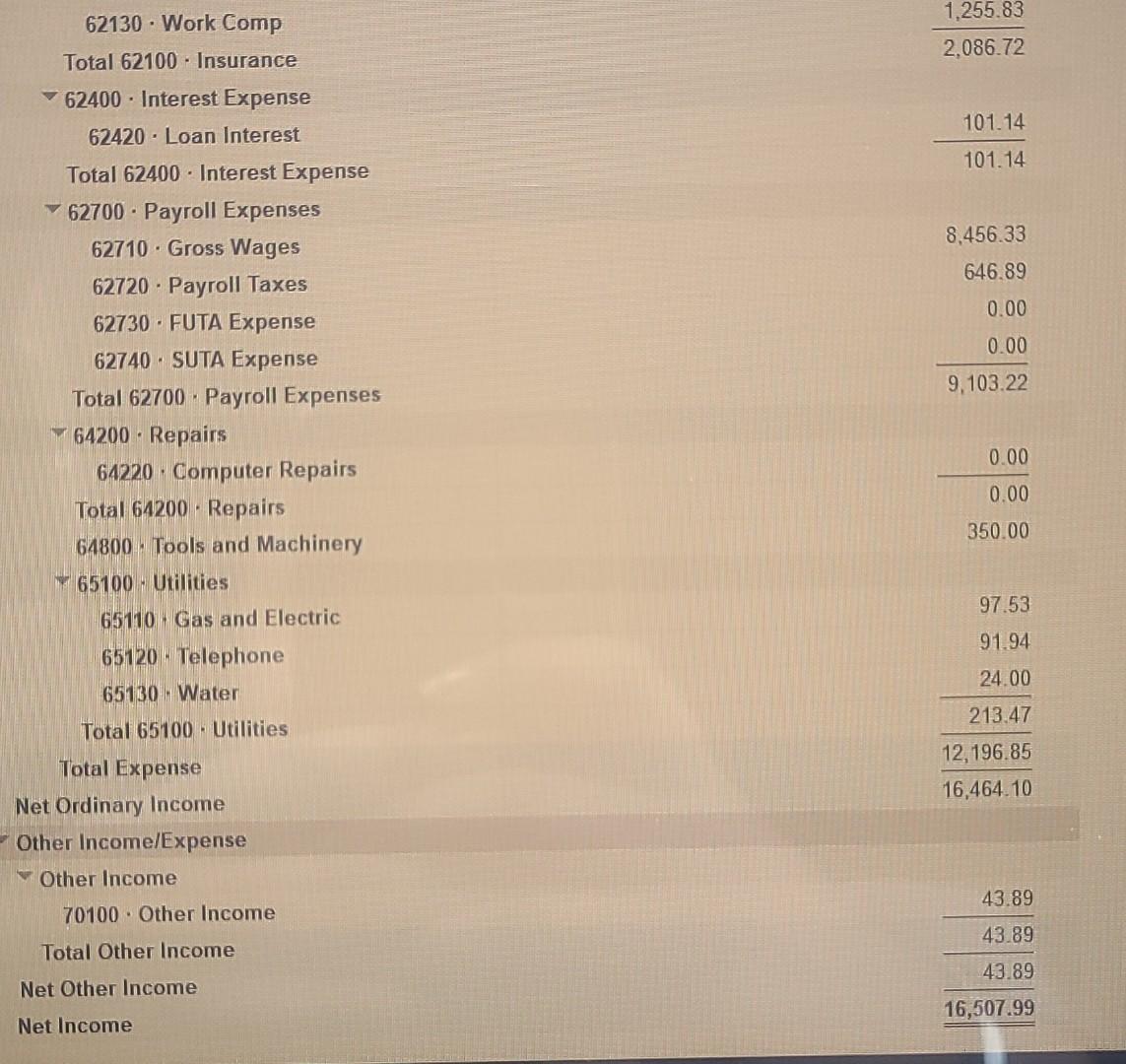

Using the Profit and Loss (P&L) Statement, Standard for Larry's Landscaping (P1.1.2.1) that you prepared and exported on Page 72, select the largest single expense

Using the Profit and Loss (P&L) Statement, Standard for Larry's Landscaping (P1.1.2.1) that you prepared and exported on Page 72, select the largest single expense item and input the respective balance.

Required information Project 1.1 The following information applies to the questions displayed below.] Larry's Landscaping just hired you as an accounting consultant to maintain its accounting records using QuickBooks financial software. The QuickBooks company file for Larry's Landscaping has already been created and transactions have been entered. Your assignment is to complete the following steps to export reports to Excel and then email them to the finance director at Larry's. Complete Project 1 by following the steps shown on Page 72. The Project 1 data file (.QBB) for Larry's Landscaping can be found here. All applicable reports prepared in Project 1 should be exported to Excel using the Go Digital Reports Excel template for Chapter 1. P1.1.2.1 Profit and Loss, Standard Required: Using the Profit and Loss (P&L) Statement, Standard for Larry's Landscaping (P1.1.2.1) that you prepared and exported on Page 72, select the largest single expense item and input the respective balance. (Round your answer to 2 decimal places.) Account Amount Largest single expense item Profit & Loss November 2024 Nov 24 Ordinary Income/Expense Income 40100 - Construction Income 13,384.50 21.256.00 32.910.00 67,550.50 225.00 225.00 67.775.50 2.127.16 40130 - Labor Income 40140 - Materials Income 40150 . Subcontracted Labor Income Total 40100 - Construction Income 40500 - Reimbursement Income 40520 . Permit Reimbursement Inc... Total 40500 - Reimbursement Income Total Income Cost of Goods Sold 50100 - Cost of Goods Sold 54000. Job Expenses 54200. Equipment Rental 54300 - Job Materials 54400. Permits and Licenses 54500. Subcontractors 54599. Less Discounts Taken Total 54000 Job Expenses Total COGS Gross Profit Expense 60100 - Automobile 60110 Fuel 60130 Repairs and Maintenance Total 60100 . Automobile 60600. Bank Service Charges 62100 - Insurance 62110 Disability Insurance 62120 - Liability Insurance 300.00 9,578.79 225.00 26,990.00 -106.40 36,987.39 39, 114.55 28,660.95 111.80 218.00 329.80 12.50 82.06 748.83 15 23 1,255.83 2,086.72 101.14 101.14 8.456.33 646.89 0.00 0.00 9,103.22 0.00 62130. Work Comp Total 62100 - Insurance 62400 - Interest Expense 62420 Loan Interest Total 62400 - Interest Expense 62700. Payroll Expenses 62710. Gross Wages 62720. Payroll Taxes 62730 - FUTA Expense 62740 - SUTA Expense Total 62700. Payroll Expenses 64200 Repairs 64220 - Computer Repairs Total 64200 Repairs 64800 - Tools and Machinery 65100 - Utilities 65110 Gas and Electric 65120 - Telephone 65130 Water Total 65100 - Utilities Total Expense Net Ordinary Income Other Income/Expense Other Income 70100 . Other Income Total Other Income 0.00 350.00 97.53 91.94 24.00 213.47 12,196.85 16,464.10 43.89 43.89 43.89 Net Other Income 16,507.99 Net IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started