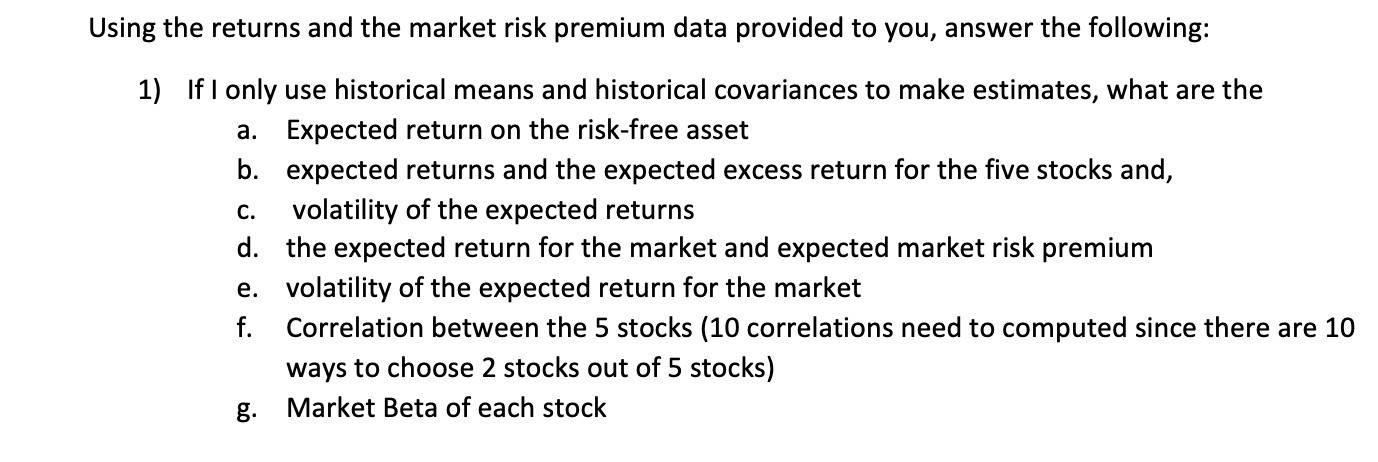

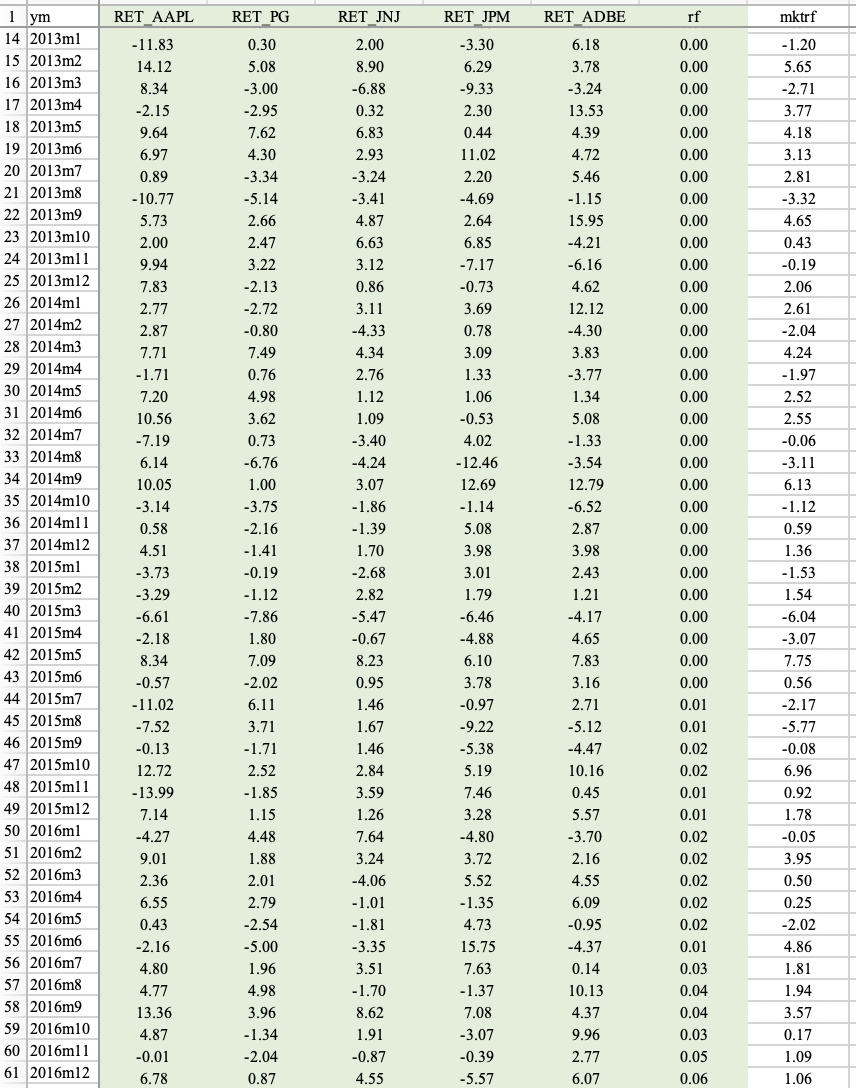

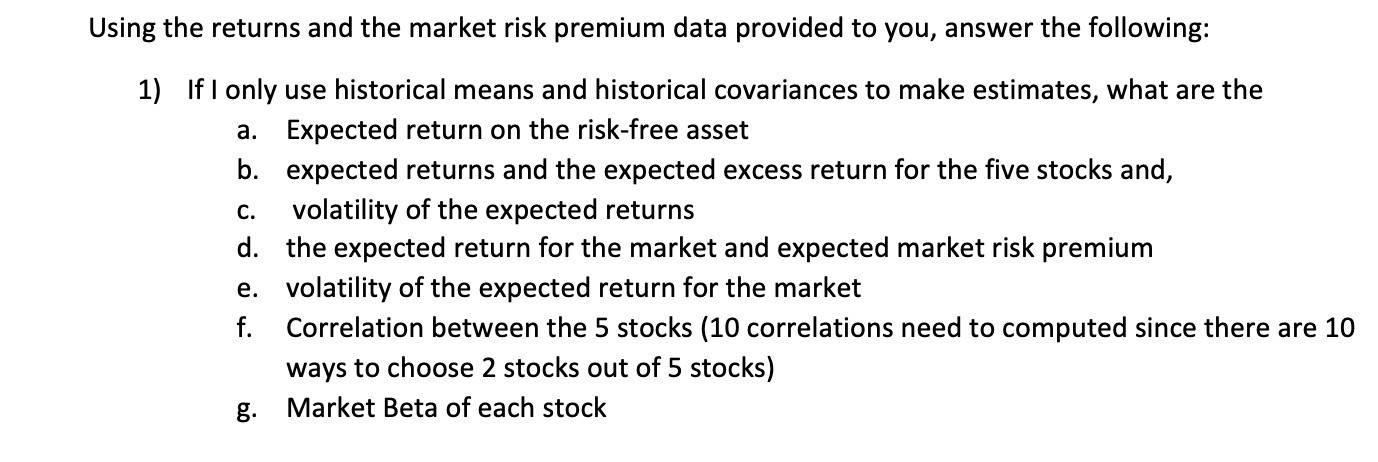

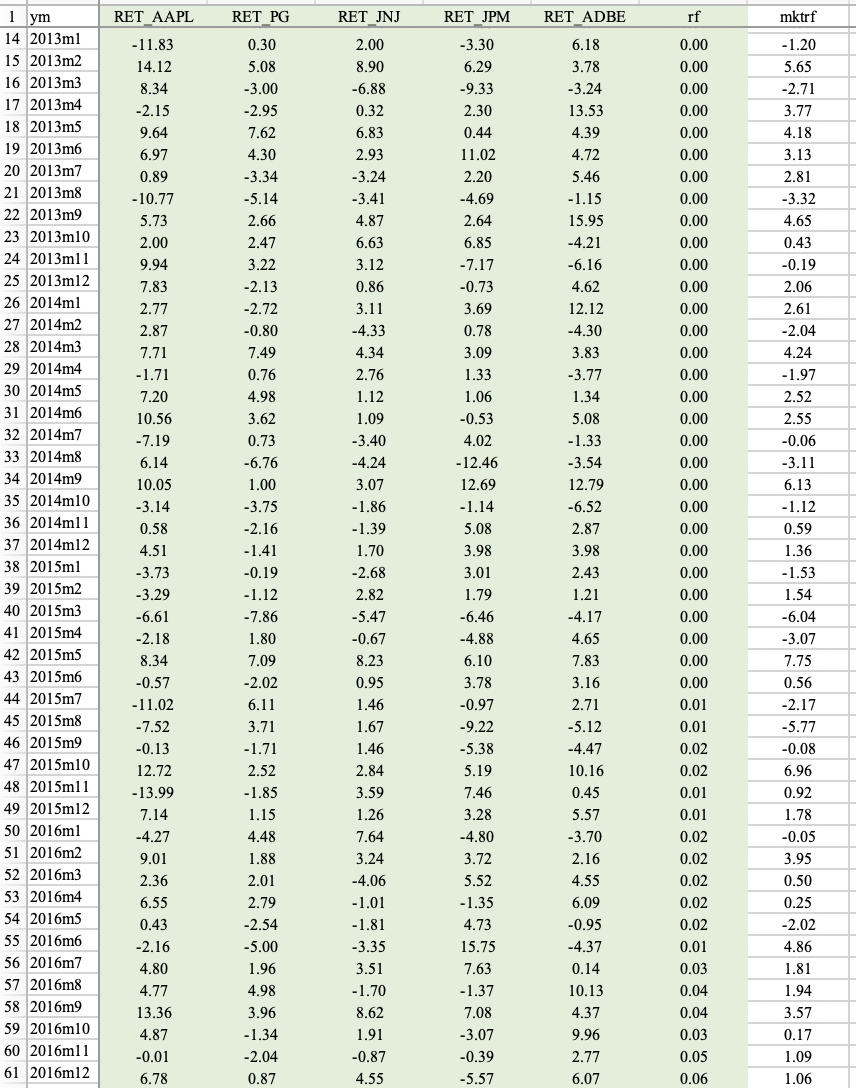

Using the returns and the market risk premium data provided to you, answer the following: C. 1) If I only use historical means and historical covariances to make estimates, what are the a. Expected return on the risk-free asset b. expected returns and the expected excess return for the five stocks and, volatility of the expected returns d. the expected return for the market and expected market risk premium e. volatility of the expected return for the market f. Correlation between the 5 stocks (10 correlations need to computed since there are 10 ways to choose 2 stocks out of 5 stocks) g. Market Beta of each stock bo RET_AAPL RET PG RET_JNJ RET_JPM rf mktrf - 11.83 14.12 8.34 2.00 8.90 -6.88 0.32 6.83 2.93 -3.24 0.30 5.08 -3.00 -2.95 7.62 4.30 -3.34 -5.14 2.66 2.47 3.22 -2.13 -2.72 -0.80 7.49 0.76 4.98 3.62 -2.15 9.64 6.97 0.89 -10.77 5.73 2.00 9.94 7.83 2.77 2.87 7.71 -1.71 7.20 10.56 -7.19 6.14 10.05 -3.14 0.58 4.51 -3.73 -3.29 -6.61 -2.18 1 ym 14 2013ml 15 2013m2 16 2013m3 17 2013m4 18 2013m5 19 2013m6 20 2013m7 21 2013m8 22 2013m9 23 2013m10 24 2013m11 25 2013m12 26 2014ml 27 2014m2 28 2014m3 29 2014m4 30 2014m5 31 2014m6 32 2014m7 33 2014m8 34 2014m9 35 2014m10 36 2014m11 37 2014m12 38 2015ml 39 2015m2 40 2015m3 41 2015m4 42 2015m5 43 2015m6 44 2015m7 45 2015m8 46 2015m9 47 2015m10 48 2015m11 49 2015m12 50 2016m1 51 2016m2 52 2016m3 53 2016m4 54 2016m5 55 2016m6 56 2016m7 57 2016m8 58 2016m9 59 2016m10 60 2016m11 61 2016m12 RET_ADBE 6.18 3.78 -3.24 13.53 4.39 4.72 5.46 - 1.15 15.95 -4.21 -6.16 4.62 12.12 -4.30 3.83 -3.77 1.34 5.08 -1.33 -3.54 12.79 -6.52 2.87 3.98 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.73 -6.76 1.00 -3.75 -2.16 -1.41 -0.19 - 1.12 -7.86 1.80 7.09 -2.02 6.11 3.71 -1.71 2.52 -1.85 1.15 -3.30 6.29 -9.33 2.30 0.44 11.02 2.20 -4.69 2.64 6.85 -7.17 -0.73 3.69 0.78 3.09 1.33 1.06 -0.53 4.02 -12.46 12.69 -1.14 5.08 3.98 3.01 1.79 -6.46 -4.88 6.10 3.78 -0.97 -9.22 -5.38 5.19 7.46 3.28 -4.80 3.72 5.52 -1.35 4.73 15.75 7.63 -1.37 7.08 -3.07 -0.39 -5.57 -3.41 4.87 6.63 3.12 0.86 3.11 -4.33 4.34 2.76 1.12 1.09 -3.40 -4.24 3.07 -1.86 -1.39 1.70 -2.68 2.82 -5.47 -0.67 8.23 0.95 1.46 1.67 1.46 2.84 3.59 1.26 7.64 3.24 -4.06 - 1.01 -1.81 -3.35 3.51 -1.70 8.62 1.91 -0.87 4.55 2.43 - 1.20 5.65 -2.71 3.77 4.18 3.13 2.81 -3.32 4.65 0.43 -0.19 2.06 2.61 -2.04 4.24 -1.97 2.52 2.55 -0.06 -3.11 6.13 - 1.12 0.59 1.36 -1.53 1.54 -6.04 -3.07 7.75 0.56 -2.17 -5.77 -0.08 6.96 0.92 1.78 -0.05 3.95 0.50 0.25 -2.02 4.86 1.81 1.94 3.57 0.17 1.09 1.06 8.34 1.21 -4.17 4.65 7.83 3.16 2.71 -5.12 -4.47 10.16 0.45 5.57 -3.70 2.16 0.00 0.00 0.0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.01 0.01 0.02 0.02 0.01 0.01 0.02 0.02 0.02 0.02 0.02 0.01 0.03 0.04 0.04 0.03 0.05 0.06 -0.57 -11.02 -7.52 -0.13 12.72 -13.99 7.14 -4.27 9.01 2.36 6.55 0.43 -2.16 4.80 4.77 13.36 4.87 -0.01 6.78 4.48 4.55 1.88 2.01 2.79 -2.54 -5.00 1.96 4.98 3.96 -1.34 -2.04 0.87 6.09 -0.95 -4.37 0.14 10.13 4.37 9.96 2.77 6.07 Using the returns and the market risk premium data provided to you, answer the following: C. 1) If I only use historical means and historical covariances to make estimates, what are the a. Expected return on the risk-free asset b. expected returns and the expected excess return for the five stocks and, volatility of the expected returns d. the expected return for the market and expected market risk premium e. volatility of the expected return for the market f. Correlation between the 5 stocks (10 correlations need to computed since there are 10 ways to choose 2 stocks out of 5 stocks) g. Market Beta of each stock bo RET_AAPL RET PG RET_JNJ RET_JPM rf mktrf - 11.83 14.12 8.34 2.00 8.90 -6.88 0.32 6.83 2.93 -3.24 0.30 5.08 -3.00 -2.95 7.62 4.30 -3.34 -5.14 2.66 2.47 3.22 -2.13 -2.72 -0.80 7.49 0.76 4.98 3.62 -2.15 9.64 6.97 0.89 -10.77 5.73 2.00 9.94 7.83 2.77 2.87 7.71 -1.71 7.20 10.56 -7.19 6.14 10.05 -3.14 0.58 4.51 -3.73 -3.29 -6.61 -2.18 1 ym 14 2013ml 15 2013m2 16 2013m3 17 2013m4 18 2013m5 19 2013m6 20 2013m7 21 2013m8 22 2013m9 23 2013m10 24 2013m11 25 2013m12 26 2014ml 27 2014m2 28 2014m3 29 2014m4 30 2014m5 31 2014m6 32 2014m7 33 2014m8 34 2014m9 35 2014m10 36 2014m11 37 2014m12 38 2015ml 39 2015m2 40 2015m3 41 2015m4 42 2015m5 43 2015m6 44 2015m7 45 2015m8 46 2015m9 47 2015m10 48 2015m11 49 2015m12 50 2016m1 51 2016m2 52 2016m3 53 2016m4 54 2016m5 55 2016m6 56 2016m7 57 2016m8 58 2016m9 59 2016m10 60 2016m11 61 2016m12 RET_ADBE 6.18 3.78 -3.24 13.53 4.39 4.72 5.46 - 1.15 15.95 -4.21 -6.16 4.62 12.12 -4.30 3.83 -3.77 1.34 5.08 -1.33 -3.54 12.79 -6.52 2.87 3.98 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.73 -6.76 1.00 -3.75 -2.16 -1.41 -0.19 - 1.12 -7.86 1.80 7.09 -2.02 6.11 3.71 -1.71 2.52 -1.85 1.15 -3.30 6.29 -9.33 2.30 0.44 11.02 2.20 -4.69 2.64 6.85 -7.17 -0.73 3.69 0.78 3.09 1.33 1.06 -0.53 4.02 -12.46 12.69 -1.14 5.08 3.98 3.01 1.79 -6.46 -4.88 6.10 3.78 -0.97 -9.22 -5.38 5.19 7.46 3.28 -4.80 3.72 5.52 -1.35 4.73 15.75 7.63 -1.37 7.08 -3.07 -0.39 -5.57 -3.41 4.87 6.63 3.12 0.86 3.11 -4.33 4.34 2.76 1.12 1.09 -3.40 -4.24 3.07 -1.86 -1.39 1.70 -2.68 2.82 -5.47 -0.67 8.23 0.95 1.46 1.67 1.46 2.84 3.59 1.26 7.64 3.24 -4.06 - 1.01 -1.81 -3.35 3.51 -1.70 8.62 1.91 -0.87 4.55 2.43 - 1.20 5.65 -2.71 3.77 4.18 3.13 2.81 -3.32 4.65 0.43 -0.19 2.06 2.61 -2.04 4.24 -1.97 2.52 2.55 -0.06 -3.11 6.13 - 1.12 0.59 1.36 -1.53 1.54 -6.04 -3.07 7.75 0.56 -2.17 -5.77 -0.08 6.96 0.92 1.78 -0.05 3.95 0.50 0.25 -2.02 4.86 1.81 1.94 3.57 0.17 1.09 1.06 8.34 1.21 -4.17 4.65 7.83 3.16 2.71 -5.12 -4.47 10.16 0.45 5.57 -3.70 2.16 0.00 0.00 0.0 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.01 0.01 0.02 0.02 0.01 0.01 0.02 0.02 0.02 0.02 0.02 0.01 0.03 0.04 0.04 0.03 0.05 0.06 -0.57 -11.02 -7.52 -0.13 12.72 -13.99 7.14 -4.27 9.01 2.36 6.55 0.43 -2.16 4.80 4.77 13.36 4.87 -0.01 6.78 4.48 4.55 1.88 2.01 2.79 -2.54 -5.00 1.96 4.98 3.96 -1.34 -2.04 0.87 6.09 -0.95 -4.37 0.14 10.13 4.37 9.96 2.77 6.07