Answered step by step

Verified Expert Solution

Question

1 Approved Answer

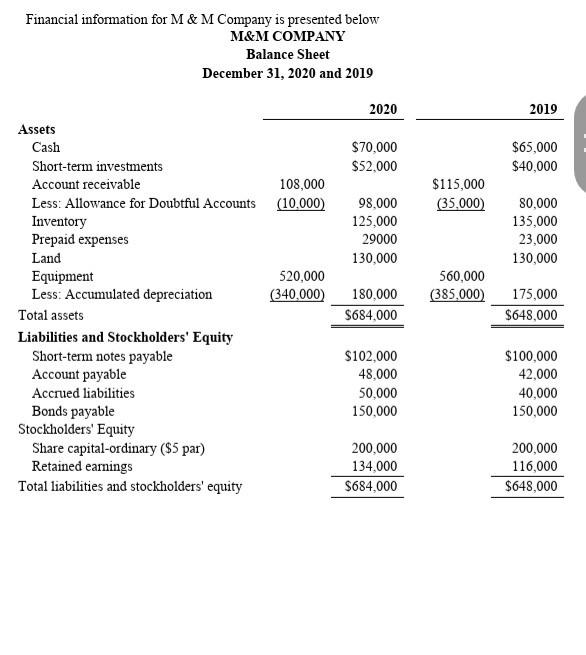

Financial information for M & M Company is presented below M&M COMPANY Balance Sheet December 31, 2020 and 2019 Assets Cash Short-term investments Account

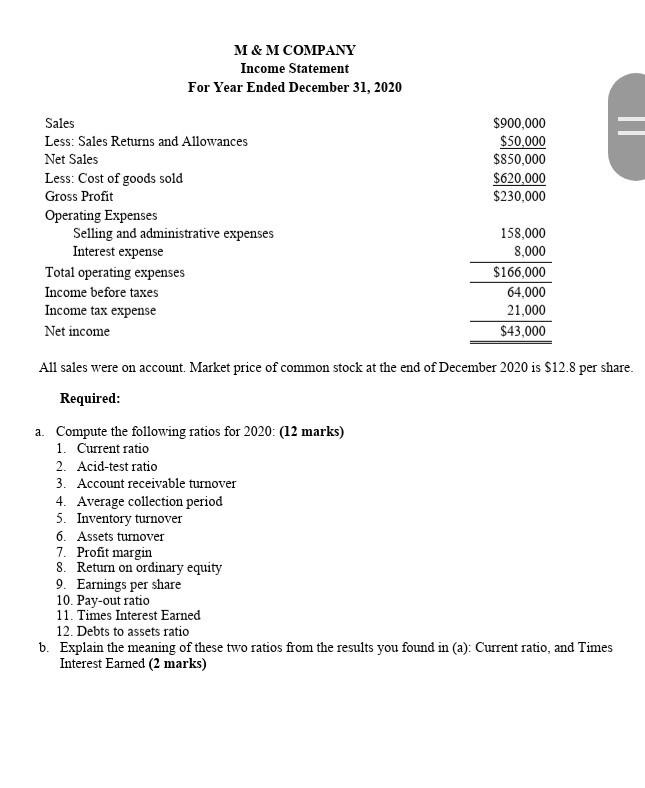

Financial information for M & M Company is presented below M&M COMPANY Balance Sheet December 31, 2020 and 2019 Assets Cash Short-term investments Account receivable 108,000 Less: Allowance for Doubtful Accounts (10,000) Inventory Prepaid expenses Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Short-term notes payable Account payable Accrued liabilities Bonds payable Stockholders' Equity Share capital-ordinary ($5 par) Retained earnings Total liabilities and stockholders' equity 520,000 (340,000) 2020 $70,000 $52,000 98,000 125,000 29000 130,000 180,000 $684,000 $102,000 48,000 50,000 150,000 200,000 134,000 $684,000 $115,000 (35,000) 560,000 (385,000) 2019 $65,000 $40,000 80,000 135,000 23,000 130,000 175,000 $648,000 $100,000 42,000 40,000 150,000 200,000 116,000 $648,000 Sales Less: Sales Returns and Allowances Net Sales Less: Cost of goods sold Gross Profit Operating Expenses M & M COMPANY Income Statement For Year Ended December 31, 2020 Selling and administrative expenses Interest expense Total operating expenses Income before taxes Income tax expense Net income $900,000 $50,000 $850,000 6. Assets turnover 7. Profit margin 8. Return on ordinary equity 9. Earnings per share $620,000 $230,000 158,000 8,000 $166,000 64,000 21,000 $43,000 All sales were on account. Market price of common stock at the end of December 2020 is $12.8 per share. Required: a. Compute the following ratios for 2020: (12 marks) 1. Current ratio 2. Acid-test ratio 3. Account receivable turnover 4. Average collection period 5. Inventory turnover 10. Pay-out ratio 11. Times Interest Earned 12. Debts to assets ratio b. Explain the meaning of these two ratios from the results you found in (a): Current ratio, and Times Interest Earned (2 marks)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Compute the following ratios for 20201 Current ratio 1 Current ratio Current assets Current liabilities Current ratio 684000 102000 Current ratio 669 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started