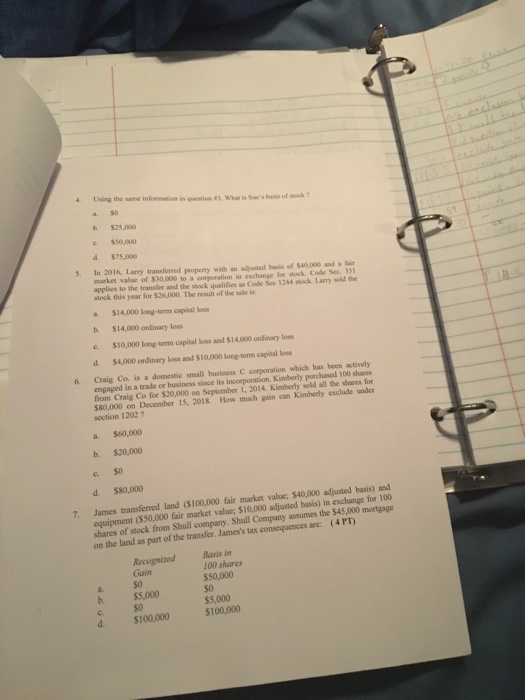

Using the same information in questo 525.000 c. 550.000 5. ST5.000 In 2016, Larry transferred property with an inte basis of $40,000 and af market value of $10.000 to coration in exchange for stock Code Sec 151 applies to the transfer and the stock qualities as Code See 1244 wock. Larry sold the stock this year for $26.000. The result of the sale is: a $14.000 lg-te capitaloss b. $14.000 ordinary loss c. $10,000 long-term capital loss and $14,000 ordinary loss d $4.000 ordinary loss and $10,000 long-term capital loss Craig Co. is a domestic small business C corporation which has been actively engaged in a trade or business since its incorporation, Kimberly purchased 100 shares from Craig Co for $20,000 on September 1, 2014, Kimberly sold all the shares for $80,000 on December 15, 2018 How much gain can Kimberly exclude under section 12027 # $60,000 b $20,000 So d $80,000 James transferred land ($100,000 fair market value; 540,000 adjusted basis) and equipment (550,000 fair market value; S10,000 adjusted basis) in exchange for 100 shares of stock from Shull company. Shull Company assumes the $45,000 mortgage on the land as part of the transfer. James's tax consequences are: (4PT) Recognised Basis in Gain 100 shares $50,000 $5,000 $5,000 $100,000 $100,000 c. 7. Using the same information in questo 525.000 c. 550.000 5. ST5.000 In 2016, Larry transferred property with an inte basis of $40,000 and af market value of $10.000 to coration in exchange for stock Code Sec 151 applies to the transfer and the stock qualities as Code See 1244 wock. Larry sold the stock this year for $26.000. The result of the sale is: a $14.000 lg-te capitaloss b. $14.000 ordinary loss c. $10,000 long-term capital loss and $14,000 ordinary loss d $4.000 ordinary loss and $10,000 long-term capital loss Craig Co. is a domestic small business C corporation which has been actively engaged in a trade or business since its incorporation, Kimberly purchased 100 shares from Craig Co for $20,000 on September 1, 2014, Kimberly sold all the shares for $80,000 on December 15, 2018 How much gain can Kimberly exclude under section 12027 # $60,000 b $20,000 So d $80,000 James transferred land ($100,000 fair market value; 540,000 adjusted basis) and equipment (550,000 fair market value; S10,000 adjusted basis) in exchange for 100 shares of stock from Shull company. Shull Company assumes the $45,000 mortgage on the land as part of the transfer. James's tax consequences are: (4PT) Recognised Basis in Gain 100 shares $50,000 $5,000 $5,000 $100,000 $100,000 c. 7