Answered step by step

Verified Expert Solution

Question

1 Approved Answer

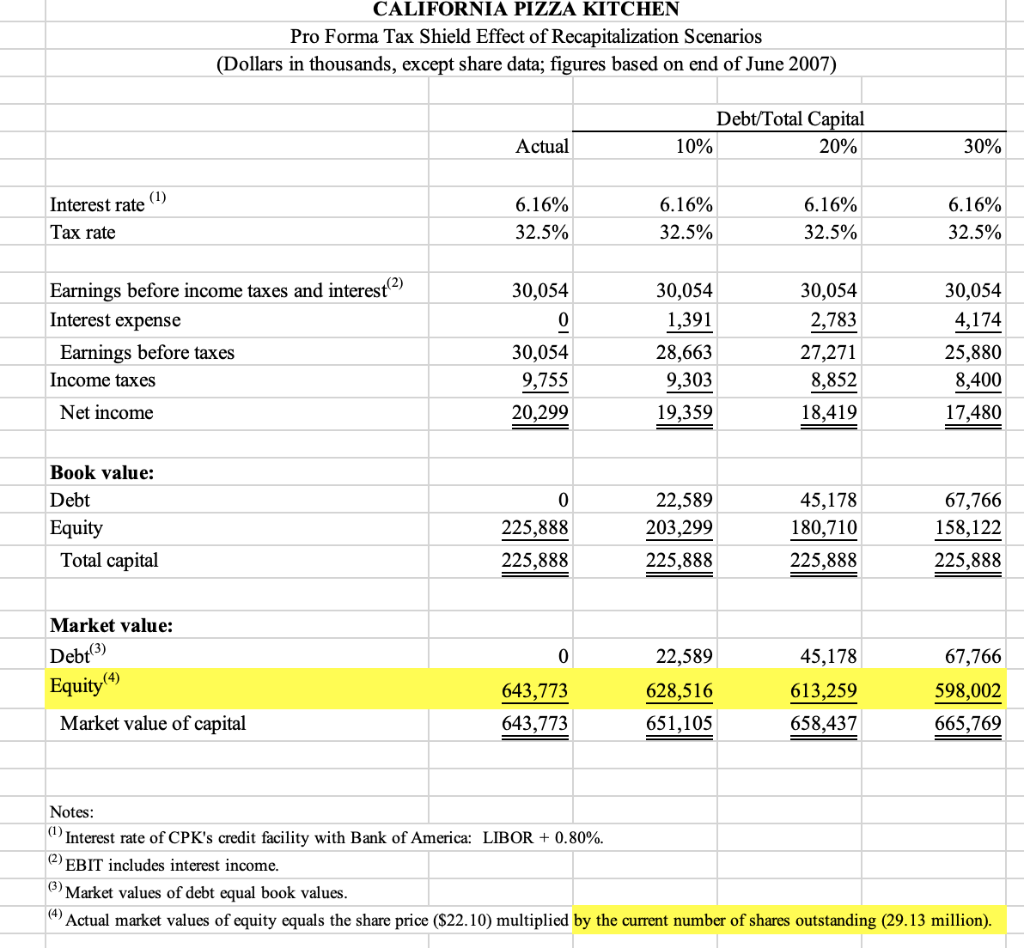

Using the scenarios in case Exhibit 9, what role does leverage play in affecting the return on equity (ROE) for CPK? What about the cost

Using the scenarios in case Exhibit 9, what role does leverage play in affecting the return on equity (ROE) for CPK? What about the cost of capital? In assessing the effect of leverage on the cost of capital, you may assume that a firms CAPM beta can be modeled in the following manner: L = U[1 + (1 T)D/E], where U is the firms beta without leverage, T is the corporate income tax rate, D is the market value of debt, and E is the market value of equity.

CALIFORNIA PIZZA KITCHEN Pro Forma Tax Shield Effect of Recapitalization Scenarios (Dollars in thousands, except share data; figures based on end of June 2007) Debt/Total Capital 10% 20% Actual 30% Interest rate (1) Tax rate 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 30,054 Earnings before income taxes and interest(2) Interest expense Earnings before taxes Income taxes 30,054 9,755 20,299 30,054 1,391 28,663 9,303 19,359 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17,480 Net income Book value: Debt Equity Total capital 0 225,888 225,888 22,589 203,299 225,888 45,178 180,710 225,888 67,766 158,122 225,888 Market value: Debt(3) Equity ,(4) 0 22,589 67,766 643,773 643,773 628,516 651,105 45,178 613,259 658,437 598,002 665,769 Market value of capital Notes: (2) Interest rate of CPK's credit facility with Bank of America: LIBOR + 0.80%. EBIT includes interest income. Market values of debt equal book values. Actual market values of equity equals the share price ($22.10) multiplied by the current number of shares outstanding (29.13 million)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started