Answered step by step

Verified Expert Solution

Question

1 Approved Answer

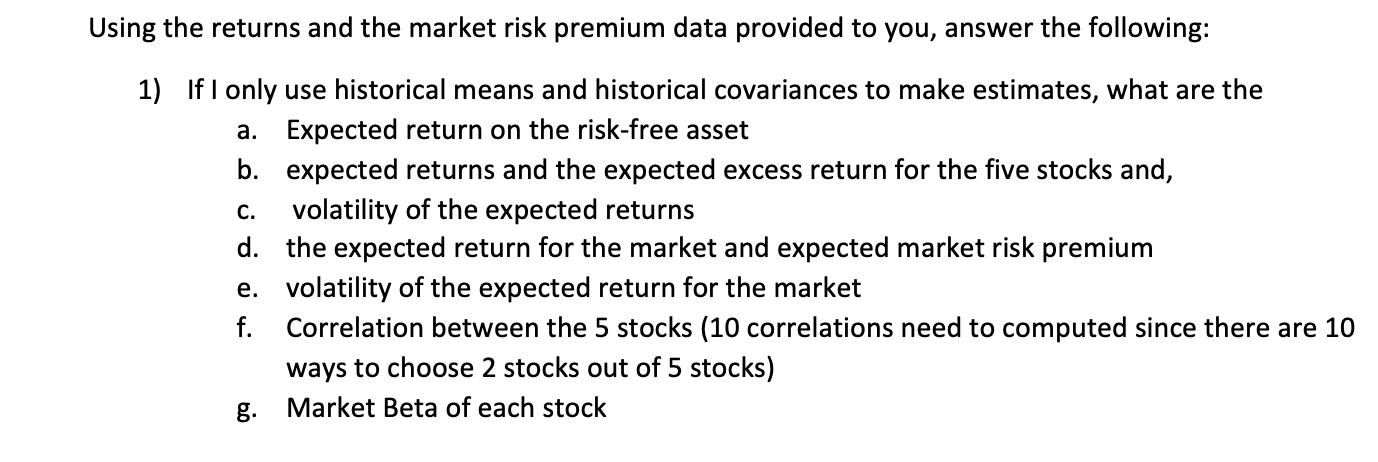

Using the returns and the market risk premium data provided to you, answer the following: 1) If I only use historical means and historical

Using the returns and the market risk premium data provided to you, answer the following: 1) If I only use historical means and historical covariances to make estimates, what are the a. Expected return on the risk-free asset b. expected returns and the expected excess return for the five stocks and, C. volatility of the expected returns d. the expected return for the market and expected market risk premium e. volatility of the expected return for the market f. Correlation between the 5 stocks (10 correlations need to computed since there are 10 ways to choose 2 stocks out of 5 stocks) g. Market Beta of each stock 1 ym RET AAPL RET PG RET_JNJ RET JPM RET ADBE rf mktrf 14 2013ml -11.83 0.30 2.00 -3.30 6.18 0.00 -1.20 15 2013m2 14.12 5.08 8.90 6.29 3.78 0.00 5.65 16 2013m3 8.34 -3.00 -6.88 -9.33 -3.24 0.00 -2.71 17 2013m4 -2.15 -2.95 0.32 2.30 13.53 0.00 3.77 18 2013m5 9.64 7.62 6.83 0.44 4.39 0.00 4.18 19 2013m6 6.97 4.30 2.93 11.02 4.72 0.00 3.13 20 2013m7 0.89 -3.34 -3.24 2.20 5.46 0.00 2.81 21 2013m8 -10.77 -5.14 -3.41 -4.69 -1.15 0.00 -3.32 22 2013m9 5.73 2.66 4.87 2.64 15.95 0.00 4.65 23 2013m10 2.00 2.47 6.63 6.85 -4.21 0.00 0.43 24 2013m11 9.94 3.22 3.12 -7.17 -6.16 0.00 -0.19 25 2013m12 7.83 -2.13 0.86 -0.73 4.62 0.00 2.06 26 2014m1 2.77 -2.72 3.11 3.69 12.12 0.00 2.61 27 2014m2 2.87 -0.80 -4.33 0.78 -4.30 0.00 -2.04 28 2014m3 7.71 7.49 4.34 3.09 3.83 0.00 4.24 29 2014m4 -1.71 0.76 2.76 1.33 -3.77 0.00 -1.97 30 2014m5 7.20 4.98 1.12 1.06 1.34 0.00 2.52 31 2014m6 10.56 3.62 1.09 -0.53 5.08 0.00 2.55 32 2014m7 -7.19 0.73 -3.40 4.02 -1.33 0.00 -0.06 33 2014m8 6.14 -6.76 -4.24 -12.46 -3.54 0.00 -3.11 34 2014m9 10.05 1.00 3.07 12.69 12.79 0.00 6.13 35 2014m10 -3.14 -3.75 -1.86 -1.14 -6.52 0.00 -1.12 36 2014m11 0.58 -2.16 -1.39 5.08 2.87 0.00 0.59 37 2014m12 4.51 -1.41 1.70 3.98 3.98 0.00 1.36 38 2015ml -3.73 -0.19 -2.68 3.01 2.43 0.00 -1.53 39 2015m2 -3.29 -1.12 2.82 1.79 1.21 0.00 1.54 40 2015m3 -6.61 -7.86 -5.47 -6.46 -4.17 0.00 -6.04 41 2015m4 -2.18 1.80 -0.67 -4.88 4.65 0.00 -3.07 42 2015m5 8.34 7.09 8.23 6.10 7.83 0.00 7.75 43 2015m6 -0.57 -2.02 0.95 3.78 3.16 0.00 0.56 44 2015m7 -11.02 6.11 1.46 -0.97 2.71 0.01 -2.17 45 2015m8 -7.52 3.71 1.67 -9.22 -5.12 0.01 -5.77 46 2015m9 -0.13 -1.71 1.46 -5.38 -4.47 0.02 -0.08 47 2015m10 12.72 2.52 2.84 5.19 10.16 0.02 6.96 48 2015m11 -13.99 -1.85 3.59 7.46 0.45 0.01 0.92 49 2015m12 7.14 1.15 1.26 3.28 5.57 0.01 1.78 50 2016ml -4.27 4.48 7.64 -4.80 -3.70 0.02 -0.05 51 2016m2 9.01 1.88 3.24 3.72 2.16 0.02 3.95 52 2016m3 2.36 2.01 -4.06 5.52 4.55 0.02 0.50 53 2016m4 6.55 2.79 -1.01 -1.35 6.09 0.02 0.25 54 2016m5 0.43 -2.54 -1.81 4.73 -0.95 0.02 -2.02 55 2016m6 -2.16 -5.00 -3.35 15.75 -4.37 0.01 4.86 56 2016m7 4.80 1.96 3.51 7.63 0.14 0.03 1.81 57 2016m8 4.77 4.98 -1.70 -1.37 10.13 0.04 1.94 58 2016m9 13.36 3.96 8.62 7.08 4.37 0.04 3.57 59 2016m10 4.87 -1.34 1.91 -3.07 9.96 0.03 0.17 60 2016m11 -0.01 -2.04 -0.87 -0.39 2.77 0.05 1.09 61 2016m12 6.78 0.87 4.55 -5.57 6.07 0.06 1.06

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started