Question

Using the Starbucks 10-k link answer the questions below: link: https://www.sec.gov/Archives/edgar/data/829224/000082922414000041/sbux-9282014x10k.htm#s6571E5A222BF69F5F8068EA40E001FDA 1. Identify one item on the Starbucks balance sheet that is accounted for using

Using the Starbucks 10-k link answer the questions below:

link: https://www.sec.gov/Archives/edgar/data/829224/000082922414000041/sbux-9282014x10k.htm#s6571E5A222BF69F5F8068EA40E001FDA

1. Identify one item on the Starbucks balance sheet that is accounted for using an AJE (there are several options to choose from).

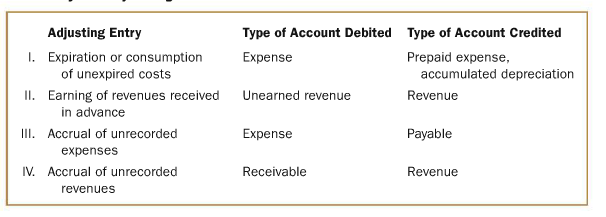

2. Describe which of the four groups or categories it falls under (the four categories as described in LO4.2-LO4.5)

3. Discuss why an AJE is required in this situation - your discussion should include points such as when the cash is collected or disbursed and when/how the income or expense is earned or incurred. You can discuss when the entries are posted and what accounts are impacted.

Adjusting Entry Type of Account Debited Type of Account Credited Prepaid expense, I. Expiration or consumption Expense accumulated depreciation Revenue of unexpired costs Il. Earning of revenues received Unearned revenue in advance II Accrual of unrecorded Expense Payable expenses IV. Accrual of unrecorded Receivable Revenue revenuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started