Question

Using the sample spreadsheet provided to you, reference the business example described on page 5 of the handout for Class 11 and please provide answers

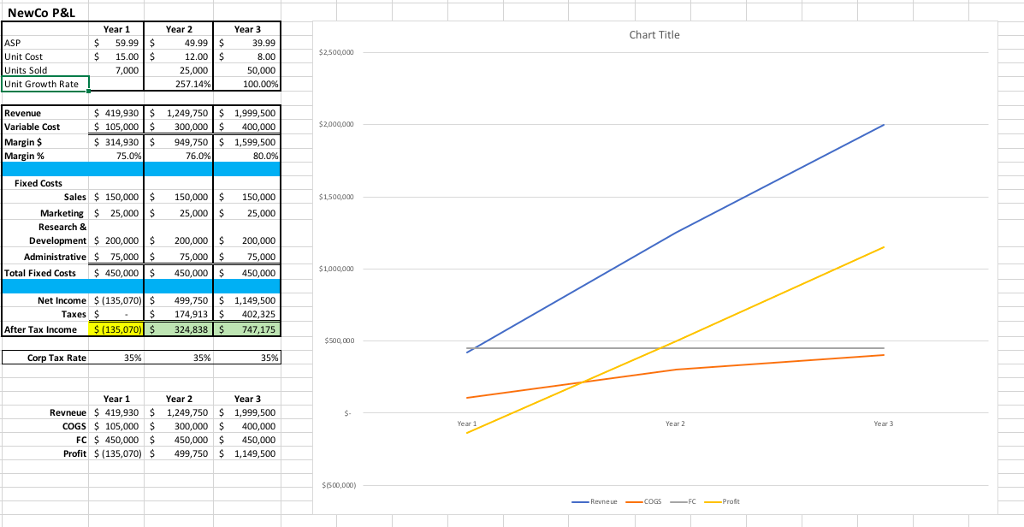

Using the sample spreadsheet provided to you, reference the business example described on page 5 of the handout for Class 11 and please provide answers to the following questions. (Assume all parts of this question are to be evaluated independently of each other.)

a. What is the After-Tax Income for Year 2 if you can sell 10,000 more units, by dropping the price to $45 per unit?

b. What is the After-Tax Income for Year 3 if you can sell 15,000 more units, by spending more $20,000 more on advertising?

c. What is the After-Tax Income for Year 2 if you can redesign your product to lower the cost per unit by two more dollars?

d. What happens to your 3 year projections, if the government corporate Tax Rate is dropped by 10%, starting in Year 2?

e. What happens to the P&L in Year 1, if your design/test labs use $5,000 more in electricity than planned?

Using the same reference information in Question 2 above, please answer the following for the business:

a. What is the After-Tax Income if, in year 2, you have a factory equipment failure and the manufacturing line is down for 4 weeks out of 50? (Assume the repairs will cost you $10,000.)

b. What happens to your Margin % and After Tax profit in Year 3, if a new competitor comes into the market and begins selling at $29.99, starting in May of that year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started